The risk aversion trade remained relatively quiet today as no major U.S. economic reports were released. Over the next couple of months, the spotlight in FX will remain with the European Debt Crisis and the U.S. fiscal cliff.

In Europe, not many optimists can put a positive spin on any reports out of Europe, especially the delaying of the release of bailout funds to Greece. Other stories include a weakening Germany and France. This does not bold well for a strong euro. The fear of debt contagion will also steal some headlines. Yields on the benchmark 10-year bond for Italy are above 5.0% and Spain’s yield is quickly approaching the key 6.0% level. Both Italy and Spain do not have necessary economic growth to warrant these extremely high borrowing costs and a bailout request for both will become more apparent in 2013.

The situation for the U.S. is better than Europe, but far from good. President Obama has about 7 weeks to end the gridlock between the red and blue tie wearing parties. Ultimately, speculation might grow that we will just see everything (tax cuts and spending) extended for 6-months or a full year. Despite, the potential end result of delaying the resolution of the cliff, the financial markets may resume its risk aversion stance as each week comes and goes with no new solution. Since, Congress has only four more working days, before it’s away for the Thanksgiving holiday, we could see another round of weakness for the U.S. dollar, euro and the other high-beta currencies.

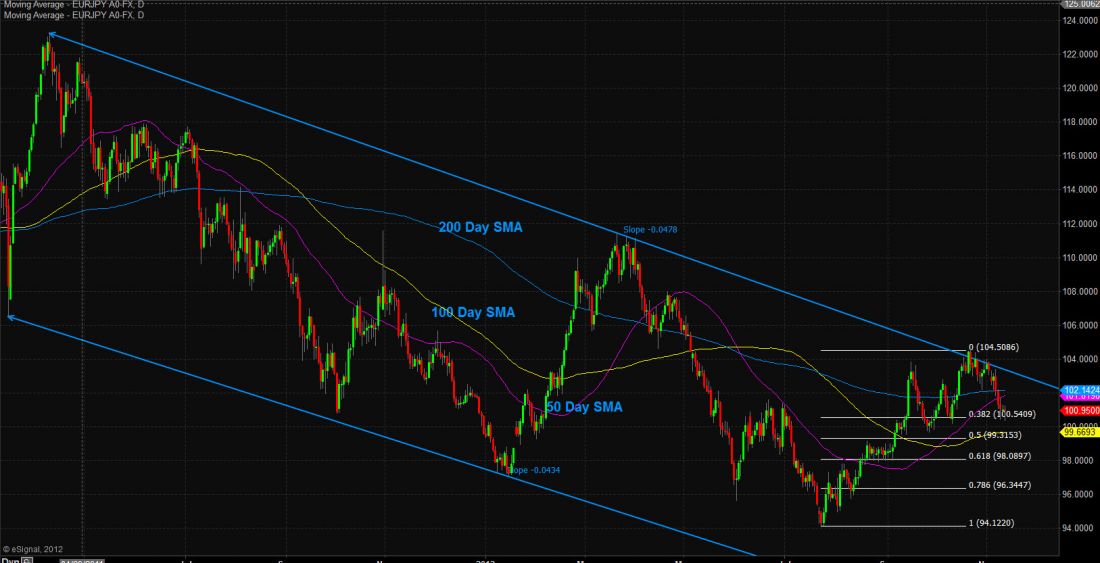

Euro/Yen

Price action on EUR/JPY continues to trade in a downward sloping channel that began early in 2011. Last week, price broke below both the 200 and 50-day Simple Moving Average (SMA), a bearish confirmation that the trend could see further downside. A continuation of selling may target 98.08 level which is also the 61.8% retracement of the most recent swing high move. A bearish bias will remain as long as the downward channel is respected. Any daily close above the channel, will negate our immediate outlook for further weakness.

= = =

Read a forex trading strategy here: