The news was not very good in the last two weeks of May. Civil wars in the Ukraine and Syria. Saber-rattling between Russia and the U.S., between the U.S. and China, between China and Vietnam. A coup in Thailand. A mine disaster in Turkey. Elections in Europe that greatly increased the power of political parties that want to end the European Union.

At home, retail spending reports that were “dismal’ – consumer spending accounts for 70% of the U.S. economy, remember. U.S. GDP revised down for the first quarter. Recalls from GM that came close to 16 million vehicles worldwide. Foreign buyers deserting U.S. bonds (in May we learned that foreigners bought $4 billion in long-term U.S. financial assets in March, compared with $90.3 billion the previous month). Droughts. Wildfires. Rising food prices. Mass Murders. Gloom everywhere.

Some of that, you might think, would be reflected in the equities market.

Nope. In the last 10 trading days of May the market didn’t just climb a wall of worry, it leapfrogged past resistance levels like a superhero on steroids. The S&P mini futures, the vehicle we use to trade the broad equity markets, was up 45 points in 10 days, and closed higher on nine of those 10 days.

Why? Because institutions were rushing in to buy in volume in the closing moments of each day – a practice known as “banging the close.” And they were doing it in the period around a holiday, when trading volume was abnormally low.

The effect is to halt declines and close the market green – “painting the tape” to make it look a little better by boosting the price into the end of the month.

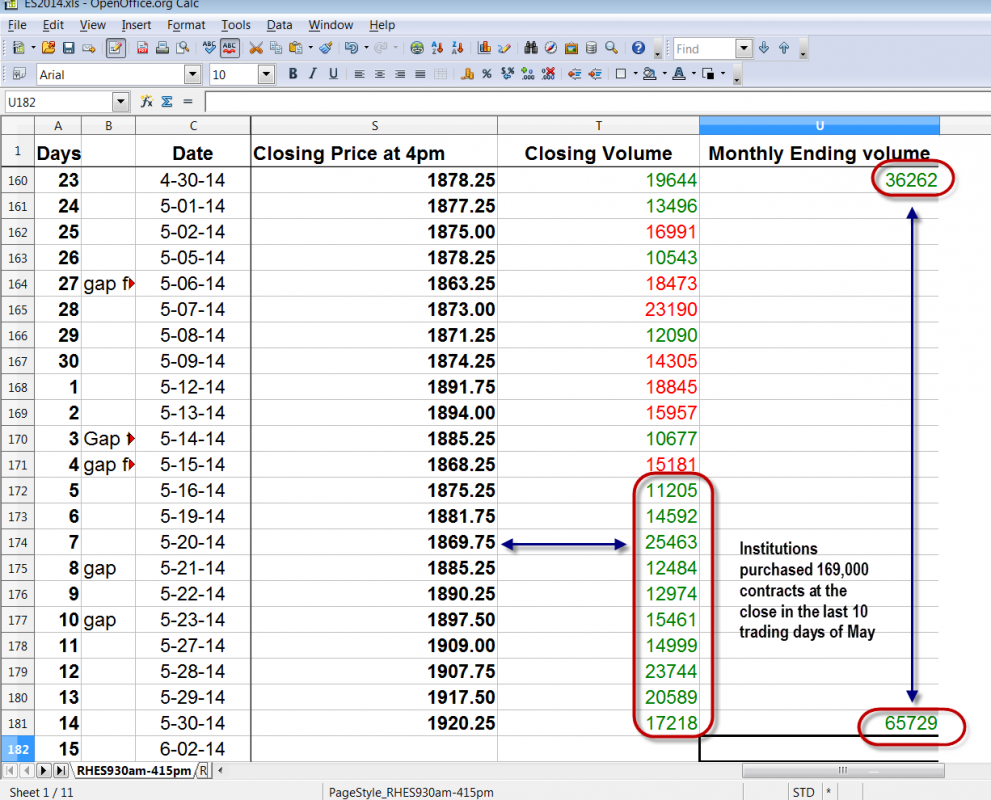

Take a look at this chart. It shows the contracts in the S&P 500 mini futures purchased at the close of trading, in the month of May, primarily by institutional traders.

In those 10 days institutions purchased 169,000 e-mini contracts right at the close, each with a notional value of about $96,000. The regular trading volume during the day was anemic in comparison.

Why Are They Doing It?

Banging the close has become common practice, but May was exceptional: 10 straight days of heavy buying at the close, almost double the volume for the previous month. Why?

They think they know something you don’t.

One of the things they think they know is that the European Central Bank is going to take the first tentative steps toward a Quantitative Easing of their own this week. Officials have been dropping hints like gumdrops, and refusing to deny the rumors.

While actual bond purchases likely won’t happen, interest rate reductions are probably in the cards. To hair-trigger traders, that is as good as a confession. Buy! Buy!

We will know on Thursday (June 5) if they are right this time, or if it is just another in a long series of pump-and-dump maneuvers.

In either case it is clear that this market has slipped the surly bonds of earth, as the poem says, and is now cruising in the stratosphere, far removed from such mundane considerations as price/earnings ratios, or economic conditions, or the technical indicators we normally use.

The river of free money flowing into the market from the Federal Reserve is now the only thing that matters. As long as it keeps flowing, the market will keep going up. And the prospect of a second river starting up in Europe is enough to make the hot money go all giddy.

Don’t fall for it. This market has already hit the initial target at 1920 we projected when the S&P was trading below 1700. We have additional targets up to about 1972 that may well be hit soon.

But the obvious truth is that there is much more room to go down from here than up. We don’t think you can short this market, because there is likely to be one more big spike up at some point. But we don’t want to be long at this level either, except for very short-term scalping trades.

The risk/reward calculation doesn’t make sense here. Time to step back, make some popcorn, and watch to see what happens next.

= = =

See detailed analysis of the equity futures here.

Read Monday’s story by Naturus on the gold market outlook here.