Over the last several years, there has been a wide ranging debate about the use of social media in trading/investment strategies and whether or not sentiment in social media chatter can be predictive of stock price movements. Numerous white papers have been written and this topic has and is continuing to garner interest in both the academic as well as the investment community. Numerous studies have shown that it is possible to derive alpha from social media signals written by researchers at prominent universities around the globe.

Social media chatter is growing at exponential rates. The market is taking notice to the undeniable fact that tweets can move markets. A widely discussed example of this is Carl Icahn’s infamous tweet about having dinner with Tim Cook (August 13, 2013) which moved the market cap of Apple (AAPL) by approximately 17 B in the span of about an hour. But it isn’t just this example that shows that tweets can move markets; there are many others that frequently occur as more and more conversation by a variety of participants continues to gravitate to social media platforms where financial markets are being discussed. This conversation is literally creating a new category of data that is becoming relevant to the financial community. This data is unique, differentiated, and oftentimes precedes reporting of market moving events in traditional media. This phenomenon can’t be ignored and at the minimum, must be paid attention to in order to stay as informed as any other investment professional who is paying attention to it. Hedge funds have been the early adopters of this concept and many are actively consuming as well as analyzing social media content for both its ability to be a breaking source of news and its ability to precede, in certain instances, market moves because of the collective crowd-sourced sentiment of that early news. Markets can trade based on emotion and sentiment in addition to other fundamental factors and social media captures that phenomenon.

As the quantity of information being shared increases, so is the noise. This poses a big challenge and legitimately has been cited as one of the major reasons of skepticism of its use by the investment community. For this reason, it is key to not only have strong filtering and noise reduction techniques, but equally as importantly to wisely choose the data streams that you process to begin with. At Market Prophit, we analyze streams of conversation that are focused on stocks (those with a $ in front of a ticker or a “cash-tag) and generate real-time sentiment signals for both retail and institutional investors. We also take the unique and differentiated approach of quantitatively ranking individual posters of stock-related tweets based on the accuracy of their stock calls and track record of predictions. By doing so, we generate additional unique signals from only those message posters that receive our quantitative rankings. Those (“Market Prophit”) signals tend to have less noise and can at times be more predictive than the “Crowd” signals which are sourced from all message posters.

Below (Fig 1) is an example of Market Prophit’s baseline Crowd signal for Tesla (TSLA) on Oct 2, 2013. On this day, a Youtube video of a Tesla car catching fire which started going viral was posted on Twitter at 2:47 p.m. Chatter on Twitter immediately picked up about this event and crowd-sourced sentiment calculated by Market Prophit’s natural language processing engine quickly turned extremely negative. This negative sentiment signal preceded an almost 6% decline in the stock which sold off on this news in approximately 30 minutes at which point the Crowd sentiment signal temporarily turned positive as the stock had bottomed while the market was digesting the news. Importantly, the first mention of this event in traditional financial media occurred at approximately 3:00 p.m., a full 13 minutes after the news broke on Twitter. Crowd sentiment had turned strongly negative again on the market close and continued to stay negative afterwards. The next day, Tesla opened down over another 3% from the previous day’s close and continued to trend down closing lower by approximately an additional 1%. Two things to note here: news can break in social media and sentiment derived from the crowd-sourced chatter about that news can be predictive of a stock’s price move in the short term.

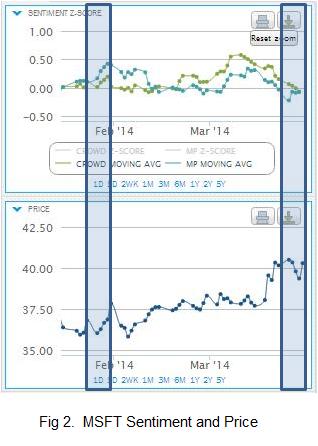

While the above example shows the potential predictive nature of social media of stock price moves in the short term, many investors ask whether social media chatter can be predictive of stock price moves over longer time horizons; i.e., is it only relevant to day traders and swing traders whose time horizons are minutes, hours, or several days or can it also be relevant to investors who have longer time horizons? In the example below, we show that sentiment signals can be predictive of longer time horizons that span weeks and months, not just minutes and hours. We show signals derived by Market Prophit’s analytics for both the “Crowd” signal (every message poster) as well as the “Market Prophit” signal (the mavens). Fig 2 shows both sentiment signals for Microsoft (MSFT) over the last two and a half months. Both sentiment signals tend to agree with each other (they don’t always necessarily do) and go positive on MSFT which precedes the rally allowing for possible alpha capture. One thing to note is that the Market Prophit signal goes positive earlier than the Crowd signal and it also goes negative earlier as well signaling earlier potential entry and exit positions which lead to more alpha capture. In either case, both signals show the potential for social media sentiment signals to be predictive of stock price moves over longer time horizons.

As the debate of whether social media signals can be predictive of stock price moves rages on, there are a few key takeaways to keep in mind. Whether one believes it or not, financial related chatter in social media continues to grow quickly. Social media platforms are becoming part of the fabric of how the investment community both produces as well as consumes financial information in addition to traditional sources. News frequently breaks on social media platforms such as Twitter. Tweets and crowd-sourced sentiment derived from this information is moving markets both in the long and the short term. With the democratization of information sharing facilitated by social media platforms and the increasing ease of the ability to post messages by anyone with an opinion, more and more people are sharing their financial ideas.

Everyone is talking. Are you listening?

RELATED READING

Buy The Rumor Sell The News? Social Media’s Impact by Thom Hartle