Negativity persists among investors, as evidenced by the ongoing stream of money leaving equity funds into bond funds. It’s challenging to pinpoint the origin of the pessimism because it comes from all over the globe. Daily polls finding Americans at an extreme political division, scenes of anti-austerity riots in Greece and Spain, and the Shanghai Composite Index falling to new lows are only three recent examples.

On one of my frequent visits to ted.com to seek different ways of thinking about very familiar subjects, I came across a presentation by Harvard University Professor Nicholas Christakis called, “How social networks predict epidemics.” I was fascinated by how he helped shed light on this unrelenting feeling of doom that has left so many people lacking confidence in equities.

Christakis showed how our world has an embedded social network fabric with various interconnections. Each person’s position in the social network varies, depending on his or her friends, families, coworkers, as well as genes. Where we are structurally located in this global network can impact our health, emotions and attitudes, he says. We all recognize how viruses spread through a network but don’t realize how a problem like obesity can also be contagious.

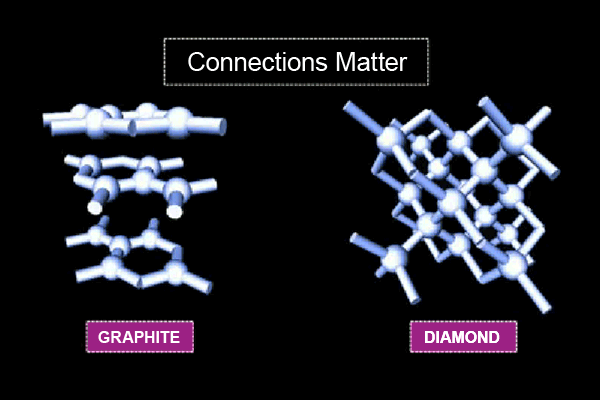

What does catching the flu or gaining weight have to do with negative sentiment? If you don’t think connections matter, consider the difference between a pencil and a diamond. Although these two common objects are both made of carbon, the atoms are arranged differently, causing the graphite to be soft and dark and diamonds to be hard and clear.

He explains:

“So, similarly, the pattern of connections among people confers upon the groups of people different properties. It is the ties between people that makes the whole greater than the sum of its parts. And so it is not just what’s happening to these people–whether they’re losing weight or gaining weight, or becoming rich or becoming poor, or becoming happy or not becoming happy–that affects us; it’s also the actual architecture of the ties around us.

“Our experience of the world depends on the actual structure of the networks in which we’re residing and on all the kinds of things that ripple and flow through the network. Now, the reason, I think, that this is the case is that human beings assemble themselves and form a kind of superorganism. Now, a superorganism is a collection of individuals which show or evince behaviors or phenomena that are not reducible to the study of individuals and that must be understood by reference to, and by studying, the collective.”

Christakis suggests that if we understand how social networks form and operate, we can understand how major events such as crime and warfare happen, how economic events including bank runs and market crashes occur, and how investor pessimism can persist.

Watch now:

The Shanghai Composite Index (SSE) is an index of all stocks that trade on the Shanghai Stock Exchange. By clicking the link above, you will be directed to a third-party website. U.S. Global Investors does not endorse all information supplied by this website and is not responsible for its content.