Sector Rotation via Accumulation/Distribution. A periodic study of sector rotations can help us understand the drivers and motivations behind price movements. One of my favorite tools is simply looking at accumulation versus distribution ratings assigned by Investor’s Business Daily® (IBD). It is an objective study of where money is flowing.

[Editor’s note: this article is a follow up to Rinehart’s May feature story: Sector Rotation: Accumulation And Distribution.]

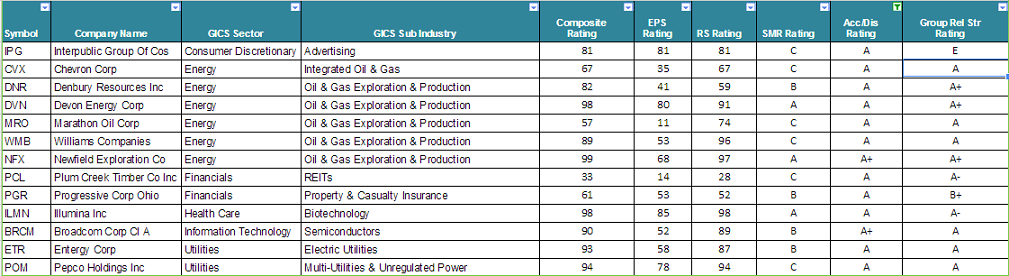

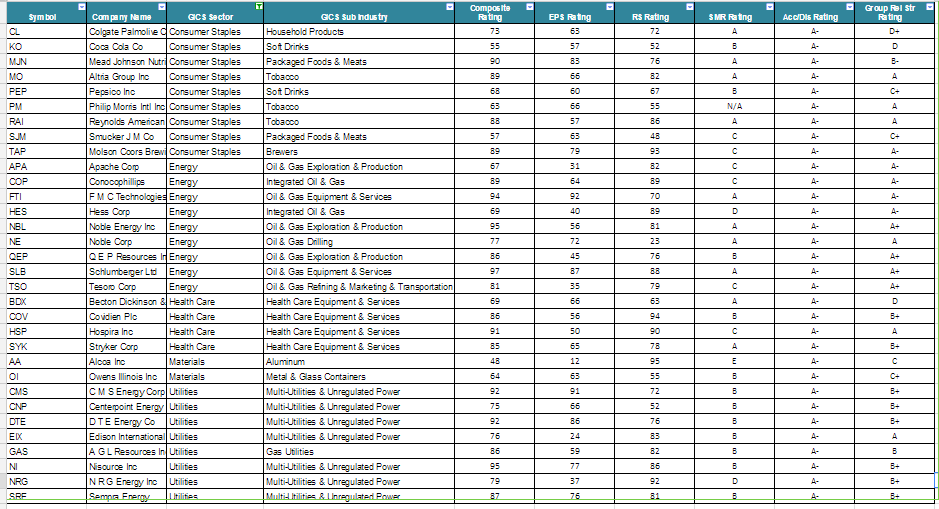

Since April, more money has been flowing into big caps. The June list is broken into three categories: stocks with A+ and A ratings; stocks with A- ratings classed as ‘defensive’; and stocks with A- ratings classed as ‘cyclical’. Figures 1 and 2 present a picture similar the one we saw in April, namely that the market continues to favor the safety of defensive stocks, those whose earnings are less susceptible to volatility.

Figure 1 S&P500/Nasdaq100 Acc/Dis A+/A Rating as of June 20, 2014

Figure 2 S&P500/Nasdaq100 Acc/Dis A- Rating (Defensive) as of June 20, 2014

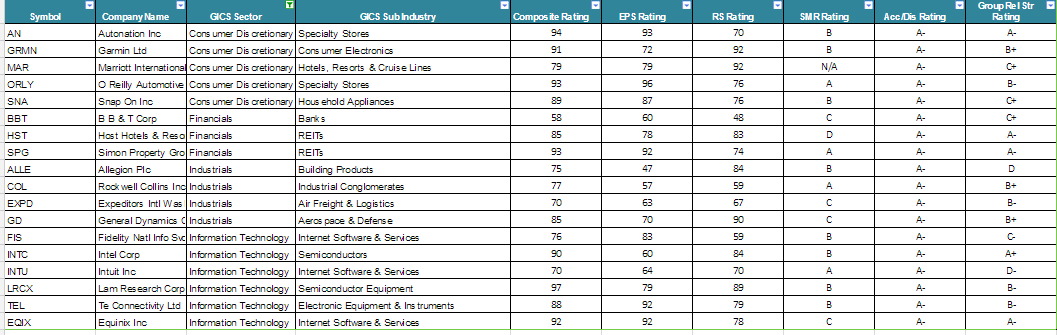

This month’s A-list is much more expansive than April’s and another picture is emerging. Figure 1 and 2 confirms April’s study of the market’s favor for defensive plays. However, Figure 3 demonstrates that the market is also anticipating continued growth. Some vehicles listed in Figure 3 may or may not surprise you. For example, after a decade of slumber, big cap Intel Corp., INTC, has recently cleared its high from 2005, a statement of the market’s anticipation for global recovery. What may be less intuitive is the two REIT’s, HST and SPG, that have made it on this list. Luxury hotels and malls fall into high risk ventures that place huge long-term bets on the consumer. Figure 3 offers a starting point to begin investigating the industries where the market is anticipating growth.

Figure 3 S&P500/Nasdaq100 Acc/Dis A- Rating (Cyclicals) as of June 20, 2014

Take Away

The A-list this month is much more expansive than it was earlier this spring. On one hand, the market in the near-term repeats the theme from April, which is its anticipation of a slowdown in the current business cycle. However, Figure 3 offers us a glimpse of where the market expects to see growth further down the road, and what industries we should begin investigating today.

Resource: Ratings Found at Investors.com

No Position