Fibonacci numbers or sequences have been written about extensively in mathematical literature. They occur in the sum of shadow diagonals in Pascal’s Triangle and have unique divisibility properties. In nature, these numbers describe the arrangement of leaves on a tree stem, the flowering of an artichoke and the arrangement of a pine cone. This amounts to nothing more than defining symmetrical patterns of a few natural curiosities.

Let’s Compare

This stands in stark distinction to such notable mathematical equations as Planks Constant which defines the quantum movement of particles. Einstein’s equations proved that light travels in discreet packets known as photons and that the wavelength of each photon determined its energy level. Thus, red light, with its low energy quanta is used in a dark room, insuring the unimpeded development of new photographs. Neil’s Bohr developed equations that showed that electrons revolve around atoms in stable orbits.

No Proof

Fibonacci numbers do not describe the motion or interaction of particles in a closed system on the macro or micro level. How the teleological leap was made, or, supposition proposed that these numbers somehow describe the movement of an unnatural system such as the stock market is unsubstantiated in science.

I have seen the somewhat ludicrous statement written that our, “brains are hardwired to respond to these proportions.” For the most part, we are told to accept Fibonacci as gospel and not to question its validity. Robert Miner writes in his book, High probability Trading Strategies, “I have almost every book relating to Fibonacci, sacred and philosophical geometry… it is a very interesting subject. But all these books and three dollars will get you a cup of cappuccino…… all you need to know are the Fibonacci numbers for trading.” Would anyone consider this a treatise on Fibonacci that is bound in fact and tempered with trading practicalities?

Trading Examples

Let’s take a look at market movement with and without Fibonacci levels:

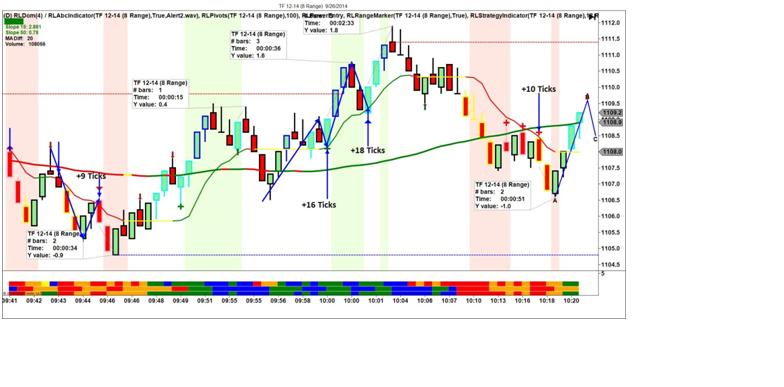

ENTRY LEVELS BASED ON MARKET STRUCTURE, ORDER-FLOW, MOMENTUM AND FRACTAL ANALYSIS

RESULTS 4 TRADES – 4 WINNERS

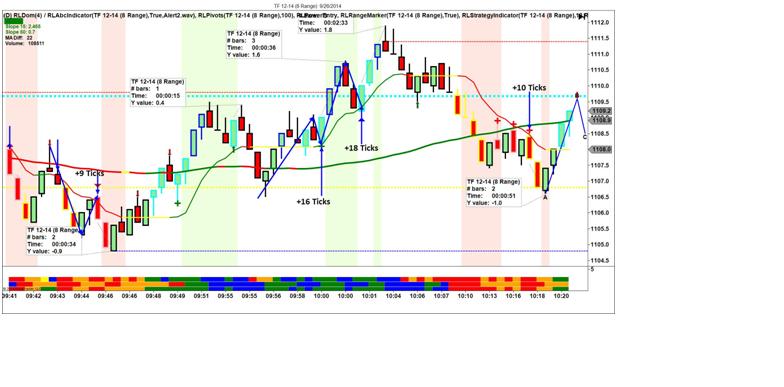

ENTRY LEVELS BASED ON MARKET STRUCTURE, ORDER-FLOW, MOMENTUM AND FRACTAL ANALYSIS AND FIBONOCCI RETRACEMENT LEVELS

RESULTS 4 TRADES – 4 WINNERS – FIBONACCI LEVELS DO NOT IMPROVE THE PREDICTIVE VALUE OF OUR TRADING ENTRIES

The Bottom Line

In conclusion, Fibonacci numbers and Fibonacci retracement levels are a mathematic curiosity. They have never been proven to enhance the positive predictive value of a trading entry in any rigorous scientific analysis. Until such an analysis is performed we will continue to rely exclusively on market structure, momentum, order flow and fractal analysis to delineate our trading entries.

Mark Sachs

Right Line Trading

Related Reading

Read another story by this author: