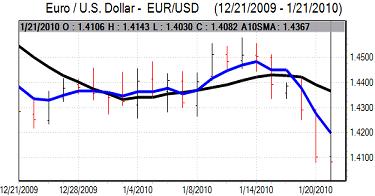

EUR/USD

The Euro initially found some support below 1.41 on Thursday and consolidated close to this level in early Europe as technical support in the 1.4070 region held. The Euro then came under fresh attack during the session and weakened to fresh lows later in the European session.

The Euro-zone PMI data recorded a slowdown in the services sector expansion which will tend to maintain fears that the economic rebound will stall relatively quickly. Structural factors were still the principal driver of currency moves and there was a further loss of confidence surrounding the Greek debt situation with speculation over a bond issue unsettling the Euro.

The latest US jobless claims was weaker than expected with an increase in claims to 482,000 in the latest week from a revised 446,000 previously. The increase was probably due to seasonal distortions, but the data will be watched more closely next week and another higher than expected figure would cause some unease.

Elsewhere, the Philadelphia Fed index was slightly weaker than expected with a decline to 15.2 for January from 22.5 the previous month. There will also be some disappointment that the orders component weakened back to near the zero threshold.

President Obama proposed fresh regulation for the banking sector which had a significant impact in undermining risk appetite. In contrast to recent weeks, the dollar did not benefit from the sell-off in stocks and retreated back to the 1.41 region from highs near 1.4030. The US dollar index did push above its 200-day moving average for the first time in 8 months which will tend to reinforce a positive technical stance towards the currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The Chinese growth data on Thursday was close to market expectations, but the higher than expected consumer inflation rate reinforced speculation that the Chinese authorities would tighten monetary policy further. In this context, potential carry trade support triggered by firm data was tempered by expectations that there would be a deterioration in international conditions over the next few months.

The net outcome was a slightly weaker yen and the dollar edged above the 91.50 level even though resistance levels were tough to breakdown. Underlying confidence in the Japanese economy remained weak which limited support for the yen with the dollar consolidating near 91.45.

The yen gained further strength during New York trading as risk appetite deteriorated with Obama’s banking-sector proposals undermining the dollar and curing risk appetite. The US currency dipped to lows near 90.10 and the Japanese currency also strengthened to test eight-month highs near 127 against the Euro.

Sterling

Sterling was initially able to hold above 1.6250 against the dollar on Thursday before weakening to lows near 1.6150 as the US currency maintained a robust tone.

The latest government borrowing data was slightly stronger than expected with a deficit of GBP15.7bn for December after a revised GBP18.7bn the previous month. This will provide some degree of support for Sterling, although it was still a record deficit for the month of December.

The latest money supply data recorded a sharp monthly decline for December and there will be some additional pressure for a further quantitative easing if the underlying money supply also records a decline.

There was a net improvement in the CBI industrial survey, although the impact was limited. The UK currency was able to consolidate close to 1.62 against the dollar while the Euro settled close to 0.87 against Sterling.

Swiss franc

The dollar pushed to a high near 1.05 against the Swiss franc on Thursday, but was unable to sustain the gains and dipped sharply back to near 1.0415 later in the US session. The Euro remained firmly on the defensive against the franc and weakened to lows below 1.47.

The Swiss currency will tend to gain further defensive support if there is a sustained deterioration in risk appetite. The ZEW business-survey index recorded a small monthly increase which provided some reassurance over the economy.

The Euro retreat to below 1.47 against the franc will increase pressure for the National Bank to intervene and prevent further gains.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

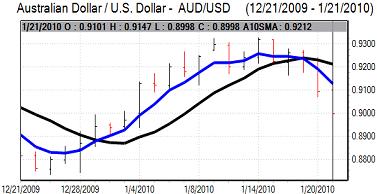

Australian dollar

The Australian dollar maintained a weak tone over the past 24 hours as the US currency was generally firmer while risk appetite was also weaker on fears over a tightening in China’s monetary policy.

These pressures continued in US trading with an Australian dollar low close to 0.9015 before a slight recovery. Trends in risk appetite will remain very important for the Australian currency in the near term and there is liable to be a more defensive tone.