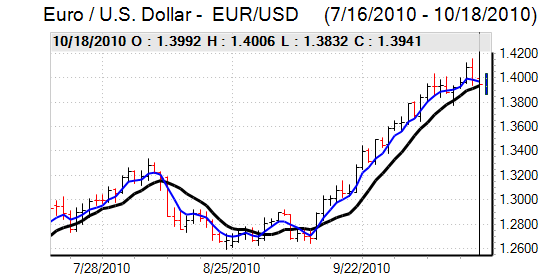

EUR/USD

The Euro was unable to regain momentum in early Europe on Monday and was subjected to a further round of heavy profit taking with a decline to the 1.3830 area ahead of the US open. The Euro found support below 1.3850 and then rallied steadily during the US session with a peak close to 1.40.

The US housing-sector data was slightly stronger than expected with an NAHB gain to 16 for October from 13 the previous month. In contrast, the industrial data was disappointing with a 0.2% monthly decline for September.

Markets continued to monitor Federal Reserve remarks closely and Regional Fed President Lockhart stated that the quantitative easing would need to reasonably large to have a significant effect and the general thrust of comments from Fed officials has been in favour of further easing. There are uncertainties over the size of any further boost and the markets have also priced in further easing which should limit dollar selling.

The capital-account data recorded long-term capital inflows of US$128.7bn for August from US$61.2bn the previous month. Although the overall figure was capital inflows was more modest, the strength of long-term flows will provide some degree of relief.

The latest price action in the options market indicated that demand for Euro puts had increased sharply and this will increase market speculation that the Euro has hit at least a near-term peak and the currency retreated back to the 1.3950 area.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

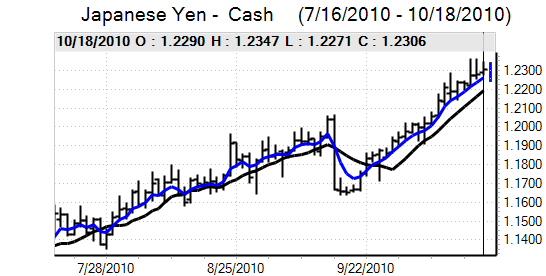

Yen

The yen was still able to resist significant selling pressure in Asia on Monday, especially with reduced speculation that the Bank of Japan would decide on further intervention. There was also a further round of profit taking on long positions in commodity currencies which helped underpin the Japanese currency.

With G7 bond yields remaining at low levels, there was a reduced incentive to push funds out of the yen and the dollar remained blocked below the 81.50 level. There was a further decline to lows near 81.10 ahead of the US open, but there was a reluctance to push the US currency lower, especially with evidence that yen demand was fading slightly.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Sterling

This dollar correction initially continued on Monday which pushed Sterling to lows near 1.5910, but Sterling was resilient against the Euro with a 3.1% increase in Rightmove house prices for October providing some support.

Despite the firmer than expected housing survey, there are still strong expectations of a weaker economy over the next few months. In the near term, media attention will focus on the programme of spending reductions due to be announced by the government on Wednesday. Although the fiscal-policy adjustment should be priced in to Sterling’s value, there is still liable to be a negative impact on market sentiment. Former Bank of England MPC member Blanchflower warned that there was a high risk of a double-dip recession.

There will also further speculation over additional quantitative easing by the Bank of England within the next few months and comments from Bank of England head King will be watched closely on Tuesday. In this environment, Sterling will find it difficult to make much headway and there was renewed selling pressure above 1.59 against the dollar.

Swiss franc

The dollar was again unable to mount a challenge on resistance levels near 0.97 against the franc on Monday and weakened to lows below 0.950 before finding fresh support. The Euro dipped to lows near 1.33 before finding support.

Developments surrounding quantitative easing within the major economies will remain an important focus. As well as expectations of further Federal Reserve action, there will be further speculation that the ECB will need to be more aggressive than it wants to be in order to combat weakness in the financial sector. In this environment, the franc should prove to be broadly resilient.

Australian dollar

The corrective Australian dollar trend persisted in Asia on Monday with a low near 0.9820 against the US dollar. A slightly more cautious tone towards risk appetite will tend to lessen currency demand, but there are still expectations of further quantitative easing by the Fed which will curb selling pressure. Finance Minister Swan also stated that he was opposed to intervention to weaken the Australian currency.

As the US currency was subjected to renewed selling pressure, the Australian dollar was able to rally to the 0.9920 area later in the US session.