If you are following Tesla, and especially if you own the stock, you are probably interested in stock price forecasts. As a shareholder, I know I am. The news flow for Tesla since the Q1 earnings call has been generally positive and the stock has shown some relative strength. Nevertheless, in the current profit-taking climate, few high-octane four-letter names are feeling the love.

A Mean-Spirited Reversion

Periods of seemingly punitive action are entirely normal in the Nasdaq, because “momentum” is a two-way street. The laws of market physics cannot be repealed because they present financial opportunity for those who know how to exploit them.

For example, reversion to a 200-day moving average is a typical pullback target during bearish times. Hedge funds take profits and institutional players pick up shares at a bargain. Such is the nature of the market ecosystem. Everyone eats, but at different times.

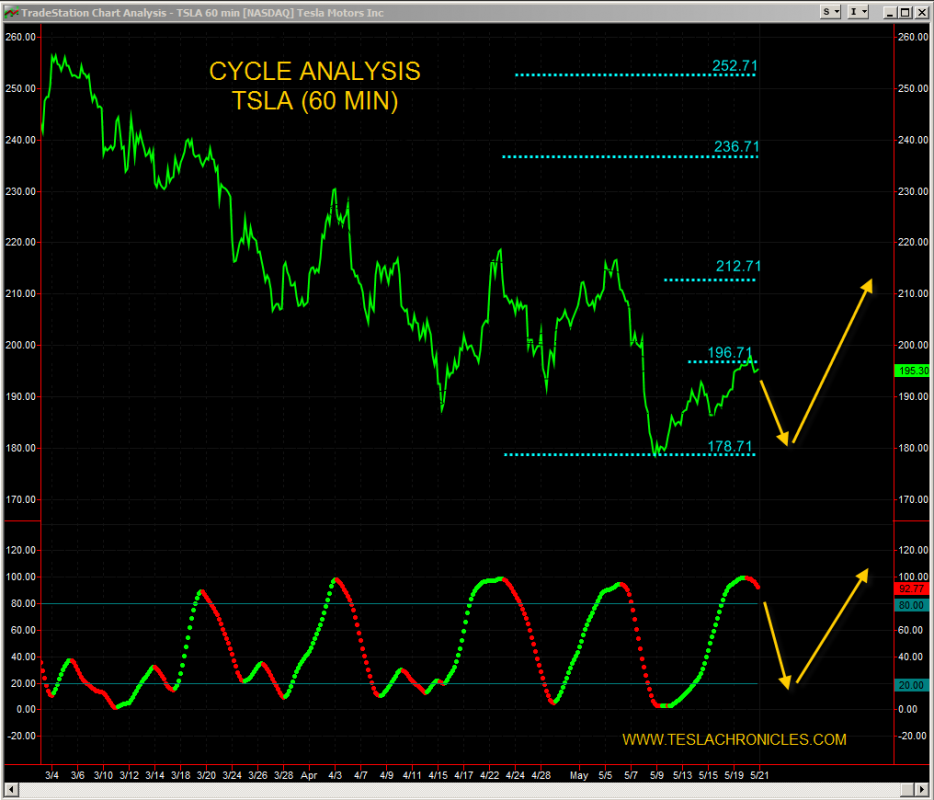

Most traders know what moving averages are and how to use them to help define trend. I have developed different tools to predict short- and long-term price behavior. Applying these indicators to an hourly chart of TSLA tells the following story.

1) TSLA is still in a downtrend on the hourly timeframe.

2) The area around $196, where the stock is now, is a pivotal level.

3) TSLA is overbought on my proprietary oscillator.

4) Over the short-term, the most likely trajectory is down.

5) A retest of the $178 level is possible.

6) A subsequent bounce up to $212 is then likely.

The Nasdaq Elite

That said, a focus on short-term price behavior can be a psychological trap when it comes to ‘story stocks’ such as Tesla. Truly innovative companies such as Apple, Amazon, Netflix and Starbucks are an elite group. There are always more reasons not to own them than there are to take the plunge. Valuations are rarely attractive, chasing is dangerous and pullbacks are scary. This makes people fret over meaningless fluctuations in price.

Additionally, members of The Elite tend to generate a degree of investor loyalty that borders on religious fervor and skeptics are quick to point out the over-zealous fanaticism. This is the formula for endless media controversy, generating plenty of heat, but little light.

In my opinion, The Elite are the true fortune makers, but only if you have the wisdom to identify them early and the courage to buy and hold. These are the companies you will want to load up on during the next bear market and perhaps nibble on now. I think TSLA belongs in this group.

= = =

Related Reading

Read more Tesla Analysis here: