Mr. Market in a Pull-Back

The S&P 500 (SPX) has not had a drawdown greater than 10% since summer of 2012. The Great Rotation from bonds to equities made 2013 an exciting year for stocks. However, after more than 18 months without much rest, this pullback is long overdue. On Monday, the SPX is trading below its 10/50 day moving average, and so while we’ve seen a couple of positive days, it is too early to determine whether we are at a real turn-around or whether the market will get pushed back at the moving average. Despite market weakness, it is not too early to note who are showing signs of strength, and forming bases for when the next leg begins.

Retail And The Consumer

This recovery in many ways has not followed the expected script for those who follow business cycles. While it is true that cyclicals and finance were among the first to leave the starting gate in the fall of 2012, a year later, the consumer continues to show signs of struggle. In October, I penned an article for SeeItMarket.com questioning the consumer’s health in light of the anemic wage growth rate. This fall, as a commentary on the consumer, the retailers were one of the first groups to demonstrate weakness. Rather than continue its run after the holidays, the SPDR ETF for retail (XRT) traced down. This week, the XRT is back near the summer lows. It is trading below the 10/50 day moving average, a technical sign of weakness. However, as proven by last week’s action by retail leaders, e.g. Green Mountain Coffee Roasters (GMCR) and Michael Kors Holding Ltd. (KORS), it may be time to begin watching the retailers for a potential turn around.

Figure 1, Daily Chart of XRT (SPDR S&P Retail ETF)

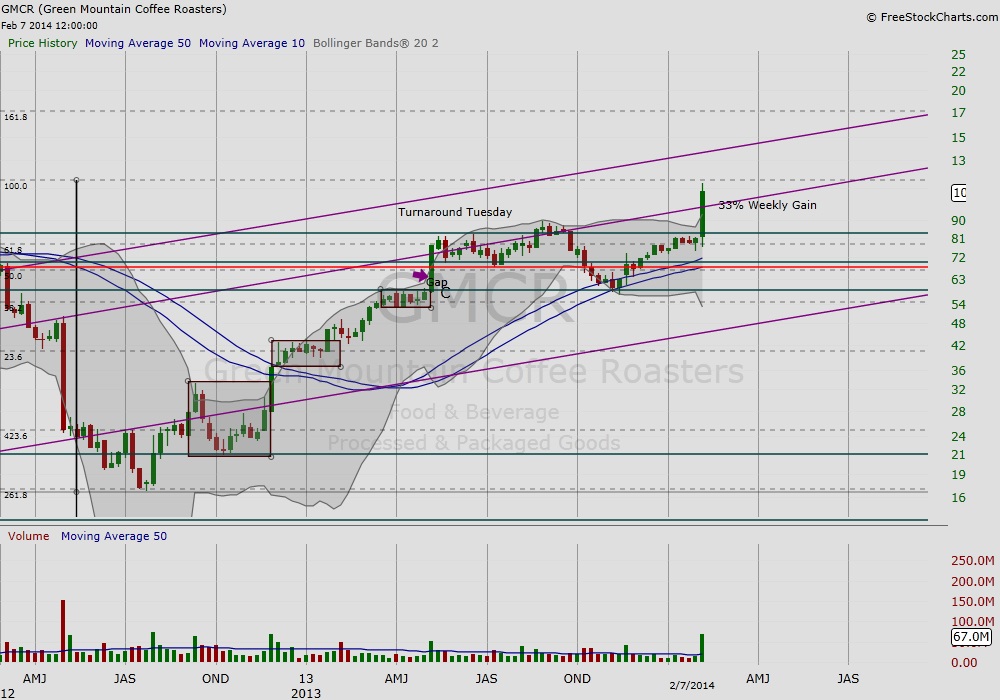

GMCR Has Left The Station

At the end of summer, and when buyers were expected to return, retail leader GMCR failed to recoup the upper purple channel. GMCR traded in this channel from 2009 until the market slowed in the summer of 2011. Rather than breaking out when the market returned from summer vacation, GMCR traded down. Weakness by the retail darling presaged the market’s concern with the lagging consumer despite the heady bullishness by the general market. Is last week’s market action a sign that we may have discounted the consumer too soon? GMCR beat earnings, and made headlines for its global pact with beverage giant, Coca-Cola (KO). Combined news was a wake-up call, and GMCR rocketed 33% for the week. Although, the market does not appear as enthused for KO, GMCR looks finally ready to continue the trend that was interrupted in 2011. Note the heavy volume that accompanied the week’s gains. Unfortunately, it goes without saying that GMCR has left the station, and prudent trend followers who missed this bus will likely wait for GMCR to form another base.

Figure 2, Weekly Chart of GMCR

Mr. Market: More than 18 Months without a Rest and Trading Below its 10/50 Day MA

More than 18 months without a significant pull-back and a lesson from previous cycles is that the market may be due for further consolidation. Technical traders will be watching for the SPX to recoup the 10/50 day moving average in volume or other signs of a follow-thru. For now, the markets are showing tentative signs of turning around with last week’s action by retailers and even oil. In the meantime, it is not too early to begin following the retailers and other leaders to develop bases for the next leg if you’ve missed some of their early moves.

Thank you for reading.

No positions in any names mentioned.

Stock Charts from FreeStockCharts.com

RELATED READING

Read another story by this author.