The holiday season is just around the corner. Traders and economic watchers will be closely watching the Retail Sector given the dismal turnout by consumers in recent years. The XRT (SPDR S&P Retail ETF) peaked in 2013 and since has traded sideways, until today. There are clues that this year may be a different season for both the consumer and retailers alike, and traders will be following the XRT to signal a breakout.

Figure 1, Weekly Chart of the XRT (SPDR S&P 500 Retail ETF)

Lower Prices at the Pump

Beginning mid-summer, consumers have enjoyed lower and lower prices at the pump. Prices trending down to $3.00 or lower per gallon is a welcome and noticeable change. In fact, Crude Oil is back again at its 2011/2012 lows. While it seems unlikely for Oil to trend lower, given the way the economy feels today versus 2012, lower prices are just the relief consumers need as the holiday season gears up.

Figure 2, Weekly Chart of Light Crude Futures

Uptick Last Quarter in Wage Growth for the Private Industry

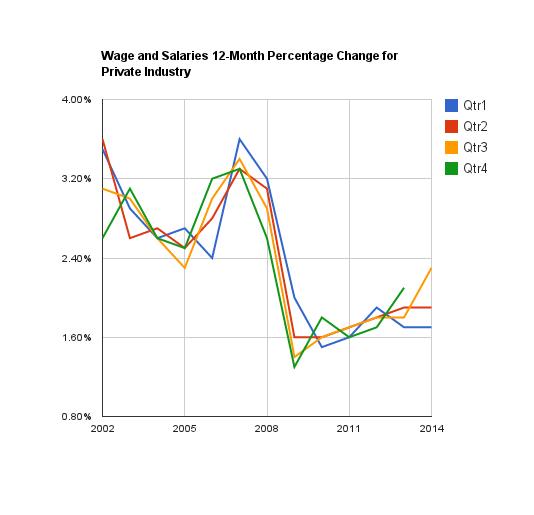

Figure 3 charts wage growth for the private sector over the last decade. This chart was originally shared in October 2013 for SeeItMarket.com. Then the chart was relatively flat demonstrating the ongoing problem with anemic wage growth, and it served as an early warning signal for the retail sector in the upcoming holiday season. However, this year’s story in the chart is a little different.

Wage growth is now well off the lows of 2009, and the sharper uptick recorded for the third quarter is in contrast to the dip last season, making this year’s chart more optimistic for the season ahead. Improved wage growth may indicate that the consumer will be feeling less constrained this season.

Figure 3, Wage and Salaries 12-Month Percentage Change for Private Industry Provided by Bureau of Labor Statistics

Take Away

The Retail ETF (XRT) peaked in early December 2013, and has since traded sideways, demonstrating the reality of a still struggling consumer. Although, rising employment numbers were celebrated, consumers continued to feel the constraint of high prices at the pump and stagnant wage growth. However, this season, Crude Oil is back at 2011/2012 levels while wages in the third quarter have demonstrated a noticeable uptick when compared to this time last year. These factors just may indicate a better turnout by consumers this holiday season.

Thank you for Reading