When mathematician Leonardo of Pisa (nicknamed Fibonacci) discovered a way to predict the number of pairs of rabbits after a year of breeding, he probably had no idea that centuries later people would make trading decisions based on his work. Fibonacci ratios and expansions might play an important role in today’s trading, but you don’t need to be a mathematician to use these ideas.

In this article we’ll discuss the idea of Fibonacci retracements, we’ll explain the concept of Fibonacci expansions, and introduce a strategy that will help you identify the best opportunities for trading breakouts using Fibonacci expansions as profit targets.

WHY FIBONACCI?

Fibonacci ratios are based on the Fibonacci sequence, and found as repeating ratios in nature. If you’re new to the ideas of Fibonacci and the Golden Ratio, take the time to do a little research. The concept is fascinating. When trading, the most commonly used ratios are 23.6%, 38.2%, 50% and 61.8%. Traders use these ratios to identify possible retracement levels in a trending market. Although associated with Fibonacci retracements, the 50% level is technically not a Fibonacci ratio, but in our experience equally as valid.

USE THE RETRACEMENTS

Since a market won’t move up or down without pausing, traders accept that even the healthiest trends will have corrections and retracements. These retracement levels can be attractive areas for buyers or sellers to enter a trend that they expect will continue. Using Fibonacci ratios, traders will watch for strength and continued buying or selling at these levels. If a market retraces past the 61.8% level, the move might be over, and it’s probably best to look for other trading opportunities.

SETUP AND TRIGGER

To trade the Simple Fibonacci Expansion setup, we need a market that is moving. This is a momentum trade and not meant to be used in quiet or sideways markets. For day traders the E-mini S&P, Euro FX, Crude Oil, and Gold are nice markets to trade. Although this setup can be traded on different time frames, our testing and live trading experiences are based on setups using range bars, not time bars.

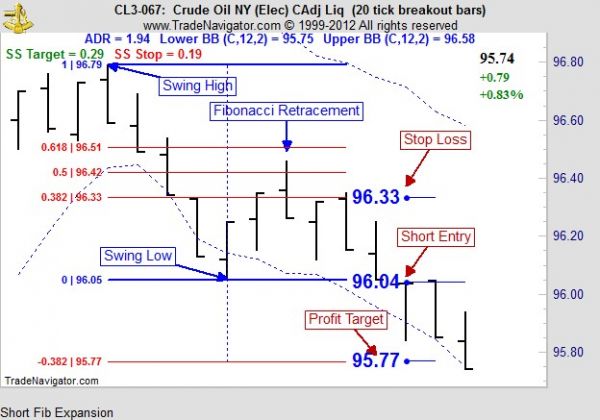

When a market is moving, we’re either looking to identify a trend, or major reversal. Trends can be identified by connecting the most recent swing low (lowest low in a series of lows) and the most recent swing high (highest high or peak after a series of highs). If we are anticipating a continuation of a trend and move higher, we want to see a retracement to the 38.2%, 50%, or 61.8% level. Based on the Fibonacci ratio concept, we expect that traders will step in at key Fibonacci levels, pushing the market higher.

Following a pullback to a Fibonacci level, we wait for a break above the recent high to go long or recent low to go short. To get into the trade we will simply place a buy stop order 1 tick above the recent high after a valid setup, or a sell stop order 1 tick below the recent low.

After a suitable retracement and breakout, we expect that the market will have enough momentum to continue to move. Once in a trade, our profit objective will be based on the Fibonacci expansion concept. Similar to Fibonacci retracements, expansions can be calculated using Fibonacci ratios to project market moves. A 1.382% Fibonacci expansion is a nice conservative profit objective for day traders, and where we look to exit a move. Most popular charting packages allow you to draw both Fibonacci retracements and Fibonacci expansions, so you don’t need to do these calculations on your own. These Fibonacci drawing tools are very handy, and you should make sure to learn how to use them!

Since the setup requires a retracement and breakout, we expect the move to continue and not to retrace before reaching the 1.382% Fibonacci expansion target. Since a retracement could mean that we don’t have enough momentum for the market to move, we want to get out of the trade if another 38.2% retracement occurs. With this said the previous 38.2% Fibonacci retracement level will be where we place our stop loss.

FOUR SCENARIOS

Based on the rules above, there are four scenarios that we look to trade:

Long Swing High Breakout – In this scenario we look for a breakout from a sideways move and connect the recent low and the recent high. Using the Fibonacci expansion strategy we wait for a pullback of a minimum of 38.2%, but no greater than 61.8%. Then wait for a breakout through the high.

Short Swing Low Breakout – In this scenario we look for a breakout from a sideways move and connect the recent high and the recent low. Using the Fibonacci expansion strategy we wait for a pullback of 38.2%, but no greater than 61.8%. Then look for a breakout through the low.

Uptrend Reversal – Following a major uptrend, we’ll look for 3 or more bars closing lower (ideally a move below the 61.8% retracement level of the previous trend). We’ll then wait for the 38.2%-61.8% retracement, and look to trade a breakout short, counter to the previous major trend.

Downtrend Reversal – Following a major downtrend, we’ll look for 3 or more bars closing higher (ideally a move above the 61.8% retracement level of the previous trend). We’ll then wait for the 38.2%-61.8% retracement and look to trade a breakout long, counter to the previous major trend.

TIPS AND TRICKS

Many times the best breakouts occur when other technical indicators are confirming the trend. Since the risk/reward ratio is usually 1:1 with this setup, any additional confirmation to improve your accuracy or confidence will help. If you’re a trader that prefers better risk/reward ratios consider entering a position at the 38.2% retracement, then look for a move to the 1.382% Fibonacci expansion. By placing your stop just below the 61.8% retracement level you’ll often find setups that offer 1:2 or 1:3 risk/reward ratios. The earlier entry is more rewarding, but also more aggressive since the breakout might not occur.

ANOTHER TOOL FOR YOUR TOOLBOX

Many traders focus on Fibonacci ratios, missing the bigger opportunity available when looking at Fibonacci expansions as profit target. With these simple rules for day trading Fibonacci ratios and expansions, you should be well on your way to incorporating this powerful trade setup into your trading.

Read our daily Markets section here for specific trading ideas.