George Lindsay (1906-1987) began his life as an artist, owned his own seat on the Chicago Board of Trade from 1939-1940, and started his market advisory service in 1951, one year after the publication of his seminal paper “An Aid to Timing.”

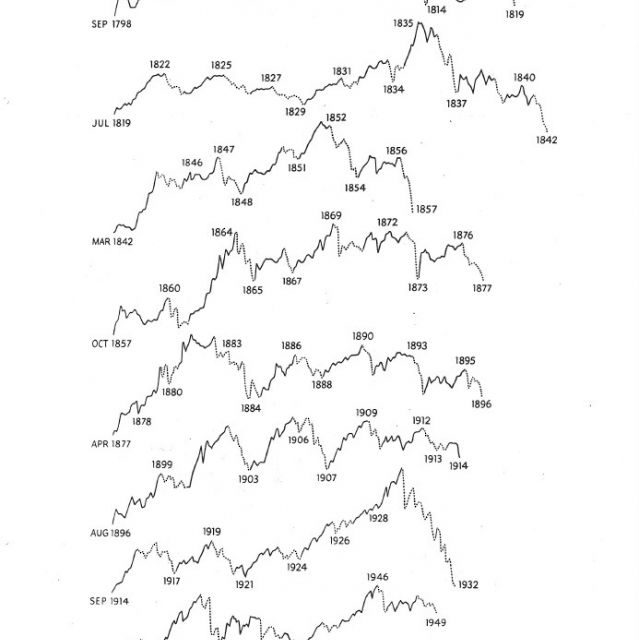

While so much of today’s technical analysis is focused on short-term changes in the market (i.e. daily, 60-minute, 15-minute, 5-minute, and tick charts) and has become heavily dependent on mathematics that only a Stanford PhD. could ever hope to understand, Lindsay spent his life looking at multi-year changes in the markets all the way back to 1798.

TIME WAS KEY ELEMENT

By doing so, he was able to understand regular, repeating changes in the market based, not on price but, on time. These “changes” are similar to cycles but not in the way most people today think of cycles. His work is unique and had almost disappeared until I began my endeavor to save it for history with the publication of my first book in 2011.

His approach to the markets appears to transcend even that mirror of human behavior as it can play a role in forecasting non-market related events throughout human history (described in his only book “The Other History” Vantage Press, 1969). It was this “understanding” of intervals in time that enabled him to sell his seat on the Board of Trade in 1940 only weeks before the Germans marched into Paris during the spring of that year causing the U.S. government to impose price controls on commodities and trading volumes at the exchange to collapse. His book is long out of print but anyone who has read “The Fourth Turning” (Strauss and Howe, Bantam/Doubleday, 1997) will have an idea as to the direction Lindsay’s research was headed.

LIKE A SECULAR TREND

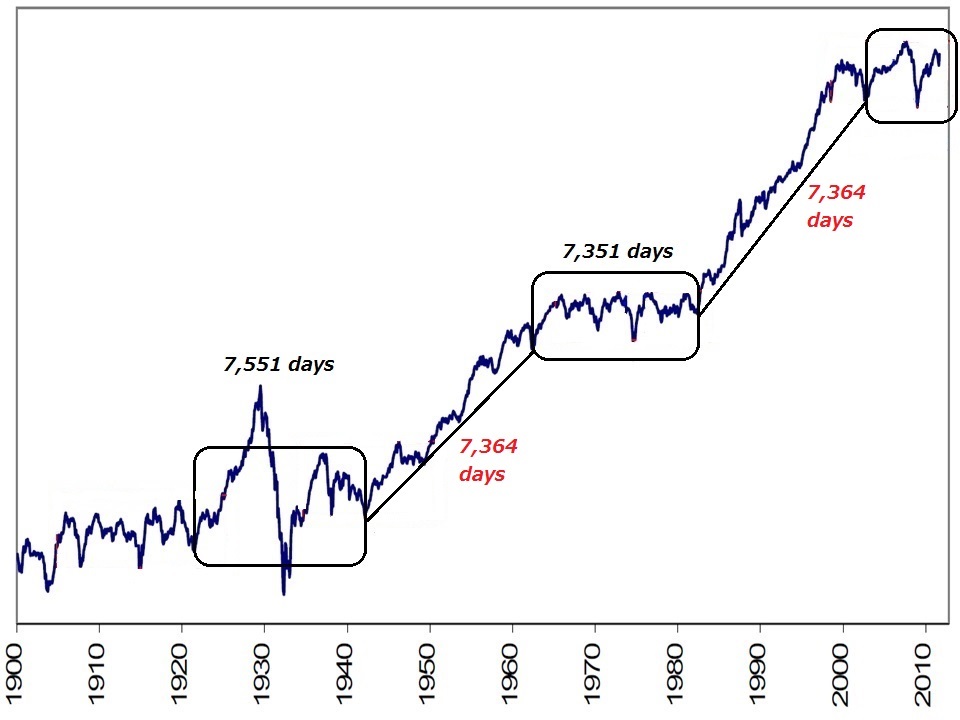

Lindsay’s Long Cycles are analogous to what modern investors refer to as secular bull and bear markets as each long cycle lasts approximately 20 years. A constant question/concern among investors today is “are we still in the secular bear market that began with the high in 2000 or did that secular bear conclude with the low in 2009?”

HIS METHOD HAS ANSWERS

Lindsay is the only analyst to ever create a disciplined methodology for forecasting the beginning and ending dates of secular cycles and his methods hold the answer for today’s investors.

Most investors’ day-to-day decisions are more concerned with cyclical bull and bear markets than the secular variety. Lindsay called these cyclical bull and bear markets “basic advances and basic declines” and to forecast these, too, he developed very specific, disciplined methods. But in order to forecast these cyclical swings in equities, using his methods, it is necessary to identify and understand his Long Cycles. The precision of his models to forecast highs and lows in the stock market caused Louis Rukeyser to call him “uncannily accurate” and the Stock Traders’ Almanac to refer to his work as “the finest long term forecast we have ever seen.”

GETTING STARTED

My new book “George Lindsay Training Course; 1921-1942 Long Cycle” is intended to be the first of four volumes covering the long cycles of 1921-1942, 1942-1962, 1962-1982, and 1982-2002. I began with the 1921-1942 Long Cycle not just because of chronological order but because this Long Cycle saw the same shift in Long Cycles that we are witnessing today.

Despite the apparent distance in time from us today, it is actually the most directly applicable of all the 20th century Long Cycles to our current market (and further proof that “those who forget history are doomed to repeat it”). In addition to understanding Lindsay’s Long Cycle and how the current shift will affect markets for years to come, understanding Lindsay’s Basic Cycles (cyclical bull and bear markets) and how to forecast them is the Holy Grail for all investors.

#####

Read Ed Carlson each Monday on TraderPlanet‘s Markets On The Move.