This month marks the sixth year after Lehman Brothers filed for Chapter 11, an act that served as a precursor to market meltdown of October 2008.

Six years later, and despite the amazing recovery for the general market since the market bottomed in 2009, the financials as a sector continues to lag.

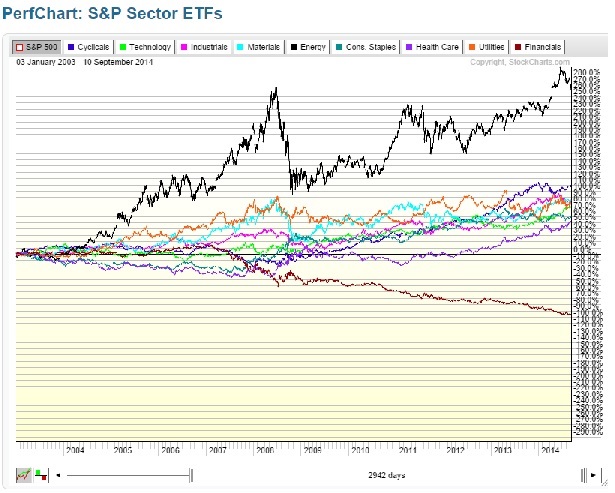

Figure 1, the 10-year PerfChart for the S&P Sector ETFs, depicts the Financials (brown) relative weakness during a decade plagued by low interest rates that created an environment for risk taking ending with a banking crisis not seen since the Great Depression.

[Editor’s note: learn why sector study is so important. Sector Study: Where Is Growth Seen Ahead?]

Today, despite the major indexes at all-time highs, the XLF (SPDRs Financials ETF) is only just above its 50% retracement since its peak in 2008. However, the economy is improving and with that the expectation that interest rates will rise with it. Last fall we saw bond markets show signs of interest rates peaking when long-term bonds began forming a base. Almost a year of consolidation and the long-term bond market may be signaling that interest rates is again on the rise. Rising interest rates and it may be time to begin looking at the financial sector for signs that their consolidation period is over.

Figure 1: 10-Year PerfChart: S&P Sector ETFs

Rotation Rotation

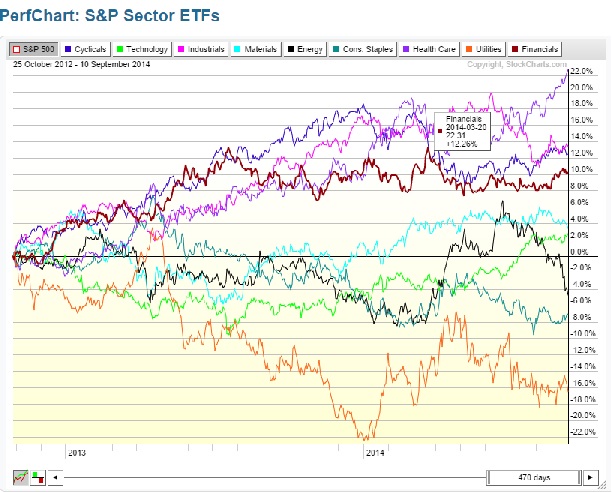

Let’s take a closer look at the last two years with Figure 2. Following the 2012 election and the last viable market correction, we see that cyclicals along with financials led the trend up into the New Year. The year 2013 was an exciting year for the market.

Social media IPOs trended along with the future of cars and Elon Musk. However, look more closely, and you will see that financials began to peter out in the fall around the time that the TLT (20+year Treasury) began forming a base, demonstrating that interest rates had peaked for the time being. Moreover, despite improvement in the overall economy, the consumer continued to lag behind as wage growth stalled. The dismal showing by the retail sector during the 2013 holiday season confirmed the reality of a still struggling consumer. In response, cyclicals began topping by the end of the year.

A lesson from Graham and Dodd, adding confirmation to signs of slowing growth, utilities and energy would enter the rotation as the market looked for security in historically defensive stocks. In the meantime, Main Street celebrated continued economic improvement with encouraging employment numbers, a reminder that employment is a lagging indicator.

Figure 2: 2-Year PerfChart: S&P Sector ETFs

Interest Rates On The Mend

A look again at Figure 1 and we see that financials have lagged for a full decade while interest rates remained at historically low levels. Low interest rates allowed consumers to borrow at levels that created a sense of prosperity. Unfortunately, low interest rates is a sign of deflation and stagnant growth. So while asset prices rose, real production lagged. However, since the market bottomed in 2009, cyclicals continue to be the big winner demonstrating that the economy is on the mend and with that the expectation that interest rates will rise as demand returns.

Take Away

Market rotations remind us that the market is forward looking and nothing remains the same. A full year of banking consolidation, and it might be time again to start looking at the sector for change. It has been six years since the financial meltdown. Today, a signal from the bond market that interest rates are rising is a signal that it is time to again look at the sector.

PerfCharts from StockCharts.com

Disclosure: Author owns shares in BAC.