October sugar closed up 74 points at 16.98 cents yesterday. Prices closed near the session high yesterday and hit a fresh contract high. Panic short covering and fresh speculative buying was featured. The key “outside markets” were bullish for sugar futures yesterday, as the U.S. stock indexes were firmer, and crude oil was solidly higher, while the U.S. dollar was sharply lower. A bearish rounding-top reversal pattern on the daily chart was negated yesterday and the bulls gained fresh upside technical momentum. Bulls’ next upside price objective is to push and close prices above technical resistance at 17.50 cents. Bears’ next downside price objective is to push and close prices below solid technical support at last week’s low of 15.61 cents. First resistance is seen at yesterday’s contract high of 17.00 cents and then at 17.25 cents.

First support is seen at 16.75 cents and then at 16.50 cents.

Wyckoff‘s Market Rating: 7.5

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

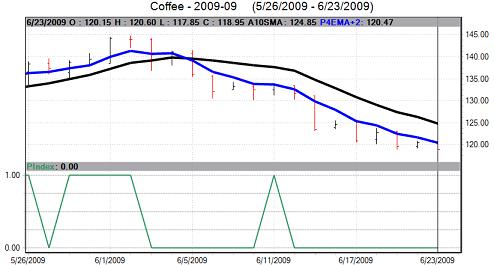

September coffee closed down 150 points at 118.95 cents yesterday. Prices closed near mid-range yesterday and did hit a fresh six-week low. The key “outside markets” were bullish for coffee futures yesterday, as the U.S. stock indexes were firmer, and crude oil was solidly higher, while the U.S. dollar was sharply lower. Yet, coffee sold off, which is a bearish clue. Prices are still in a steep three-week-old downtrend on the daily bar chart. Coffee bulls’ next upside price objective is pushing and closing prices above solid technical resistance at 125.50 cents. The next downside price objective for the bears is closing prices below solid technical support at 115.00 cents a pound. First support is seen at yesterday’s low of 117.85 cents and then at 116.00 cents. First resistance is seen at this week’s high of 120.90 cents and then at 122.50 cents.

Wyckoff’s Market Rating: 2.5

September cocoa closed up $12 at $2,492 yesterday. Prices closed near the session high on short covering. Prices did hit a fresh three-week low early on yesterday. The key “outside markets” were bullish for cocoa futures yesterday, as the U.S. stock indexes were firmer, and crude oil was solidly higher, while the U.S. dollar was sharply lower. Serious chart damage has been inflicted in cocoa recently. The next upside price objective for the cocoa bulls is to push and close prices above solid technical resistance at $2,650. The next downside price objective for the bears is pushing and closing prices below solid technical support at the May low of $2,289. First resistance is seen at this week’s high of $2,510 and then at $2,550. First support is seen at yesterday’s low of $2,466 and then at $2,450.

Wyckoff’s Market Rating: 4.0.

December cotton closed up 38 points at 55.87 cents yesterday. Prices closed nearer the session high on tepid short covering following recent strong losses. The key “outside markets” were bullish for cotton futures yesterday, as the U.S. stock indexes were firmer, and crude oil was solidly higher, while the U.S. dollar was sharply lower. Prices are still in a six-week-old downtrend on the daily bar chart. The next downside price objective for the bears is to produce a close solid technical support at 52.00 cents. The next upside price objective for the bulls is to produce a close above solid technical resistance at 60.00 cents. First resistance is seen at yesterday’s high of 56.23 cents and then at this week’s high of 56.65 cents. First support is seen at 55.00 cents and then at this week’s low of 54.77 cents.

Wyckoff’s Market Rating: 4.0.

September orange juice closed down 30 points at $.7810. Prices closed nearer the session high yesterday after hitting a fresh three-month low early on. The key “outside markets” were bullish for FCOJ futures yesterday, as the U.S.stock indexes were firmer, and crude oil was solidly higher, while the U.S. dollar was sharply lower. Yet, FCOJ could get no traction, which is a bearish clue. FCOJ bears still have the solid near-term technical advantage. Prices are in a steep three-week-old downtrend on the daily bar chart. The next downside technical objective for the FCOJ bears is to produce a close below solid technical support at the contract low of $.7270. The next upside price objective for the OJ bulls is pushing prices above solid technical resistance at $.8500. First resistance is seen at $.7900 and then at $.8000. First support is seen at $.7750 and then at yesterday’s low of $.7625.

Wyckoff’s Market Rating: 2.0.

July lumber futures closed down the $10.00 limit at $200.90 yesterday. Prices gapped lower on the daily bar chart. The key “outside markets” were bullish for lumber futures yesterday, as the U.S. stock indexes were firmer

and crude oil was solidly higher. Yet lumber closed limit down, which is a bearish clue. The next upside technical objective for the lumber bulls is pushing and closing prices above solid technical resistance at last week’s high of $216.30. The next downside price objective for the bears is pushing and closing prices below solid support at $190.00. First resistance is seen at $205.00and then at yesterday’s high of $208.40. First support is seen at $196.00 and then at $195.00.

Wyckoff’s Market Rating: 3.5.