The market’s been running higher for a while now and the number of base breakouts is shrinking. That’s not necessarily a bad thing but careful not chase extended stocks. Scads of growth names broke out weeks ago. They’re too far past proper buy points to consider buying now.

That said one growth name that still looks interesting here is IAC/Interactive Corp. (IACI).

THE NUMBERS

Fundamentals are solid at IACI. Sales growth has accelerated for four straight quarters, from 23% to 25% to 32% to 39%. In its latest reported quarter, sales rose 40% from a year ago to $680.6 million. Earnings increased 39% to $0.86 a share. Annual earnings are expected to grow 25% this year and next.

IACI owns a collection of Internet properties including Ask.com, Match.com and The Daily Beast. In late August, the company acquired the About Group from the New York Times for $300 million. About’s main asset is About.com.

CONSTRUCTIVE ACTION

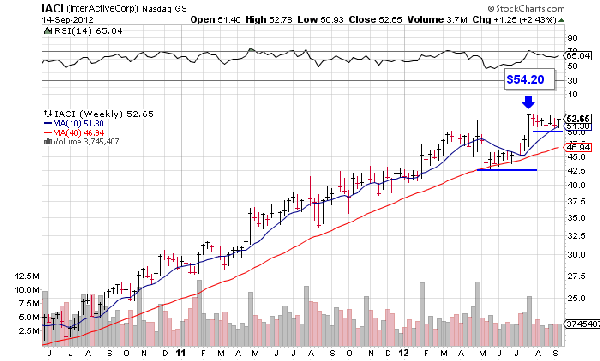

Heavy volume came into the stock during the week of July 27. It rose 11% for the week and broke out of an 11-week consolidation. It didn’t get very far but continues to show constructive action, trading tightly and firming up at its 10-week-moving average.

BASE ON BASE

IACI’s current chart pattern is known as a base-on-base pattern. The pattern forms when a stock breaks out, rallies less than 20%, then forms another base on top of the first base. Keep an eye on IACI for a heavy-volume move over its recent high of $59.20.

RALLY STAGE MATTERS

Keep in mind that the strongest stocks tend to come out in the early stages of a market uptrend so it’s important not to buy second- and third-tier stocks in a group at this point. No question IACI is a market leader, but the one risk here is that it’s made a big price move already. Late-stage breakouts can work but they’re more prone to failure.

The one thing IACI has going for it is that the major averages remain in confirmed uptrend. In other words, the market tide continues to flow positive.

Looking for more trading ideas? Read our daily Markets section here.

[Editor’s note: Shreve provides live market analysis every day on the TFNN radio network, hosting a daily call-in talk show: Breakout Investing, from 3-4 ET. Listen live]