During January we see a lot of discussion surrounding the ‘January effect’ and its impact on the full year’s performance. But there’s another level that doesn’t get as much attention that we should be paying attention to.

For those of you that are not familiar with the ‘January effect,’ historically the performance of the full month of January, whether it’s positive or negative, has had a strong correlation to how the whole year will turn out. This barometer is discussed in greater detail in the Stock Trader’s Almanac (a great read by the way), which shows that since 1950 January has “predicted” the year’s performance with an 88.9% accuracy ratio.

To give a few examples, in 2013 January was up 5% and as you well know, the equity market finished the year with a double digit return. However this tool is of course not always correct. January was down in 2010 and 2009 while both years finished in the green.

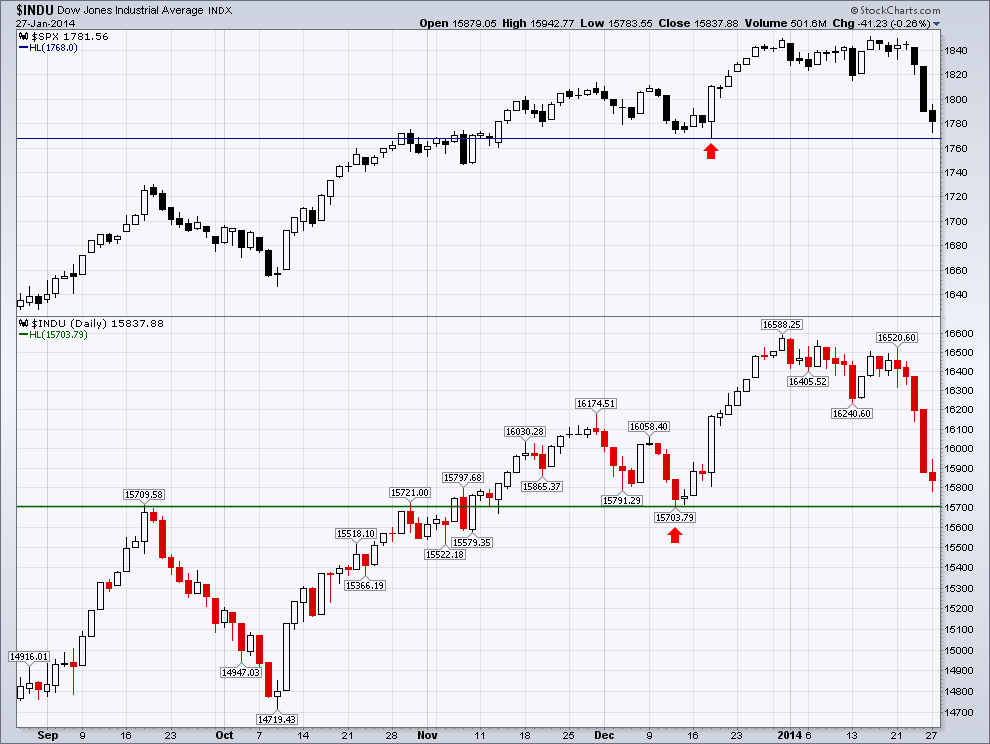

Now let’s move on to the lesser discussed topic that some may argue has a greater impact on intermediate-term returns. Also discussed in the Stock Trader’s Almanac is the December Low Indicator. Like the January Barometer, going back to 1950 when the prior year’s December low was taken out in the preceding year’s first quarter, the Dow Jones Industrial Average has dropped an average of nearly 11%. The most recent example of this was in 2010, from the point of breaking the 2009 December low, Dow dropped 4.8% before finding a new low in ’10. 2009 saw a 17.6% drop and 2008 (being exacerbated by the financial crisis) dropped 42% before making a year low after dropping below the respective past December lows. Since 1950, there have only been two periods where a continued decline was not produced at least by some degree – 1996 and 2006.

I think it’s important to discuss this because with last week’s decline in the major U.S. indices, we have become extremely close to approaching the December 2013 low. I’ve put a horizontal line to show the low in the Dow as well as the S&P 500.

As we progress through the first quarter of 2014 I’ll be keeping an eye on this level during any future drops we may see. Although it’s important to note that just because further weakness has occurred in past years, it does not mean the market is required to follow the beat of history’s drum. With that, I think it’s important to recognize past market actions surrounding similar circumstances, and I feel the December Low Indicator is not something to ignore.

Disclaimer: The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.