Wheeeeeeeeee!

Wheeeeeeeeee!

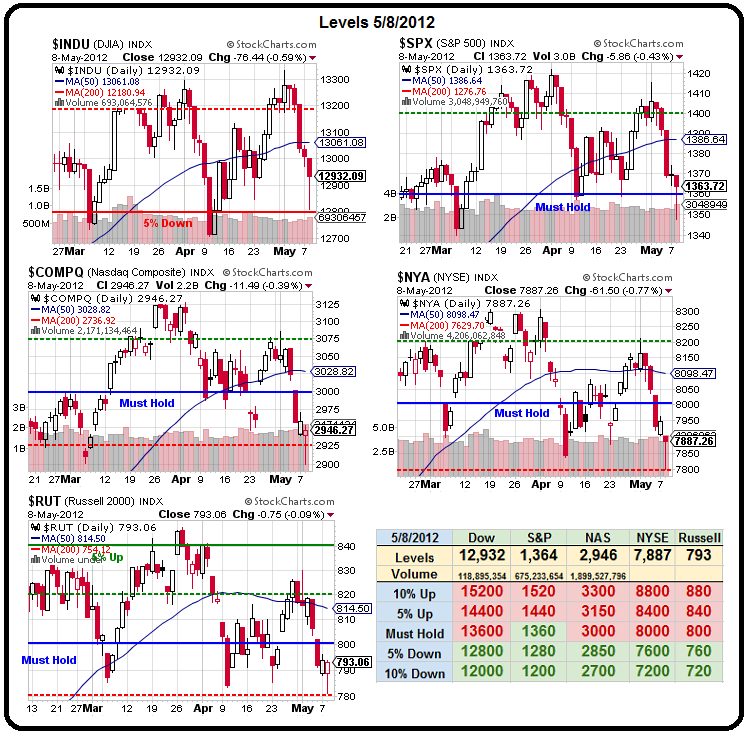

Isn’t this fun? We’ve been having a good old time watching our levels get tested and, as you can see from our fabulous Big Chart – we spiked down to EXACTLY the lines we predicted on the Dow, NYSE and the Russell – all on the same day at the same time, almost to the penny – that’s pretty good predicting!

The Nasdaq and the S&P went below but came back above their 5% lines but it’s the S&P we were focused on in yesterday’s post when I said it would be “1,360 or Bust” and the S&P was not fooling any of us with that BS move back up in the afternoon. As I said to Members in Chat at 3:24:

Holy crap – S&P flying up to 1,360 in Futures – index is back to 1,362 as it gains 10 points since 2:15! For perspective, yesterday the S&P was at 1,360 in the Futures at 10:30 and took until 1:30 to get to 1,370. Oh, and did I mention that it then dropped to 1,345 this morning?

Moral of the story – CASH IS KING – this is a very BS market and these moves are crap. All that matters is whether or not they can establish a breaking up TREND that last more than 2 days – other than that, all this intra-day nonsense is just noise.

Not at all surprisingly, the S&P Futures are down over half a point this morning but we are testing the bottom of our bullish range and we’re now at the point where we do expect a little Government/Fed intervention – if not from our own Bernank or do-nothing Congress, then perhaps from the EU, BOJ or PBOC – so many cooks to spoil the broth that we had to take some bearish profits off the table yesterday and move to more cash.

Not at all surprisingly, the S&P Futures are down over half a point this morning but we are testing the bottom of our bullish range and we’re now at the point where we do expect a little Government/Fed intervention – if not from our own Bernank or do-nothing Congress, then perhaps from the EU, BOJ or PBOC – so many cooks to spoil the broth that we had to take some bearish profits off the table yesterday and move to more cash.