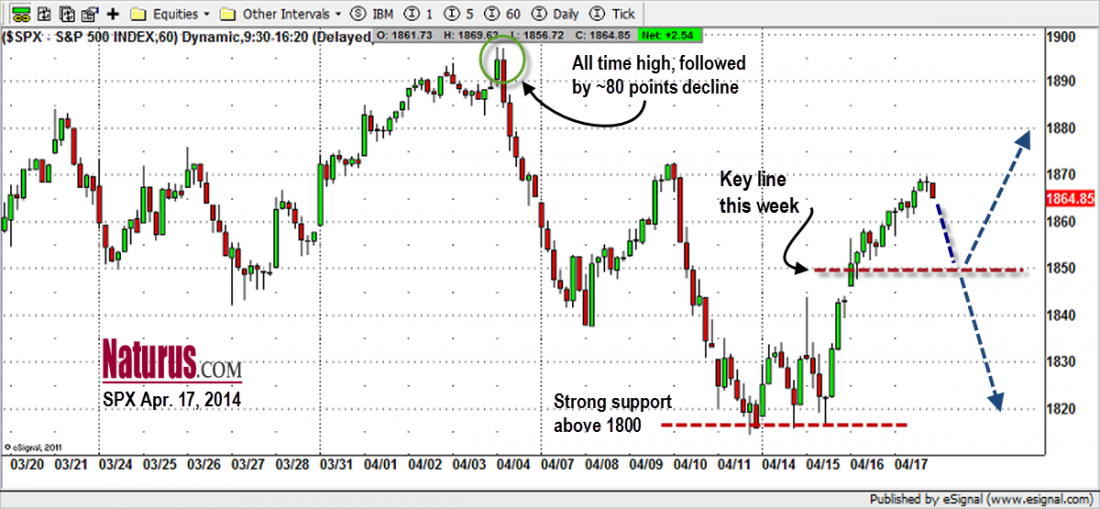

The way the U.S. equity markets bounced back last week was enough to make all the predictions about a market crash sound a bit lame. The S&P 500 cash index ($SPX) closed at 1864.85 on Friday, up 49.16 points, for weekly net gain about 2.7% – the best one week open-to-close performance this year.

Sure, it was the week before a holiday weekend, and the volume was pretty light. But we’re back up now almost to March’s closing price. It is as if the big decline in the first week of April never happened.

So it is reasonable to ask: Is the bull market back? Are we expecting new highs before that magic winter ramp ends – if it ever does.

What Happens Next

We certainly could have a continuation move up in the early part of the week. But the market is over-bought in the short term; we will probably re-test last week’s support area below 1820 at some point if we fall below the key support around 1850.

The price has moved above the 50-day moving average line, and the intermediate-term trend has moved back into the neutral area.

So holding above 1850 could change the short-term direction from down to up, and will also encourage the Bulls to fight through the next resistance level at 1878-75 as they try to make new highs near 1900.

We are still long-term bulls.

= = =

Learn more about Naturus, a subscription service for futures traders, here.