By: Scott Redler

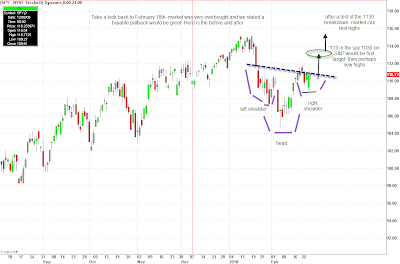

On February 19th, I posted a chart of the SPYs trying to use some X-ray vision on what the SPY could look like if we were to get a healthy pull-in.

.png)

The market was very overbought, but the potency of the move off of the reactionary 9% retracement down to 1,044 was strong enough to make the next pullback a buyable move. I drew out the potential right shoulder build in the 1,080-1,085 area. On Thursday, we hit 1,086 intraday and have not looked back since.

Well, we start the week with a forward looking chart already built–the question is, how did you handle it? Did you closely watch for the market to confirm the plan? Or did you get caught up in the emotion of the headlines? You always need to have a plan, but you also need to execute it when the market confirms your ideas.

We now have two overlapping patterns developing on the charts: a small reverse head and shoulders formation, and a bigger macro wedge.

This gives us a point of entry if we see a huge volume breakout through $111-111.50 on the SPY and 1,110-1,115 on the S&P. We must see a strong daily close on expanding volume in order to confirm the move. Such a break would also put the market back in confirmed rally mode according to IBD. If this happens, our first stop should be 1,130 and then a test of the January highs probably sometime in May.

This gives us a point of entry if we see a huge volume breakout through $111-111.50 on the SPY and 1,110-1,115 on the S&P. We must see a strong daily close on expanding volume in order to confirm the move. Such a break would also put the market back in confirmed rally mode according to IBD. If this happens, our first stop should be 1,130 and then a test of the January highs probably sometime in May.

We should get some type of range resolution this week. With the way we absorbed all of the negative headlines over the last two weeks, I am leaning towards the upside. We do have some positive technical action in market leading stocks that can help support such a move.

My watch list stocks–including some of the strongest in the market–are all setting up with bullish technical patterns:

AAPL RIMM BIDU AMZN

VMW CREE

MSFT CSCO INTC

JPM BAC GS

V

CAGC CAAS RINO

FCX X

GLD

I will have some charts later on.