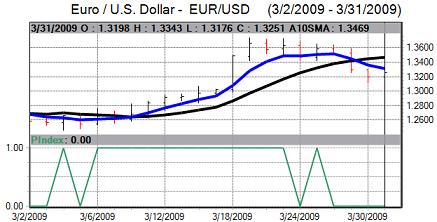

EUR/US$

Risk appetite generally improved during Tuesday and this helped underpin the Euro with support below 1.32 against the dollar. Improvements in underlying Euro sentiment were still limited as there were further credit-rating downgrades for European countries with Irish and Hungarian debt ratings both cut over the past 24 hours.

German unemployment rose by a further 69,000 for February which was a sharper increase than expected and the Labour Office forecast that there would not be an improvement during 2009. The flash Euro-zone inflation rate fell sharply to 0.6% in March from 1.2% previously.

There is a very strong probability that the ECB will cut interest rates at Thursday’s council meeting. Any comments on non-conventional policy measures will continue to have an important impact on Euro sentiment with any move to buy bonds likely to undermine the currency.

The US economic data was slightly weaker than expected and contributed to a slightly more cautious market tone in New York. The Chicago PMI index weakened to 31.4 in March from 34.2 previously and all the main components remained trapped near record lows. Consumer confidence edged higher to 26.0 from 25.3 previously with confidence in the labour market still very weak.

Comments surrounding the G20 meeting will continue to be watched closely. There has been further friction over the past 24 hours with the French government threatening to walk out of the meeting if there is no agreement on tighter financial regulation, although a more consensual approach is liable to prevail eventually which should curb Euro selling.

There was evidence of position adjustment in US trading as the first quarter drew to a close and the Euro settled below 1.33 after a high of 1.3340.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

Yen:

The price action has continued to suggest that underlying yen demand remains weaker with selling on any significant rallies and there was evidence of yen renewed pressure during Tuesday.

The Japanese economic data offered no significant support to the yen as unemployment increased to 4.4% in February from 4.1% the previous month while household spending fell 3.5% over the year. Markets were also fearful that the quarterly Tankan business sentiment index will record a further severe downturn.

Underlying capital flows remained weaker for the yen and it dipped back to lows beyond 98.20 against the dollar as Asian stock markets stabilised on Tuesday. The yen maintained a consistently weaker tone during the day and the dollar pushed to a three-week high above 99. The yen also suffered the largest quarterly decline for eight years with net flows liable to remain weaker for now..

Sterling

The UK currency resisted a further decline below 1.42 against the US dollar on Tuesday and challenged resistance levels above 1.43. Sterling also found support beyond 0.93 against the Euro.

The latest consumer confidence data recorded an improvement to -30 in March from -35 and this was the strongest level for 10 months. The data will trigger some hopes that consumer spending will be broadly resilient over the next few months despite a very weak labour market and this will offer some degree of currency support.

Overall confidence in the economy is still likely to be very weak and Sterling will be dependent on a sustained improvement in risk appetite to sustain any significant gains. As Wall Street advanced, Sterling edged firmer to 0.9255 against the Euro.

Swiss franc

The dollar was unable to sustain levels above 1.15 on Tuesday and weakened to lows near 1.1350 before consolidating near 1.14. The franc maintained a firm tone against the Euro with a 20-day high near 1.5120. The franc gained some support even though risk appetite was generally firmer over the day.

The Swiss currency performance will increase the risk of further National Bank action to weaken the franc within the next few days.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

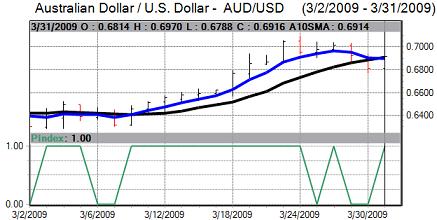

Australian dollar

The Reserve Bank suggested that the economy could well be in recession which dampened confidence to some extent, although market expectations are still focussed on only a small interest rate cut at most at next week’s policy meeting.

There is scope for significant capital inflows from Japan at the start of the new fiscal year which will help underpin the Australian currency and will also cushion it from selling in the event that risk appetite deteriorates again.

The Australian dollar found support below the 0.68 level against the dollar and strengthened to highs above 0.6950 as it secured robust gains against the yen.