Shares of the real estate information marketplace company, Move (MOVE), are down 23.51% year to date. Move trades at a PEG ratio of 0.47x (2015 estimates), 12-13% revenue growth, and has an average analyst price target of $19. On Tuesday, April 22, they announced the signing of an Approved Supplier agreement designed to maximize lead generation and lead conversion for Re/MAX agents, teams, and brokers, with the goal of quadrupling an agent’s book of business. Q1 earnings are set to be released on Tuesday, May 6.

Unusual Options Activity

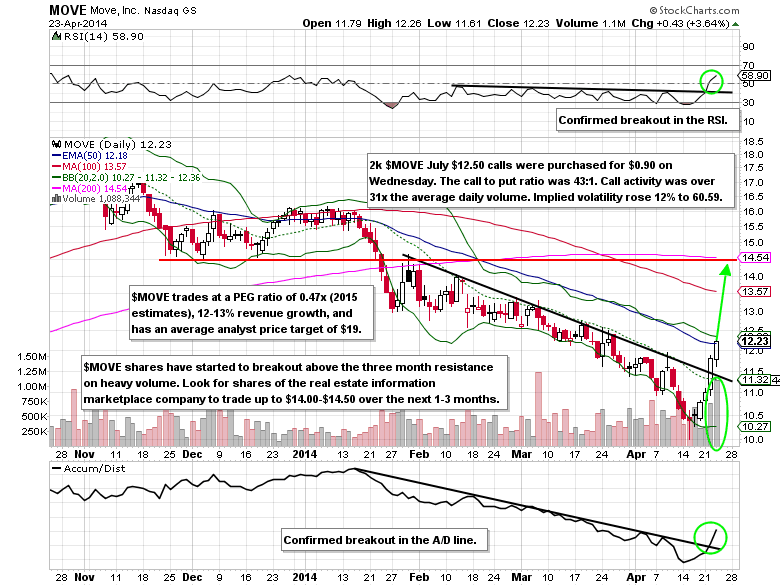

On Wednesday, April 23, someone purchased 2,000 July $12.50 calls were bought for $0.90 each. Throughout the day there was sizable buying in the June and July $12.50 calls after the initial purchase. The call to put ratio was 46:1 and call activity was over 31 times the average daily volume. Implied volatility rose 12% to 60.59.

Technical Analysis

Move shares have started to breakout above the three month resistance level on heavy volume over the last two trading days. The stock was also able to close above the 50-day exponential moving average for the first time since January. Two secondary indicators, RSI and the A/D line, confirmed the breakout of the underlying at the same time. Look for a move up to $14.00-$14.50 over the next one to three months.

Move Options Trade Idea

Buy the July $12.50 call for $1.10 or better

Stop loss- None

First upside target- $2.00

Second upside target- $3.00

Disclosure: I’m long the July $12.50 calls for $1.00 each.

= = =

Mitchell’s Free Trade of the Day featuring Chesapeake Energy (CHK)