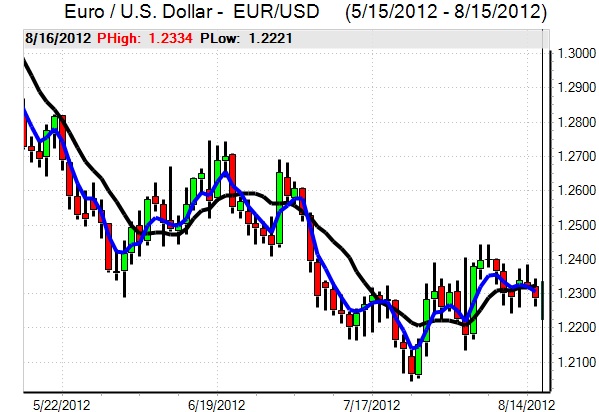

EUR/USD

The Euro was unable to make significant headway in Europe on Wednesday and dipped sharply ahead of the US open. There were reports of stop-loss selling once support in the 1.2320 area was broken and there were also reports that the Swiss National Bank was selling Euros as part of its reserve management operations following intervention to defend the 1.20 Euro minimum level. Euro weakness on the crosses spilled over into the rate against the dollar as it dipped to lows near 1.2270.

Greek Prime Minister Samaras will hold talks with Euro-zone leaders over the next few days as Greece looks for greater flexibility on loan terms amid continuing speculation that the country could effectively be pushed out of the Euro-zone.

There was still a high degree of uncertainty surrounding the Spanish situation as the government debates whether to ask for sovereign support. There were also reports that Spain would receive a first tranche of aid for the banking sector within the next few days given that Bankia is facing collateral difficulties and this would reinforce fears surrounding both the banking sector and the economy as a whole.

The latest US consumer inflation data was weaker than expected with no increase in headline prices for the month while there was a 0.1% increase in core prices to give a 2.1% annual increase. The data will maintain expectations that the Fed will not feel constrained by inflation considerations if it deems further quantitative easing necessary.

The latest New York PMI index was substantially weaker than expected at -5.9 for August from 7.4 previously and this was the first negative reading for over 18 months. The other data was more supportive with industrial production rising 0.6% while there was a the strongest NAHB house-building index for five years at 37. The net impact was higher US yields which helped protect the dollar. The Euro rallied to a high just above 1.23 before fading again in Asia on Thursday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to break above 79 against the yen on Wednesday and dipped sharply lower following the latest US economic data with a retreat back towards the 78.60 area.

The dollar was able to recover ground quickly as US Treasury yields resumed their upturn with a move to the 1.80% area for benchmark yields. The dollar continued to gain ground on Thursday and pushed to a fresh one-month high above 79.30.

There were still expectations of bond redemptions which underpinned the yen and there was also caution surrounding the regional growth outlook following a decline in Chinese inward investment.

Sterling

Sterling continued to hit resistance around the 1.57 level against the dollar on Wednesday, but did prove to be broadly resilient during the day with support on dips towards the 1.5650 area as the UK currency advanced to below 0.7950 against the Euro.

The latest labour-market data was stronger than expected with a 5,900 decline in the claimant count for July following a revised 1,000 increase the previous month and the ILO unemployment rate also declined to 8.0% from 8.1% as employment was boosted ahead of the Olympics. There were concerns that unemployment would increase again once the games had finished which dampened the impact.

The Bank of England minutes from August recorded unanimous votes to keep interest rates and the amount of quantitative easing on hold at the meeting. The majority of members were content to assess the impact of previously-announced bond purchases, although a minority did consider further action at this meeting. A weak retail sales report would reinforce unease surrounding the economic outlook and Sterling again hit resistance close to 1.57 against the dollar.

Swiss franc

The dollar found support below 0.9750 against the franc on Wednesday and pushed to highs just below 0.98 as the Euro remained pinned to the 1.2010 area.

Rumours that the National Bank was diversifying its Euro holdings increased speculation that the bank was still being forced to intervene aggressively to prevent the Euro weakening. Although narrow ranges for the major currencies may prevail in the short term, there will be underlying speculation that the bank will eventually be forced to abandon the minimum level.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar remained under pressure in Europe on Wednesday and retreated to lows near 1.0450 before rebounding to the 1.05 area on renewed hopes that the Federal Reserve could sanction additional quantitative easing.

There were underlying concerns surrounding the Australian and regional economies which had some negative impact on the Australian currency, especially given unease over the Chinese outlook, and it stalled close to the 1.05 level before drifting weaker again.