In past columns I have written about sectors which tend to lead in market rallies. Those sectors tend to be cyclical or economically sensitive groups. One of the best indicators of market health is the semiconductor group. Used in this manner the Philadelphia Semi-Conductor (SOX) Index can give us a heads-up on the immediate, future direction of the market.

RECENT ACTION

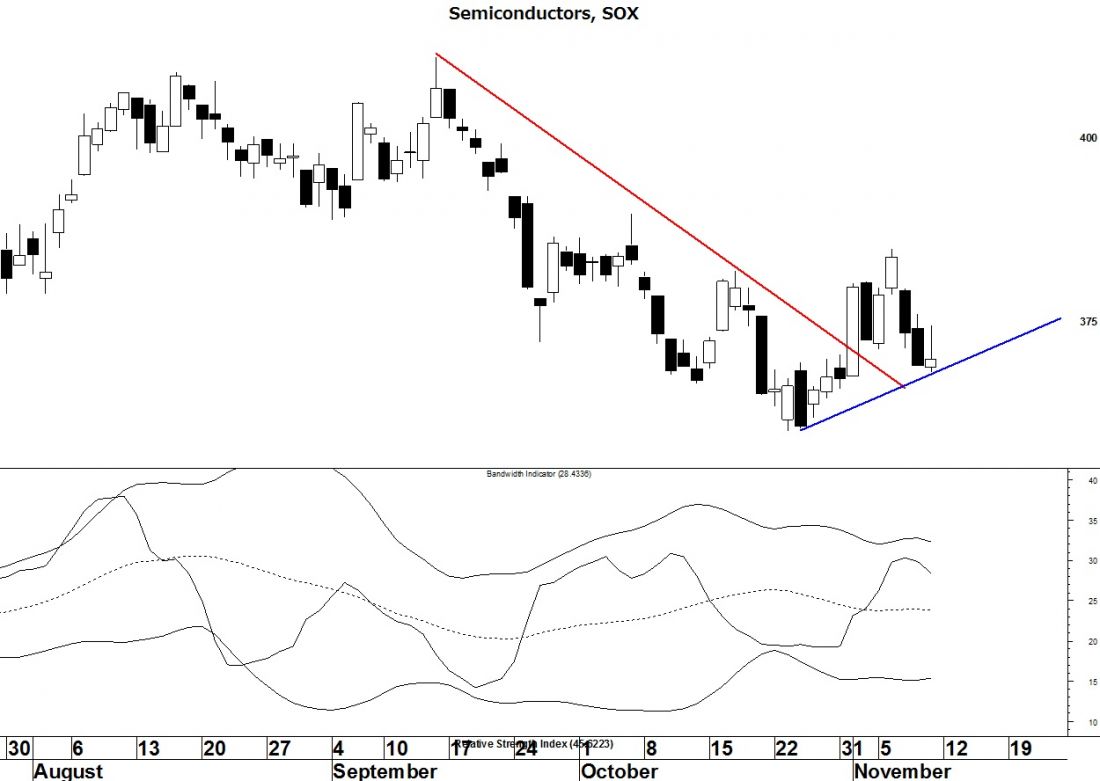

Taking a look at the SOX index we can see that the September-October downtrend was broken with the November 1 rally. How can we be reasonably confident that this wasn’t a false breakout? The indicator below is my Bandwidth indicator which I first wrote of in SFO Magazine, November 2009 (Bollinger Band Users: A New tool). The bottom line with this indicator is that it advances with the ‘true trend’ of the index under consideration.

CONFIRMATION CLUES

Notice how the bandwidth indicator turned up confirming the November rally. That was the best indicator I had that the rally in the SOX was the ‘true trend.’ Notice also how it has turned down as the index pulled back last week. I call that a “non-confirmation” and is another sign that the ‘true trend’ is ‘up.’

THE TAKEAWAY

I believe that semiconductors — a leading sector –are telling us that the broader equity market is ready to rally.

= = =

Read more daily Markets stories here.

[Editors’ note: Click here to learn about a “sneak peek” offering that Carlson is offering for his subscriptionbased newsletter.]