Weibo (WB), commonly referred to as “China’s Twitter,” is expected to price its 20 million share IPO the evening of April 16, within a range of $17-$19.

Before its financials and fundamentals are even scrutinized, this Goldman Sachs/Credit Suisse led deal is facing an uphill battle. As the stock market – growth and momentum names in particular – have fallen out of favor, so to have IPOs.

Making matters worse, shares of Twitter (TWTR) have been clobbered since reaching post-IPO highs on December 26, 2013, down nearly 40% from those levels. Add in censorship concerns from the Chinese government and negative sentiment piles up quickly.

With all that said, WB still has some compelling attributes. Revenue growth has been astounding and it has a lucrative agreement in place with Chinese internet behemoth Alibaba.

Additionally, the deal is being priced conservatively in my opinion, creating a favorable risk/reward scenario.

Closer Look at WB

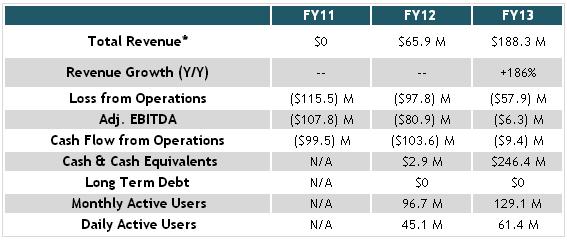

Weibo operates an online and mobile platform allowing users to post short messages in real time which followers can comment on, or re-post to their own blog. As of December 31, 2013, it had 129.1 million monthly active users (MAU), up from 96.7 million a year earlier.

WB is majority owned by Sina (SINA), the Chinese online media company. SINA will remain the controlling shareholder upon the completion of this offering with 56.9% of its then outstanding ordinary shares. Alibaba Group — which has also set its sights on a huge IPO this year — also owns a stake in Weibo, investing over $585 million in it last year for an 18% stake.

With a limit of 140 Chinese characters per feed, WB is particularly suited for mobile use. Over 70% of its MAUs in December 2013 accessed Weibo from mobile devices at least once during the month, and mobile revenues accounted for 28% of its total advertising and marketing revenue in 2013.

The company generates most of its revenue through advertising (~79%), with additional revenue coming from games in which players can purchase virtual goods.

Financials and Valuation

Taking a look at its FY13 results, revenue surged by 186% year/year to $188.3 million. Advertising and marketing revenues soared by 191%, primarily due to the increase in revenue from its social display ads, including revenues from Alibaba related to its partnership agreement.

Moving down the income statement, Sales and Marketing climbed by 56% to $63 million. While a big jump, I was expecting to see its Sales and Marketing expense up around triple digits. A good sign is that its revenue growth is far outpacing its Sales & Marketing expense growth.

Still, its total costs and expenses were up 50% to $246.2 million, a figure well above its revenue line. Consequently, WB had an operating loss of about ($58) million in FY13.

A key metric for WB is Monthly Average Users (MAU). Its 1Q14’s growth of 11% was a significant pick-up from the prior two quarters. Here’s a closer look: 2Q12: +12% … 3Q12: +15% … 4Q12: +6% … 1Q13: +11% … 2Q13: +12% … 3Q13: +2% …4Q13: +5% … 1Q14: +11%.

WB vs. TWTR

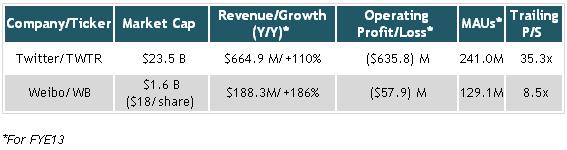

A couple items jump off the page. For one, TWTR is much larger than WB, in terms of market cap, revenue, and users.

Another major difference is the valuation. Even with its tumble lower, TWTR is trading with a meteoric trailing P/S of about 35x. At the mid-point of the proposed price range, WB’s trailing P/S would be a much more reasonable 8.5x. If we exclude its cash (including the projected IPO proceeds), its EV/Sales would be about 5x. Both companies have very strong top line growth, but both companies are far off from profitability as well.

Conclusion

Although the stock market has shown some stabilization this week, the general environment facing WB’s IPO is not favorable. After a scorching hot start to the year, the IPO market has cooled considerably.

Ever-present skepticism regarding Chinese companies and their accounting/auditing standards, along with censorship concerns from the PRC government are other hurdles.

Fundamentally, the main blemish is its lack of profitability. However, WB just began monetizing its platform in 2012, so, losses shouldn’t be surprising at this point. Topline growth has been phenomenal, and with a key partnership with Alibaba in place, revenue growth should remain strong for some time.

The most attractive feature of the deal is its valuation. When including the anticipated IPO proceeds, WB’s trailing EV/Sales would be about 5x. If we estimate 150% revenue growth for this year, that metric would fall to about 2x. For a company with such high growth potential, those metrics look very enticing.

To wrap up, WB’s IPO could struggle out of the gate, given the reasons noted above. There are clear risks involved here. However, I also believe there could be value and a positive risk/reward set-up if WB slips in its debut.

If it follows the same track of other recent IPOs, and dives below its IPO price, investors who can tolerate higher risk may want to contemplate a smaller opening position, taking an intermediate/longer term time-frame.

RELATED READING

Read another IPO story by Briefing analyst Hobein:

Will Castlight Health’s IPO Shine?