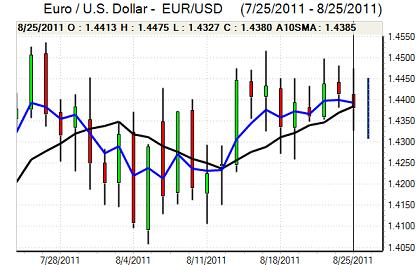

EUR/USD

The Euro again stalled in the 1.4475 area against the dollar on Thursday and was subjected to heavy selling pressure during the US session with lows near 1.4330 as a weaker Euro was compounded by a generally firmer dollar tone.

Euro confidence was unsettled initially by a further rise in Greek yields to fresh record highs as tensions surrounding collateral for bailout funds continued to fuel speculation that the support package could unravel. There were also further liquidity strains within European banks as dollar Libor rates continued to edge higher.

The Italian authorities confirmed that a ban on short selling of financial stocks would be extended which also damaged investors sentiment and confidence deteriorated sharply on rumours that Germany was also about to ban short selling or subjected to a credit-rating downgrade. The German Dax index fell extremely rapidly which also dragged the Euro down before a recovery at the end of the European day.

The latest US jobless claims data was slightly worse than expected with an increase to 417,000 in the latest week from 405,000 previously, although the impact was muted as it coincided with an announcement of a Berkshire Hathaway stake in Bank of America. Markets also remained focussed on Fed Chairman Bernanke’s Friday speech and sentiment has moved away from expecting an announcement of fresh quantitative easing, although there are widespread expectations that he will express confidence that the Fed has the tools necessary to deal with any fresh economic weakness.

The dollar gained some support from reduced expectations over further easing and will, therefore be subjected to heavy selling pressure if Bernanke takes a very dovish tone. The Euro was able to recover from its worst levels with further evidence of Euro buying from Asian central banks.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was able to resist a further test of support in the 76.50 area against the yen on Thursday and maintained a firmer tone. A break of resistance above the 77.20 area helped push the US currency to a 3-week high near 77.70 before it faded again during the Asian session on Tuesday.

The dollar gained some support from reduced expectations of additional Fed quantitative easing and yen buying support was dampened by fears over potential intervention to weaken the Japanese currency.

Underlying risk appetite remained extremely fragile as confidence in the global growth outlook weakened and this was important in curbing yen selling, especially as European bourses declined.

Sterling

Sterling was unable to regain the 1.64 level against the dollar during Thursday and was subjected to further selling pressure in New York trade with a rapid decline to lows near 1.6250 before a tentative rebound. The Euro also rallied to near 0.8850 with reported Euro demand form the Bundesbank.

There was a further unwinding of Sterling positions with fears that defensive buying support has been over-done. Sterling could still gain some protection if confidence in the Euro-zone deteriorates further with capital flows likely to remain volatile.

Domestically, the latest CBI retail sales survey recorded a further decline to -14 for August from -5 previously which was the lowest reading since May 2010 and reinforced fears that the UK economy would deteriorate further.

Bank of England MPC member Weale stated that the economic outlook had deteriorated and that further quantitative easing would be effective if the conditions required further action. He did, however, play down the possibility of near-term action and Sterling edged firmer on Friday.

Swiss franc

The dollar pushed to a high near 0.80 against the franc on Thursday and the Euro also briefly rose above the 1.15 level, but both currencies were unable to sustain the gains as resisted levels remained tough to break down with the dollar retreating back to the 0.7930 area.

Further turbulence within Euro-zone stock markets triggered some renewed defensive demand for the Swiss currency as underlying confidence remained very fragile.

There was a further decline in the Swiss ZEW index to -71.4 for August from -58.9 previously, the lowest reading since late 2008, which increased fears over industrial damage from Euro-zone vulnerability and an extremely over-valued franc. In this environment, there will be fresh pressure for the additional National Bank measures to weaken the currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar found support in the 1.0420 area against the US dollar during Thursday and rallied back to the 1.05 area in Asian trading on Friday as solid buying support emerged at lower levels as risk conditions attempted to stabilise.

Reserve Bank Governor Stevens also stated that inflation was still a concern which dampened expectations of a shift in the central bank policy stance and also provided some currency support. There were still fears surrounding the domestic and global growth environment which curbed buying support for the currency.