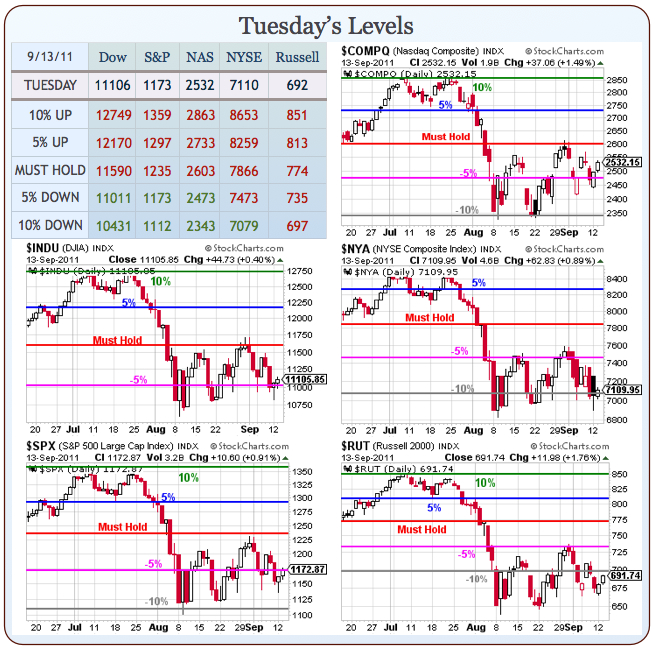

700 has been a tough nut to crack in our small-cap index.

700 has been a tough nut to crack in our small-cap index.

Dollar weakness has hurt the companies that do most of their business in the US, collecting crappy dollars for their goods and services and having to pay through the nose for high-priced commodities and imported goods. Small caps don’t have the muscle to hold down wages in overseas factories while they boost productivity to the point of suicide like our beloved Apple can. No, while our small caps may have a plentiful supply of US workers willing to work “cheap” – we’re still not at the point where our Government forces students to work in the factories as “interns.”

So, while we wait for those IPhone 5′s to roll off the assembly line, we’ll be keeping an eye on the Russell, which should benefit from the recent strength in the Dollar, which is is up over 5% in September – although probably topping out at 78 – which is good, as it will give the markets a nice boost on the way back down.

Dow futures are already up over 200 points since 3am (when they were down 100) and, when our 3am trade is working, the bots are usually taking the markets higher. Nothing has changed in the news – Moody’s went ahead and downgraded Credit Agricole and Societe General but maintained an Aa2 rating on BNP – the source of yesterday’s big drop in France on the silly rumor that I told you in yesterday’s post was nothing but blatant market manipulation by our favorite media mogul.

Don’t worry, no one will be arresting Rupert Murdoch because – well, he’s rich. Rich fixes everything, doesn’t it? Rupert’s pal, Chinese Premier Wen Jiabao (What? You didn’t think he only buys Western politicians, did you?), says no one should rely on China to bail out the world economy. “Countries must first put their own houses in order,” Wen said today. Asian stocks dropped following his comments, but European markets and futures have shaken the news off after the bank downgrades in a classic example of selling the rumor and buying the news.

Don’t worry, no one will be arresting Rupert Murdoch because – well, he’s rich. Rich fixes everything, doesn’t it? Rupert’s pal, Chinese Premier Wen Jiabao (What? You didn’t think he only buys Western politicians, did you?), says no one should rely on China to bail out the world economy. “Countries must first put their own houses in order,” Wen said today. Asian stocks dropped following his comments, but European markets and futures have shaken the news off after the bank downgrades in a classic example of selling the rumor and buying the news.

Today the big rumor is bullish on news that Geithner is going to Europe to spread the religion of Easy Money in what will be the first time a US Treasury Secretary has been invited to attend a Eurozone…