The Golden Sunrise

The essential morning read for investors!

Golden Sunrise is the Golden Surveyor’s broad-based market and world view.

Written daily 4am-7am by markets information specialist GS John!

Today’s Golden Sunrise

Monday, June 28, 2010

Hours of daily research consolidated for you

Window Dressing Week

We have again reached the end of the quarter when fund managers will be sending their performance reports to their clients. Typically, we have a run up in share prices fostered by strategic buys so the portfolio looks good and matches in holdings what the better performing managers are holding.

Fund managers have a great deal of their compensation determined by the dollar value of the assets managed against which they extract a %age fee. The idea is to keep the money in the fund and the contributions to the fund flowing on a regular basis. If we are all, basically, holding the same things there is no incentive for the clients to change funds in an asset category.

Cash from fund contributions will be coming in and available Thursday and Friday of this week, with Monday being a day off for most folks because the 4th of July falls on Sunday. Creates some interesting dilemmas for investors and fund managers-if we get a Q2 end bounce, do you dare invest at the end of the week fighting some ugly looking charts? Do you wait until next week when the market has had a chance to bounce off or decline below the key moving averages which seem to be in play for every major index? What do you if you are required to be “in the market”, not cash, by the terms of your fund’s prospectus?

I was lucky enough to attend the second day of a huge West Coast swimming meet held at the WeyerhauserAquaticCenter in the greater Seattle area on Sunday. While I didn’t see the whole event or all the participants what I did see opened eyes and thought processes to extrapolate some things that might have some use and provide some insight into markets. A couple of the events had as many as 28 heats (individual races within the context of the specific competition-eg 100 meter breaststroke, 200 meter backstroke, 100 meter freestyle) with the groupings of racers made by previous performance times. The age matrix for the racers ranged between 13 and 18 so generally the kids were competing against peers and similar achievement levels. A few things really stood out:

- The Center was a wonderful facility for the both swimmers and spectators. Very well-designed.

- The incredible precision with which the races were run-28 heats took just about an hour and by staggering the starting ends of the pool, one race would begin as the preceding race was about 25% from conclusion. Great organization and process. The conclusion of one event would lead to the start of another with no delays.

- Each race began precisely and the swimmers were all in place for each start. The races were alternated by gender, many more girls participating than boys, which was interesting.

- I saw hundreds of swimmers and each appeared to a non-expert to be using sound, disciplined technique-regardless of their speed level-reflecting good coaching and training. My grandsons go 4 times a week during the off-season which represents real commitment but also leads to excellence and “profound knowledge” (W. Edwards Deming) of the skills and techniques needed to maximize results..

- The crisp organization and exhibition of skills demonstrated to me that I need to be buying companies capable of these same things and it is now impossible to achieve positive results without these entities as a basic set of skills.

Some key indexes:

50 day crossing under the 200 of the broad-based NYA, both are going to be resistance and possibly form the right shoulder EVERYBODY is looking for-just like the end of June, early July last year when the market promptly rose straight up for months.

The SPY, representing the S&P500: nearing the death cross: 50<200

S&P is going nowhere without the financials: Same story

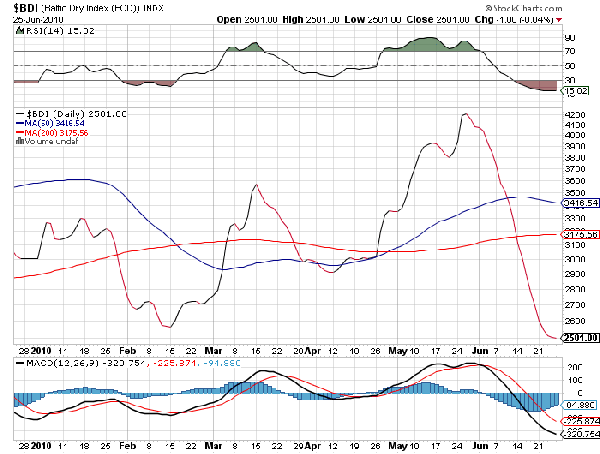

A key from last year was watching the Baltic Dry Freight Index-which measures shipping rates for bulk commodities like iron ore (especially). Mostly China bound and affected by the huge amounts of new hauling capacity which has come on stream (when making year plus comparisons) but not as influencing of the shorter term…this is about as negative as it gets, although may be due for an oversold bounce: thanks to stockcharts.com

A couple of things have been fighting their normal, seasonal doldrums although it is long way from the normal upturn in Oct/Nov has been gold.

The Russians added 1.1 million ounces in May, their biggest monthly increase ever, to bring total holdings to 22.6 million, an increase of about 5%. Year to date, the Russians have added 2.1 million ounces to reserve holdings. With about $500 billion in reserves, 3rd behind China and Japan, this is still a drop in the bucket and not a great deal of security in a world dominated by dollars and Euros.

The Saudis have quietly boosted their holdings from 143 million ounces to 322.9 million over the past several years since the first figure was reported.

Like the Russians, the Saudis have lots of paper cash.

The gold ETF GLD: compare the slope and the moving averages with the charts above.

SLV (silver) as well: the 50DMA as support?

The IBD gold index has held the #1 slot among the 23 indexes they measure since May 24th. The ranking is based on the last 3 month performance compared with the other indexes. The other key measure from IBD is the ranking of the gold and silver miner’s group which has seen a rise from 109th among 193 groups on June 3rd to the present station in the #7 slot.

The well-known HUI: Surprised? IBD recommends you try to focus buying on the top 20 groups and the gold/silver stocks have only spent 6 sessions there some of which was aided by the declines of the other market groups.

Looks like a classic cup with handle on the right side so a breakout with volume could have some legs.

It is going to be an interesting and revealing week.

JohnR

Goldensurveyor.com