We all know the value of precious metals and other powerful commodities and their uses. Most of these are widely traded in different exchanges around the world. However, there is one commodity that is not yet publicly traded as such and that’s water, also known by many as the “blue gold.”

HIGH DEMAND

Many of these traded commodities have no meaning without water. Agricultural, livestock, cattle need an extremely high amount of H2O for their development. For example, a cow needs around 400.000 liters of water throughout its life; to grow 1Kg of oranges one needs to use 1.000 liters of water. And of course, we humans consume between 2.0 and 2.5 liters per day.

On the industrial side, the microchip industry requires ultra-pure-de-ionized water in the production process and will soon be using over 1.500 billion liters of water each year.

SUPPLY NOT INCREASING

Although water covers two thirds of the earth, 96% of it is salt water. That makes it unfit for human consumption without a lot of expensive processing. It also has no use for livestock consumption, nor for growing crops or industrial uses. Therefore, only 4% of fresh water is surface water and two thirds of that is frozen in glaciers and in the polar icecaps.

Water consumption by humans has increased nine times in volume since 1900.

RISING TENSION

This top commodity has also been a reason for rising tension between Ethiopia and Egypt. Ethiopia’s initiation of a dam project on the Blue Nile has immediately annoyed Egypt, which is extremely dependent on it as a source of much of the country’s freshwater needs.

There have already been suggestions of Egypt using military force to keep the dam from potentially decreasing the Nile’s water levels downstream towards unacceptable levels.

Similarly, there are many cases around the world, in which we can see that water is a cause of conflict between countries, like oil has been for so many years.

CONCEPT

So now that we’ve cleared that water could become the most important physical commodity of all times, let’s look at how to profit from this market.

I’m not suggesting that the CME Group look into this asset class (which they should), but in the meantime we could satisfy our craving for trading with some ETFs related to this industry.

ETF PLAY

In order to profit from the upcoming fresh water crisis, and taking into account that water is not yet tradeable as a priced commodity that can be purchased on the futures market, there are two main ETFs that we need to study here.

These exchange traded funds are one of the most efficient tools to use for accessing the niche water sector, since it reduces the risk of investing in single companies and allows the investor to still have exposure to this valuable industry, which is forecasted to grow over time, as potable water supply will have trouble keeping up with demand

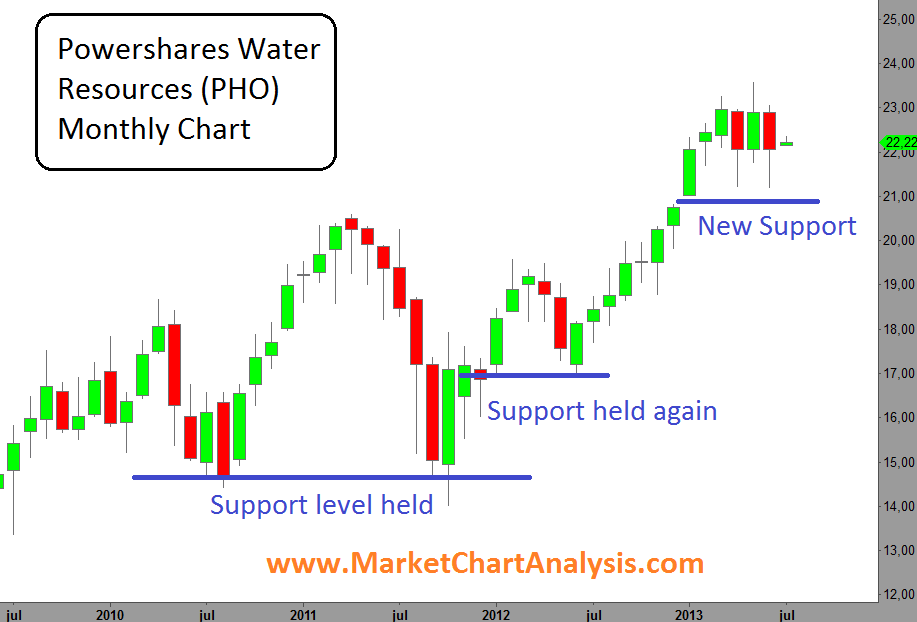

ETF 1: PowerShares Water Resources (Ticker: PHO) an American domestic play that looks to invest around 90% of its total assets into the underlying components of the Nasdaq OMX US Water Index, focusing on small and mid-cap companies. This fund is spread out over a wide range of water-related companies that specialize in water treatment, utilities, pipe and pump manufacturing. If we take into account the urgent need for upgrading America’s water infrastructure, this ETF is sure to rise in the long term.

ETF 2: Meanwhile, PowerShares Global Water (Ticker: PIO) is focused on international markets. This ETF attempts to place approximately 90% of its assets into tracking the underlying securities of the Nasdaq OMX Global Water Index. It basically consists of foreign water infrastructure stocks that focus on conserving and purifying water for residential, commercial and industrial buildings.

One of the reasons why PIO has appreciated slightly less than PHO is due to the impact of European and Asian economy that has not been growing at the same pace as the United States. However, it’s clear that both funds have more than doubled in value and this is just the beginning of this bull market.

WHY INCLUDE WATER IN YOUR PORTFOLIO

Although it may seem that water stocks are boring and grow slowly, it’s clearly a long term play that we can all capitalize on that day in the near future when the world realizes that fresh water, our most precious resource, is more valuable than oil. Especially since this industry is supported by the population growth in emerging markets, as well as the global population. The need for more potable water for irrigation in emerging economies is also present, as more people need to eat, drink and use this element: a first-hand necessity in a world where drought is continuously in focus.

As industrial cost keeps rising (electricity bills, labor force, etc.), the cost of processing and distributing water will also be increased, impacting the final product. Like the agricultural and industrial sectors, we might soon see the water industry capable of hedging these increasing costs with “Water Futures”.

It’s only a matter of time. So keep these ETFs on your radar and look for a good moment to invest in them.

Click here to see some more ETFs and stocks involved in the water industry

= = =

Related Reading:

The Science of Trading: Supply and Demand