As an active trader, following the big money is where I have greatest opportunity.

The timing is not always pristine but sometimes it is, and I will take my chances when ‘smart money’ is making a big bet. Volume is the polygraph; there is no lying about where the money is flowing. It tells what may be happening around the corner. Again, it’s not always right – but since the market is 80% controlled by institutions, I’ll take my chances with it.

The options market really tends to show its hand with few market makers and often times less liquidity. When a big player comes in to provide some liquidity vis a vis a strong option purchase that tends to stick out like a sore thumb. When it’s a buy, then it really catches my attention (most of them are unless there is a major market disconnect). There are a million reasons to sell but only ONE reason to buy.

WATCH SWKS

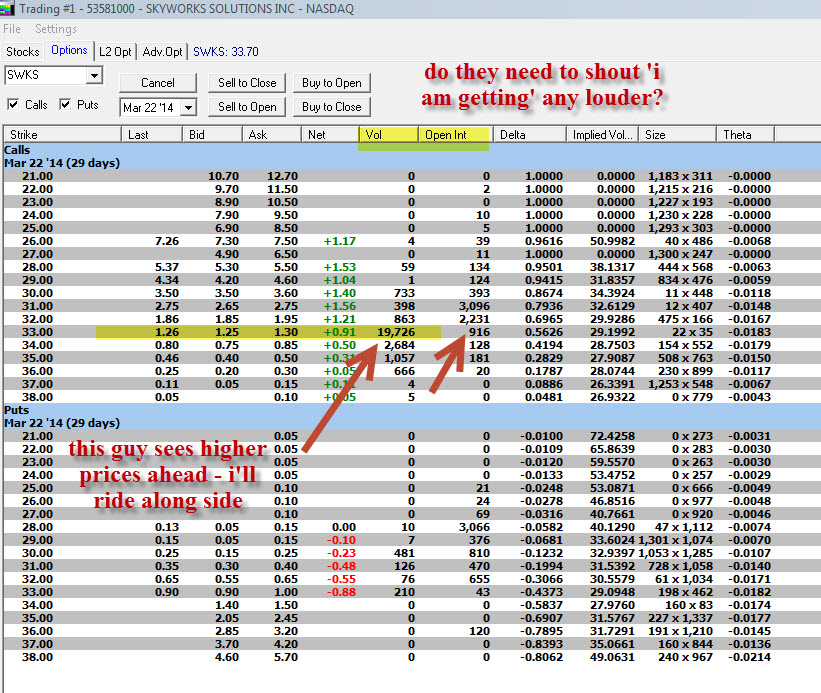

So, Thursday is a great example. We saw Skyworks Solutions Inc. (SWKS) coming out of a nice, tight base on good stock turnover, but my attention was on the options flow. Specifically, the Mar 33 call, slightly out of the money. On Thursday, 19,000 calls were bought for about 1.3 million, a good-sized bet and far exceeded the option open interest (see below).

Other strikes were active too, but this one had my interest. So, we have about a month to go, this is now in the money and we can make a decision. My choice was to follow this big buyer. I don’t even think it’s too late, since this buyer is still in the position. We’ll see how it unfolds!

= = =

Learn more about Explosive Options here.