When we think of how to invest in the technology sector we tend to look at the traditional blue chips such as Google (GOOG) and Apple (AAPL), or upcoming companies such as Facebook (FB) and Twitter (TWTR).

However, there is a segment within this industry which is growing at faster pace and is worthy of studying for our investment portfolios. This segment is the mobile gaming industry in China.

THE INSTRUMENT

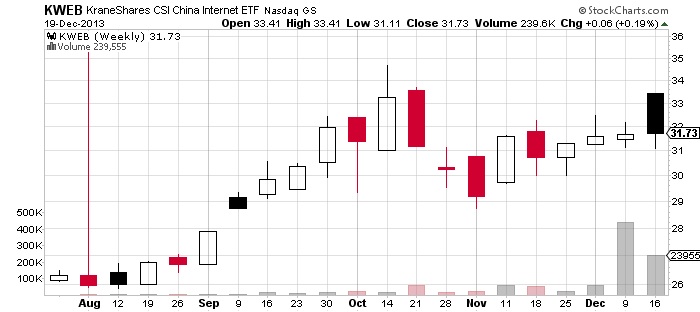

One of the ETFs that covers this area is the KraneShares CSI China Internet ETF (KWEB), which tracks a group of Chinese internet stocks. It debuted in early August and has grown over 20% in hardly 5 months.

THE REASON

Why should we track this industry and an ETF like KWEB?

The answer is very simple. There are more internet users in China than there are people in the United States. The upside is that internet penetration in China is still low relative to other developed markets. However, there is a rising demand from an emerging middle class.

The big players in the mobile gaming space are Baidu (BIDU) and Qihoo 360 Technology (QIHU), which are the two largest mobile app stores in China, along with Tencent, which has over 500 million accumulative mobile gamers as of November 2013, 40% of which have never played a PC game.

KraneShares’ KWEB ETF has significant holdings in each of the three companies, including 9.9% in Tencent, 8.9% in Baidu and 7.4% in QIHO.

ETF PLAY

The best way to participate in this market would be to buy and hold an ETF like KWEB, instead of actively trading individual stocks that we cannot follow on a daily basis.

===

Click here to see Daryanani’s work

Like us on Facebook. We’d love to hear from you.