Shares of the paint and fiberglass supplier, PPG Industries (PPG), are up 6.29% year to date. PPG trades at a P/E ratio of 18.39x (2015 estimates), PEG ratio of 1.23x (2015 estimates), 4.5% revenue growth (2.3% growth this year), 1.34% dividend yield, and has an average analyst price target of $220. On 4/21, Jefferies maintained a buy rating with a price target increase to $228 from $165 on 4/22/13. On 4/17, PPG reported a year over year increase of 17% in total revenue and a 27% increase in the performance coating segments. They reported EPS of $1.98 vs. the $1.87 consensus estimate for Q1.

Unusual Options Activity

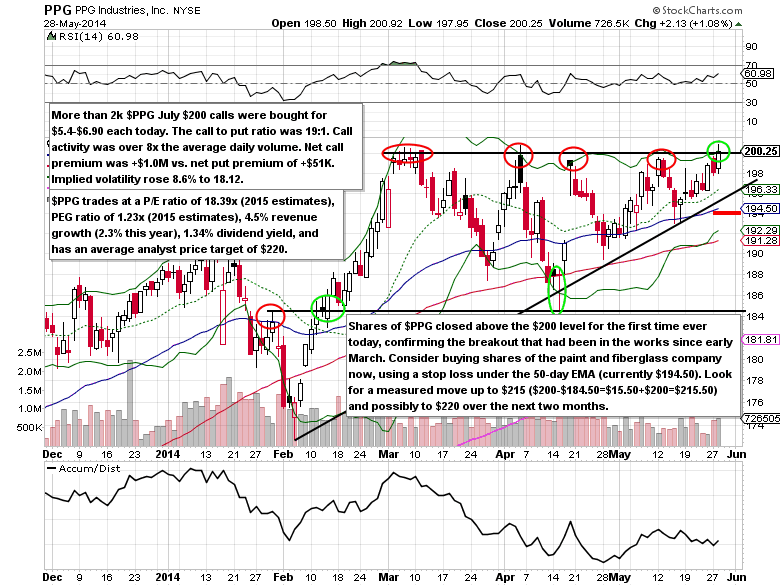

On Wednesday, May 28, more than 2,500 July $200 calls traded with the majority going on the offer (bought) for $5.40-$6.90 each. The call to put ratio was 19:1. Call activity was over eight times the average daily volume. Net call premium was +$1.0M vs. net put premium of +$51K. Implied volatility rose 8.6% to 18.12.

Technical Analysis

The early call buying on Wednesday helped spur the breakout above the $200 level for the first time ever, which had failed on the four previous attempts since March. Look for a measured move up to $215 ($200-$184.50=$15.50+$200=$215.50) and possibly to $220 over the next two months. A stop loss placed under the 50-day exponential moving average (EMA)—currently $94.50 makes the reward/risk ratio on a long stock trade better than 3:1.

PPG Industries Options Trade Idea

Buy the July $200 call for $7.00 or better

Stop loss- None

First upside target- $15.00

Second upside target- $20.00

Disclosure: I’m long the PPG July $200 calls for $6.30 each.

= = =