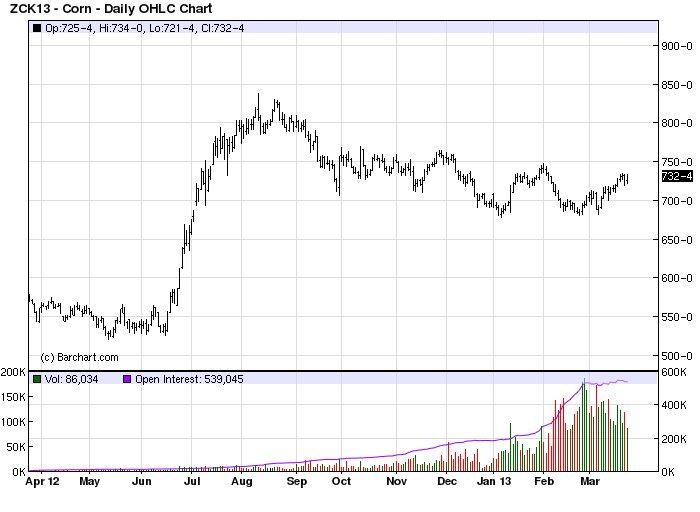

Included below is yearly chart for May 2013 Corn. Currently, December 2013 Corn futures are trading near 570.00. Last year’s chart shows the rally that occurred around late spring 2012 took corn futures from $5.50 level to over $8.00 by mid-summer.

Last year’s rally was likely due to a few reasons; however, in my opinion, one of the largest supporting influences was last year’s drought which affected the cash market for corn.

In the CropCAST Agricultural Weather Outlook dated March 22, 2013, Kyle Tapley from MDA Weather Services indicates that “…a large area, encompassing approximately 65% of the Corn Belt, remains in at least moderate drought, with large swaths of the pains still experiencing extreme to exceptional drought. This compares to only around 25% of the belt last year at the same time.”

Possible Reasons for a Rally:

Planting Conditions – Possible Growing Season Delays

- Snowpack leading to slow planting in northwest portions of Corn Belt

- Above normal precipitation in central and eastern Midwest

- Ending Stocks for Corn at low levels

- Possible uneven growing conditions in summer

The Trade

I am looking to gap this trade or hedge my strategy of going long corn throughout 2013. It is my belief, that positive growing conditions, along with timely needed rains, will potentially send corn futures near the $6.00 level by mid-summer.

To take advantage of potential events of downward movement, I will first look to buy a July Corn $6.00 put for 3 cents or $150.00 risk, plus all commissions and fees. To try to take advantage of potential hot and dry conditions, combined with possible growing season delays, I will also look at buying the December 2013 Corn $7.00 call and selling the December Corn $8.00 call for a purchase price of 8 cents or a $400.00 risk per spread, plus all commissions and fees. Potential max profit is $5,000 on this trade, minus all commissions and fees, if corn futures settle above $8.00 at expiration. By buying the July put along with the December call spread, I am looking to hedging the possible risk of the unknown going into growing season. Risk combined on both trades is $550.00, plus all commissions and fees on the trades.

The gap strategy has is utilized as a potential protection strategy on both sides of the Corn market until July option expiration near the end of June. The downside to this trade, or what I wouldn’t want to see happen, is prices to stay range bound throughout the spring. Specifically, if July Corn Futures trade above $7.00 along with New Crop December Futures trading below $6.50 by mid- July, the premiums on the options will likely not increase. However, I believe the risk to reward with this trade may be good here.

Ending Stocks for Corn on the government reports remain at low levels. Any planting delays may have possible talk of rationing new crop corn, which could, in my opinion, possibly send prices higher. Please e-mail or call me at any time with questions or to discuss at sean.lusk@ironbeam.com or 312.765.7213.

RISK DISCLOSURE: THERE IS A SUBSTANTIAL RISK OF LOSS IN FUTURES AND OPTIONS TRADING. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. THIS REPORT IS A SOLICITATION FOR ENTERING A DERIVATIVES TRANSACTION AND ALL TRANSACTIONS INCLUDE A SUBSTANTIAL RISK OF LOSS. THE USE OF A STOP-LOSS ORDER MAY NOT NECESSARILY LIMIT YOUR LOSS TO THE INTENDED AMOUNT. CURRENT EVENTS, MARKET ANNOUNCEMENTS AND SEASONAL FACTORS ARE TYPICALLY BUILT INTO FUTURES PRICES. A MOVEMENT IN THE CASH MARKET WOULD NOT NECESSARILY MOVE IN TANDEM WITH THE RELATED FUTURES AND OPTIONS CONTRACTS.

= = =