“Flash crash,” a market crash that is over and reversed in a matter of minutes, is a new phrase in the trader’s lexicon.

THE FALSE TWEET

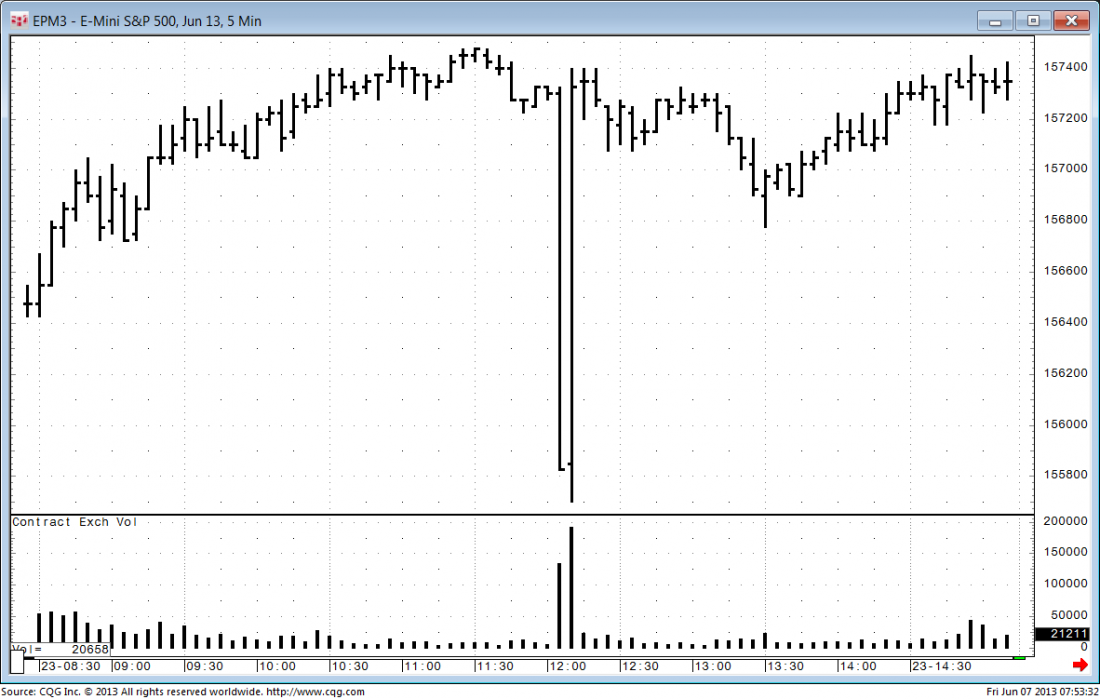

The most recent example of a so-called “flash crash” occurred on April 23, 2013, when a false tweet reporting “Breaking: Two Explosions in the White House and Barack Obama is Injured.” sent the stock market sharply down.

The fake tweet came from the Associated Press news agency’s @AP handle, a Twitter account with more than two million followers. The AP quickly said it was hacked, and White House Press Secretary Jay Carney confirmed that the President was fine.

Traders immediately reacted to the false tweet by hitting bids in equities and index futures, and lifting offers in U.S. Treasuries and the derivatives – the classic “flight to quality” play. The Dow lost more than 140 points and treasury yields fell. Reuters estimated that the false tweet temporarily “wiped out $136.5 billion of the S&P 500 index’s value before the markets recovered.”

PROFITS AND HEDGING

Free markets, especially derivative markets, are driven by both the opportunity for traders to develop ways to make profits and at the same time provide the mechanism for which participants can hedge exposure. Computerized management of trades aimed to capture profits, no matter how small, and for hedgers to lay off risk using algorithms was a predictable market evolutionary step. It appears the computers executed the trades in accordance with the designers’ intentions.

What if the tweet had been true? No one would be second guessing the initial sell-off driven by the computers. Current talk often focuses on trading decisions generated by computers monitoring news feeds and Twitter, while suggesting that markets and investors should be somehow sheltered from risk due to these unsavory geeks with computers lurking in the shadows. So, naturally and predictably, high frequency traders (HFTs) became a target of blame after the event.

TRADING ON RUMOR: NOTHING NEW

The simple fact, however, is markets have always been vulnerable to rumors, leaked news releases, mistakes, and technology failures. To believe otherwise is like believing that people making their marriage vows really do mean “until death do us part.”

