Wheeee – I told you this was going to be fun!

Wheeee – I told you this was going to be fun!

What a day we had yesterday with the down and the up and the down and the up and now, this morning – down again! We cashed our directionals on the morning dips yesterday but now our disaster hedges are putting us in a great mood this morning (I mentioned our QID play in yesterday’s post and that was a very easy fill on yesterday’s run-up). This morning’s action should push QID over goal ($17) and we’ll see what sticks as we test our first line of (hopefully) defense at Dow 10,450 and S&P 1,100.

If we lose the S&P then the Dow has a quick ride back to 10,200 so we’ll be looking at DXD again for a add-on hedge. We already have DXD plays and we were just adjusting them on Monday, as some Members were worried that the market was going too far the other way, which led me to comment in Member Chat:

When all you guys start capitulating on your short positions I usually figure that’s a great time to get aggressively short because the end is probably near. Keep in mind we are trading a range and right now we are at the top of that range so hedges like DXD are going to get stressed. If you do not need the protection, of course take it off the table but if you do need downside hedges, then a simple roll on the call side can give you a much bigger upside.

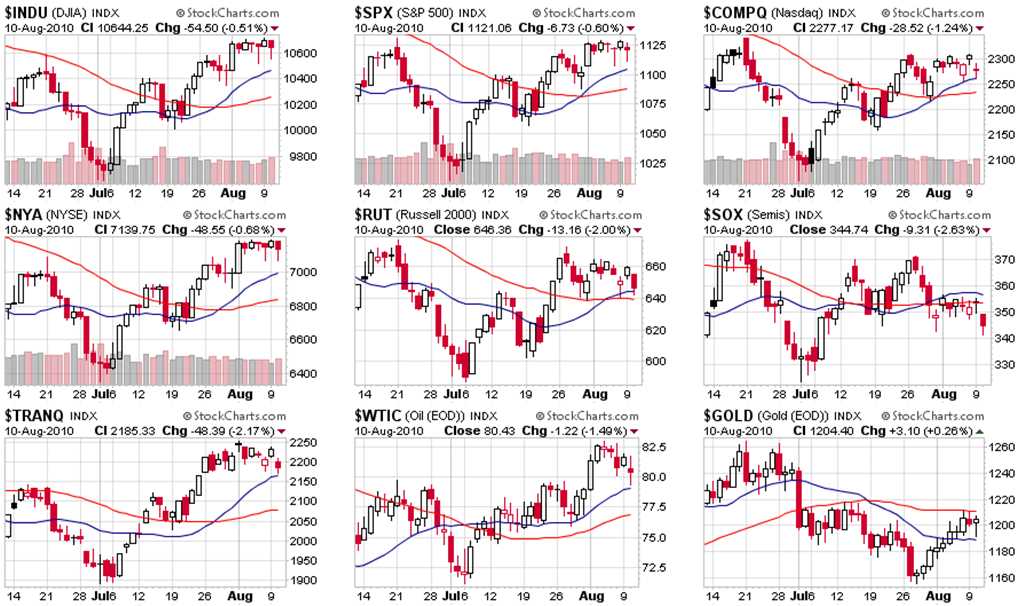

Range trading is great but you have to BELIEVE in your range. The bottom of our range, as I posted in yesterday’s Morning Alert to Members, is Dow 10,200, S&P 1,070, Nas 2,200, NYSE 6,800, and Russell 635 and until we fail 3 of those 5, we will continue to make bullish plays when we get near those levels, just as we make our bearish bets as we test our breakout levels. Even these levels are just 2.5% off our midpoints so we don’t get gung-ho bullish until we hit the full 5% bottom – which is now the rising 50 dmas (red lines) – but we’re kind of losing faith in getting back there so we’re a little more aggressive with our buys now than we were last month.

What I love about our 5% rule is that, eventually, the charts finally catch up and confirm the levels we’ve been using as targets all year. As I…