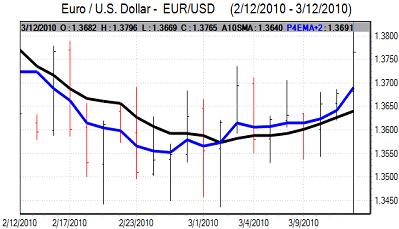

EUR/USD

The Euro maintained a firmer tone in early Europe on Friday and challenged resistance levels above 1.37 against the US currency.

Risk appetite was generally firmer during the day which provided some support to the Euro. The latest Euro-zone industrial production data was also stronger than expected with an output rise of 1.7% for January which gave an annual increase for the first time since 2008.

ECB President Trichet made comments on Friday that Greece had taken courageous and convincing measures on the budget deficit. The remarks suggest that the ECB has decided to provide strong verbal support for Greece to help soothe market tensions and this will tend to provide some support for the Euro. Confidence in the Euro could still erode very quickly given the underlying stresses.

The headline US retail sales data was stronger than expected with an increase of 0.3% for February while there was an underlying 0.8% rise for the month. There were downward revisions to the January data, but overall confidence surrounding first-quarter spending levels is likely to remain robust. In contrast, there was a downward revision to the University of Michigan consumer confidence data which will maintain some unease over the outlook further ahead.

There was speculation that San Francisco Fed President Yellen would be nominated for one of the vacant Fed Governor positions and this maintain some speculation over a more dovish FOMC and potential battles with the regional Fed Presidents.

The dollar was unable to regain ground and the Euro pushed to a high near 1.38 before consolidating near 1.3760 in choppy trading.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

In comments on Friday, Japanese Finance Minister Kan stated that intervention was an option to weaken the Japanese currency. The remarks inevitably fuelled market speculation that there would be Bank of Japan action to sell the yen and there were also expectations that the central bank would loosen policy at next week’s monetary policy meeting.

The yen maintained a generally weaker tone on the crosses and the dollar remained comfortably above the 90 level, although it did hit resistance above the 90.70 area ahead of the US data.

The dollar gained initial support following the US retail sales data before hitting resistance above 91. There was a sharp dip later in US trading with reports of heavy investment bank selling before the dollar consolidated around 90.50.

Sterling

Sterling found support above 1.50 against the dollar on Friday and maintained a stronger tone during the day.

The latest opinion polls suggested a slightly stronger chance that there would be a decisive election result in the May general election which had some positive impact on Sterling while the currency also drew support from the improvement in risk conditions. The political developments will be watched closely over the weekend and it will still be difficult to secure sustained relief.

Bank of England Economist and MPC member dale stated that a pause in the quantitative easing did not mean that it had come to an end and there is likely to be further speculation that there could be an expansion of the programme within the next few months, especially if there is evidence of deteriorating credit conditions within the banking sector.

During the remainder of Friday, a covering of short Sterling positions was still the dominant influence and the UK currency pushed to a high just above 1.52 against the dollar.

Swiss franc

The dollar was blocked below 1.07 against the Swiss currency during Friday and weakened to test support below 1.06 during the day.

The Euro/Swiss franc cross remained an important focus during the day and there were initial reports of the Swiss National Bank selling the franc which kept the Euro above 1.46.

The Euro was subjected to renewed selling pressure later in the US session and dipped to a low near 1.4560. With the markets looking to take on the National Bank, there will be further speculation over renewed intervention next week.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

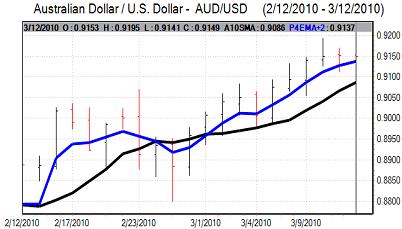

Australian dollar

The mood of underlying Australian dollar confidence was sustained in local trading on Friday with the currency edging stronger with highs near the 0.92 level.

There will still be unease over the risk of further monetary tightening by the Chinese authorities which would tend to weaken commodity prices and put some downward pressure on the Australian dollar.

Risk appetite was generally stronger during Friday, but the Australian currency was unable to make any further headway and consolidated near 0.9150 with some selling pressure on the crosses restraining the Australian dollar.