When we think of the solar industry, we seem to only remember the huge downfall many stocks and exchange traded products suffered last year. However, some of these funds have managed to turn their business around with extremely attractive gains.

This is the case of Guggenheim Solar ETF (TAN) that has almost doubled so far this year, becoming one of the top performing non-leveraged exchange traded funds in 2013.

This stunning rally is mostly based on rising demand for solar installations along with falling prices for solar modules.

Consumers are realizing the value in having clean energy systems attached to their homes. As the technology in this sector keeps advancing, we might see an even greater demand from buyers to lower their utility costs.

TAN consists of 29 individual companies involved in various segments of the solar energy industry. The top three holdings include First Solar Inc (FSLR), Hanergy Solar Group, and GT Advanced Technologies Inc (GTAT).

ENTRY LEVEL

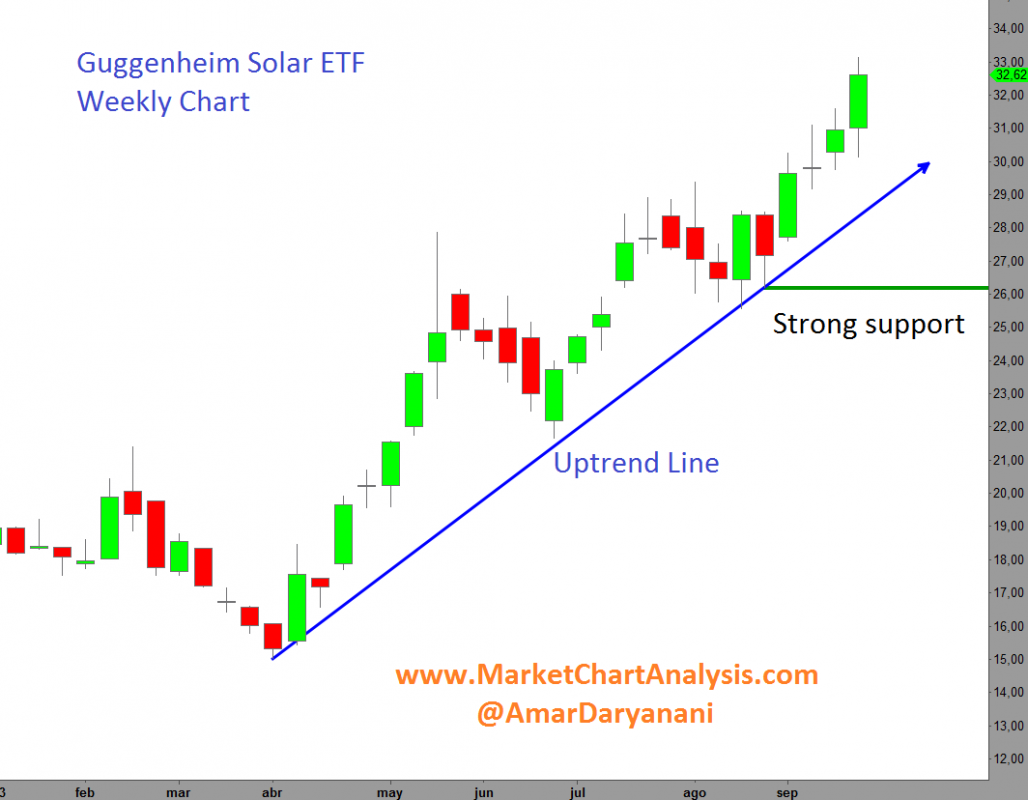

As the price keeps shooting up, we wonder what would be a good level for us to enter this ETF. Based on the weekly chart, we can see an uptrend line that establishes a first support area around the $28.00 – $28.50 range. The deep support would be at $26.00.

A weekly close below this deep support could imply a change in trend causing damage on the chart and one would have re-evaluate their position in this market.

= = =

Learn more about Daryanani’s work here.

Read another story by this author: