Traders of individual stocks have a wide variety of technical indicators that rely on price and volume to help them time their trades. These indicators track such things as a stock’s momentum, trend, or volatility. Historically, sentiment indicators have not been a part of most traders’ toolkits due to the fact that they haven’t tracked individual stocks.

FOLLOW THE STREAM

The rising popularity of Twitter among traders has made it possible to track individual stock sentiment by reading the Twitter stream and scoring tweets. With the aid of a computer system large volumes of data can be compressed into a Twitter Sentiment Indicator that can be used as a new tool in technical analysis.

This tool has the advantage of tracking not only the bias of a trader for a particular stock, but also the rationale for their views. Actions like buying, selling, and hedging can be tracked as well making Twitter sentiment a powerful means of confirming the trend of a stock and warning of consolidation.

AN EXAMPLE

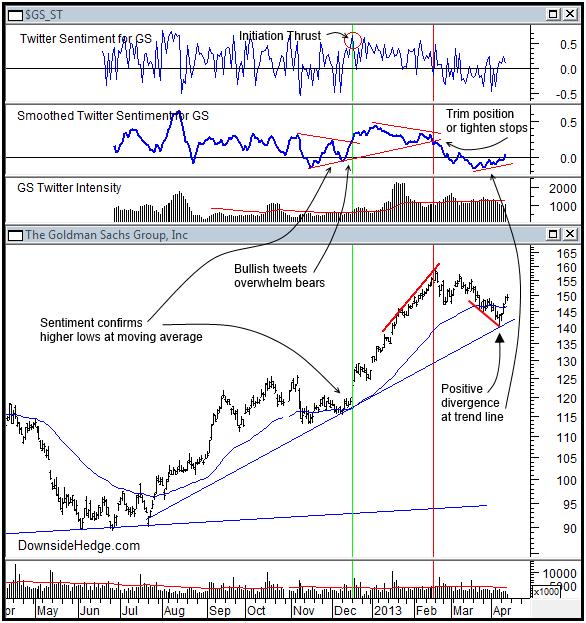

Goldman Sachs (GS) provides a good example. In late August and early September of 2012 Goldman Sachs was beginning a rally that was confirmed by Twitter sentiment which printed mostly positive scores on a daily basis. Smoothed sentiment held at high levels above zero for the next few months. When the stock started to fall in early November, smoothed sentiment dipped with it. The question in many traders’ minds was, “Should I buy this dip?”

A patient trader watching Twitter sentiment would have found a low risk setup to buy Goldman Sachs in mid December. Price for the stock made a higher low near the support of its 50-day moving average. This higher low was reinforced by a higher low in smoothed sentiment. When the stock moved sharply higher on 12/17/2012 the move sparked and initiation thrust in daily sentiment that showed a rising volume of bullish tweets. Positive sentiment eclipsed bearish sentiment as traders tweeted their enthusiasm for the stock moving to higher prices. The combination of confirming bullish sentiment that broke the downward sloping trend in smoothed sentiment signaled a low risk entry.

As Goldman Sachs continued to move higher in price, sentiment started to wane causing smoothed sentiment to paint a negative divergence. This was the first sign that the stock was losing sponsorship from traders on Twitter. In mid February, bearish sentiment overwhelmed the rising trend of bullishness which warned of a probable consolidation in price. This was a time to start trimming the position or tighten up stops.

It was not a good time to short Goldman Sachs due to the fact that the stock was in a clear up trend. A trader looking to short stocks would follow the opposite pattern outlined above and identify stocks that are in a down trend with confirming Twitter sentiment. When a rally stalls at a resistance point and sentiment isn’t showing bullish support a good short trade setup is offered.

KEY LEVELS

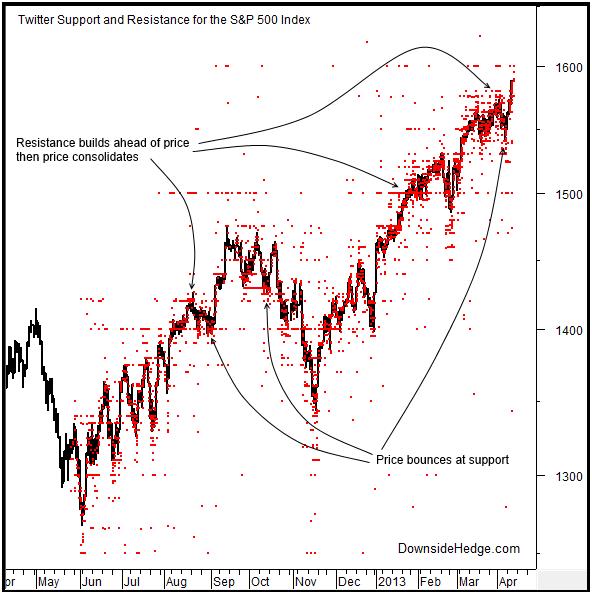

The Twitter stream also provides support and resistance levels for actively traded stocks and indexes. When several market participants tweet the same price point for a stock, that level acts as support or resistance. Traders often tweet their targets and stops for trades they have made. This results in support and resistance levels showing up on a chart well before that price target is met. On the following chart you can see how price has reacted to Twitter support and resistance.

STAY WITH THE MARKET FLOW

By following the trend of Twitter sentiment a trader stays with the natural ebb and flow of the market. Sentiment combined with support and resistance levels highlight the actions of other traders. This allows trades to be made at the same time as many other market participants. Using Twitter sentiment for confirmation that others are buying obvious support levels such as moving averages or trend lines can help a trader improve the odds of profitable trading.

===