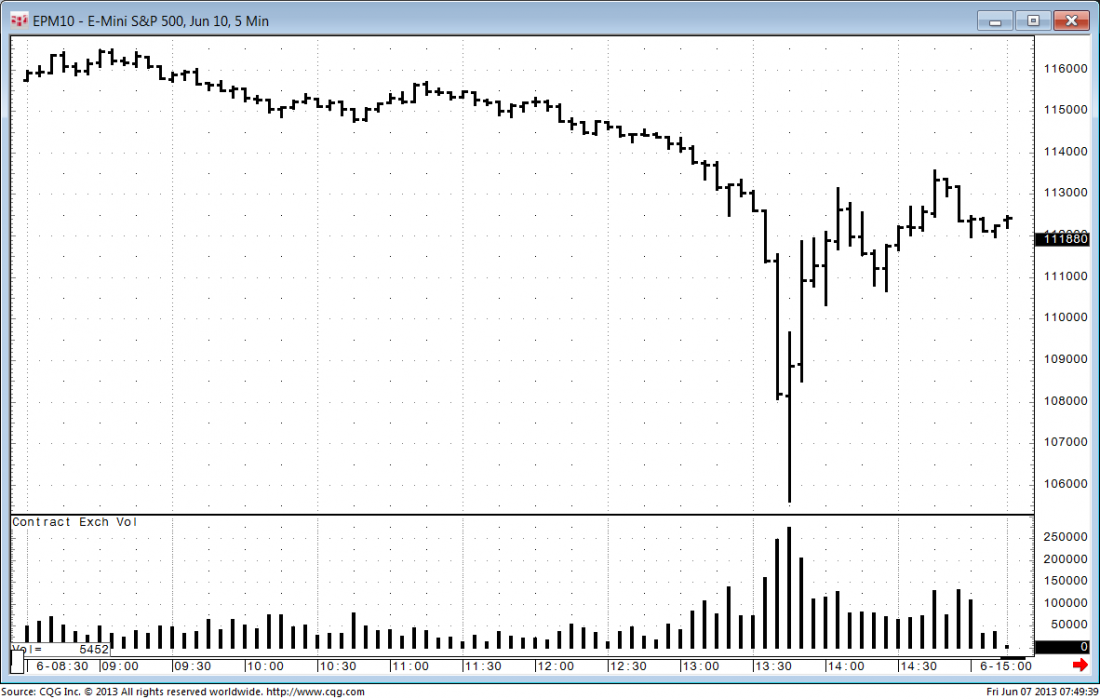

MAY 2010 FLASH CRASH

A quick review of past market events can illustrate this point with the most prominent example being the May, 6, 2010 Flash Crash. At 2:45 p.m., the Dow Jones was down approximately 300 points as investors stepped away due to concerns about the Greek debt crisis. Then, according to a joint SEC/CFTC report, a large mutual fund attempting to hedge its equity position used an algo to place sell orders for 75,000 E-mini S&P 500 contracts. In this situation, HFTs will take the other side of these orders as they provide liquidity, but only for a short period of time – HFTs will buy and then offer their longs back into the market. In the case of the Flash Crash, HFT buying and reselling activity led to a not-so-technical situation known as the “hot-potato.”

In just four minutes the combined selling by the mutual fund’s algo and the HFTs drove the E-mini S&P futures contract down 3% triggering the Chicago Mercantile Exchange’s Stop Logic Functionality. The E-mini and equity markets began to recover after a five-second trading halt.

Another technical breakdown occurred the next month in Japan. On June 1, 2010, there was a $434 million trading error by Deutsche Bank’s proprietary trading business. According to Bloomberg.com: “Automated sell orders for Japan’s Nikkei 225 Stock Average futures contracts sent the index into a brief dive on June 1 seconds after trading opened at 9 a.m. The orders were sent after changes to an automated trading system resulted in market data being misread, the bank said in the statement. Deutsche Bank said it has since stopped using the automated trading system in Japan.”

LOOKING BACK

Not all scares are technology-based. In the pre-Twitter world of August 2000, a fake press release claiming to be from Emulex Corporation maintained that the company’s CEO was stepping down, previously reported earnings were being revised down, and that the company was under investigation by the SEC. Emulex Corporation stock dropped from just over $103 down to $43 in sixteen minutes. The responsible individual was arrested after an FBI investigation and later sentenced to forty-four months in prison.

Not all market-roiling stories or rumors are necessarily negative in nature. During 1982, the Falklands war was, at times, a news driver for gold traders. One day a “peace scare” rumor sent gold limit down (the most the exchange rules permit a market to rise or fall relative to the previous day’s close), which was $25 at the time. Gold prices then quickly recovered when the “peace scare” was refuted.

THE KEY: MANAGING RISK

Leverage is a two-edged sword in the futures markets. Accept this reality. You can make a lot of money, but one dark day can wipe out years of gains. Understand that successful trading is not made up of winners and losers, but of survivors and losers, so traders must maintain a survivor’s mentality.

The paramount rule is managing risk. Some traders tend to use “cancel-if-close” stop orders; that is, they place stop orders, but then think the market is wrong if price trades near their stop. They then cancel stops assuming the minor trend against them will soon reverse and come back in their favor. These flash crashes have come back, but that is trading with hindsight. Traders cannot be in the position where they are caught and hope the markets will recover. A future flash crash may be the start of a major move that will not recover, despite hope.

Don’t be that trader who is trading on hope.

= = =

Related Reading:

Augment Mean Reversion Strategies Using Twitter