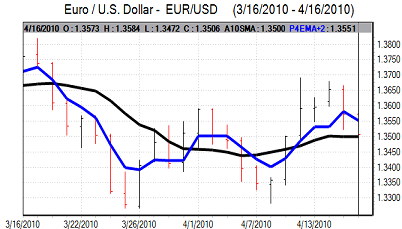

EUR/USD

The Euro drifted lower again in early Europe on Friday with a lack of buying support as fears surrounding the Greek situation persisted. There were reports that the Greek government was about to announce a formal application for EU and IMF support in order to stabilise the budget situation and this maintained selling pressure on the Euro. The reports were later denied by the government, but uncertainty remained a negative factor for the currency.

The US data was again mixed during the day. There was a 1.9% increase in housing starts for March while there was a 7.5% increase in permits which will maintain some degree of optimism over the construction sector.

In contrast, the Michigan consumer confidence was significantly weaker than expected with a decline to 69.5 for April from 73.6 the previous month. There will be particular concern that the expectations component declined to the lowest level for over 12 months which will increase doubts over future spending trends and curb yield support for the dollar.

The consumer confidence data had an important impact in undermining risk appetite during the New York session and the pressure intensified following an SEC announcement that Goldman Sachs would be subjected to fraud charges relating to CDOs. There was a sharp drop in equity markets following the news which also helped trigger some defensive dollar demand against the Euro.

The Euro dipped to lows near 1.3470 before rallying back to the 1.35 area as stop-loss Euro selling was lower than expected.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The yen regained some ground on the crosses in US trading on Friday as a slightly more cautious attitude towards risk curbed selling pressure on the Japanese currency. This pattern of trading continued on Friday with the yen strengthening towards 125.50 against the Euro as sovereign risk fears tended to increase again.

There was further speculation over an imminent move to revalue the Chinese yuan, possibly over the weekend, and this was an important factor in curbing yen selling pressure. The dollar dipped to a low towards 92.60 in early Europe.

There were comments from the Japanese Finance Ministry that there should be intervention to weaken the yen and there was initial selling pressure on the Japanese currency, but the dollar failed to hold the gains.

The yen drew support from the Goldman Sachs fraud charges as risk appetite deteriorated. There were also comments from Chinese President Hu as he stated in a speech that China would move gradually to adopt a floating exchange rate regime. In this environment, the dollar dipped sharply to lows just below 91.90 before stabilising.

Sterling

Sterling was again blocked close to the 1.55 level against the dollar in early Europe on Friday and also stalled against the Euro.

There was some increase in uncertainty over the General Election outcome which had a negative impact on Sterling confidence, although the impact was measured.

There was also a deterioration in global risk appetite which tended to undermine the UK currency, especially as there were increased fears over global risk appetite.

The economic data will come under greater focus next week with the latest consumer inflation data on Tuesday, borrowing figures on Thursday and the latest GDP data on Friday. The data will have a significant impact on underlying Sterling sentiment and a weak GDP figure would undermine confidence.

Sterling dipped to lows just below 1.5370 against the US currency before stabilising just below the 1.54 level.

Swiss franc

The dollar found support near 1.0550 against the franc on Friday and pushed to a high of 1.0630 in US trading. The Euro was confined to relative narrow ranges, but did edge towards the 1.4325 area as the potential threat of intervention discouraged franc buying.

The Swiss currency should continue to gain some support from the underlying lack of confidence in the Euro area. Any sustained deterioration in risk appetite would also tend to provide some degree of support for the franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar edged lower to test support below 0.93 against the US dollar in Asian on Friday. A measured deterioration in risk appetite curbed currency support and the currency will also tend to lose ground if there is a Chinese yuan revaluation.

Both these factors were an important market influence during New York trading on Friday and the Australian dollar dipped to lows around 0.9230 level as equity markets dipped sharply before stabilising just above 0.9250.