Over the past month, the IPO market hasn’t provided traders and investors with many compelling opportunities as activity has dried up. With Chinese e-commerce giant Alibaba (BABA) lined up to go public on September 19, the IPO market will soon come to life in dramatic fashion.

Demand has been so strong that its expected price range has been bumped higher to $66-$68 from the original expectation of $60-$66. With BABA offering 320.1 million ADS, its projected proceeds of over $24.6 billion (including exercise of over-allotment shares) put it on pace to become the largest IPO ever.

As enthusiasm for this IPO reaches epic proportions, there is little doubt that it will price well and open with a bang. There is good reason for all the excitement. BABA is the dominant force in China e-commerce with a staggering 95% share in the consumer-to-consumer market (think EBAY) and a 50% share in the business-to-consumer market (think AMZN).

The company’s growth has exploded over the past few years thanks to the massive size of China’s consumer economy, estimated at $3.4 trillion, and as Chinese consumers shift towards online shopping. Additionally, BABA implements an asset-light business model in which it takes on zero inventory costs. This helps explain why BABA is generating sizable profit margins while AMZN continues to struggle on the bottom line.

The opportunity BABA presents is a unique and compelling one that investors should strongly consider. With that said, investors shouldn’t throw caution to the wind from a risk/capital management perspective. There are plenty of risks to be aware of, which I discuss below.

Closer Look at BABA

BABA has been described as a combination of AMZN and EBAY, which is accurate to a certain extent as its C2C and B2C online and mobile platforms are its largest sources of revenue, accounting for 82% of total business. Recently, though, the company has expanded into many other areas through acquisitions, raising concerns that margins will take a hit as it ramps up new businesses. We’ll touch on that more below, but first, here is a closer look at its core segments.

Taobao Marketplace: Translated to “Search for Treasure” in Chinese, this is BABA’s consumer-to-consumer platform. BABA owns the C2C market with an estimated 95% share and GMV of RMB 1.26 T over the past twelve months. Buyers can look for anything from hard to find, one-of-a-kind items, to everyday household goods.

Tmall: Tmall is BABA’s B2C business. With GMV of RMB 576 B over the past twelve months, it is China’s largest third-party platform for brands and retailers. During its road show, BABA described Tmall as an “online version of 5th Ave in Manhattan”, targeting upscale shoppers with money to spend.

Alibaba.com: Launched in 1999, this is BABA’s original platform and is an online wholesale marketplace where global wholesalers and manufacturers supply buyers. BABA founded Alibaba.com to help small exporters, primarily located in China, to reach international buyers.

To complete the buying and selling process, the company launched AliPay (similar to PayPal) in 2004, which holds payments in an escrow account until the buyer is satisfied with the product received. With almost 80% of transactions facilitated through AliPay, this service helped BABA explode into the company it is today.

Financials

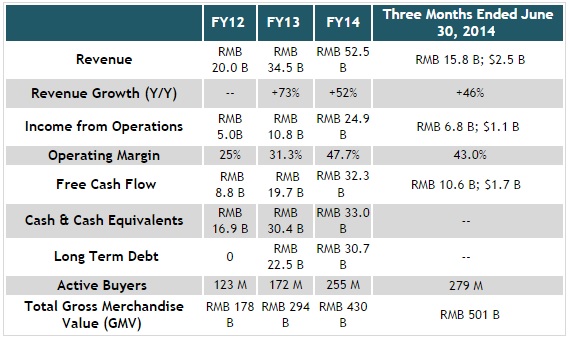

Although the rate of growth has slipped, revenue is still growing at a fast clip. As its revenue base becomes larger and larger, that should not come as a surprise. Investors just need to be aware that BABA’s days of hyper-growth are behind it.

The upside is that the company is already profitable, and has been for some time. It also generates plenty of free cash flow.

I do have one concern, though. Its operating margin and EBITDA margin has been sliding and the company commented that it expects further slippage in margin as it invests in new businesses. This is the price of its acquisition spree as it looks to keep revenue growing briskly.

Looking at the numbers, operating margin has gone from 47.9% in 2Q14 (ending Sept), to 47% in 3Q14, to 45.3% in 4Q14 and then 43.0% for the most recent quarter ended June 30, 2014.

Valuation

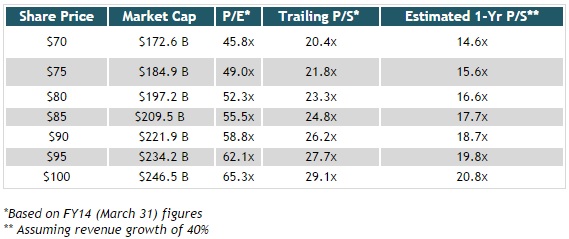

The table above displays BABA’s key valuation metrics at various price points. Without a doubt, the price tag is rich, making valuation one of the key risks for investors.

Risks

It’s easy to get caught up in the emotion and hype of an IPO of this magnitude, but, there are plenty of risks associated with BABA, outside of the aforementioned rich valuation.

For instance, its corporate structure is about as unfriendly as possible to U.S investors. BABA must use an arcane legal structure called a variable interest entity required by the Chinese government that allows for foreign ownership in internet related companies. In essence, an investor who purchases shares of BABA is actually only buying a Cayman Island based holding company that has rights to BABA’s profits, not any direct ownership of the assets or company itself.

It also must be noted that Jack Ma, the Founder of BABA, will retain complete control over the company and U.S. investors will not have any say in major strategic decisions. In fact, they may not even be aware changes are happening.

Back in 2010, Jack Ma decided to spin-off AliPay to a separate entity, while keeping a 46% stake in Alipay. Controversy arose when Yahoo (a 22% stakeholder in BABA) disclosed to its shareholders that it was not informed of the decision to spin of Alipay until five weeks after the transaction was consummated.

Another concern is BABA’s recent spending binge on acquisitions. Since last April, the company has made at least seven major purchases, including stakes in Weibo (WB), Qyer.com, Kanbox, AutoNavi, and Intime Retail Group. The issue is two-fold. First, it suggests that BABA needs to look to in-organic means to keep its top line growth rates chugging along at high levels. Second, these investments have pressured its EBITDA and operating margins, causing its profit growth to slow.

Conclusion

There are many factors and moving parts to consider, but, it boils down to this: BABA is an exciting and compelling opportunity and I believe it is worthy of a place in investors’ portfolios. However, the risks (slipping margins, slowing revenue growth, valuation, corporate structure) makes me somewhat cautious on it.

Therefore, while picking up some shares looks like a promising longer term opportunity, investors’ should caution against getting caught up in the hype and emotion and guard against risking an out-sized amount of capital.

In order to manage risk, the prudent strategy may be to start with a smaller-than-typical initial investment, and then once the hysteria dissipates and profit-taking has set in as momentum traders head for the exits, look for an opportunity to add to that position.