Teva Pharmaceutical Industries (TEVA) is the $55B Israeli based, generic drug maker of products such as Azilect and Copaxone. Recently, the company announced it was selling ANDA (Flecainide Acetate tablets USP 50mg, 100mg and 150mg) to ANI Pharmaceuticals and its Sellersville, PA facility to G&W Laboratories as part of a cost cutting effort.

The stock trades at a relatively cheap valuation of 11.23x forward earnings, price to sales ratio of 2.36x, and a price to book ratio of 2.05x. Given the recent pickup in M&A activity, RBC sees Perrigo (OTC and generic drugs) as a potential target of Teva’s. At the end of last year, they had $2.2B in cash and a long-term debt load of $8.6B, meaning it is not out of the realm of possibility for a deal to occur.

This is especially true, whether it is Perrigo or a smaller pharmaceutical company, since Teva is expected to see relatively flat earnings growth over the next year. Despite that, analysts remain optimistic with an average price target of $62.37. On March 10th, Leerink Swann raised its price target to $69 from $67.

Unusual Options Activity

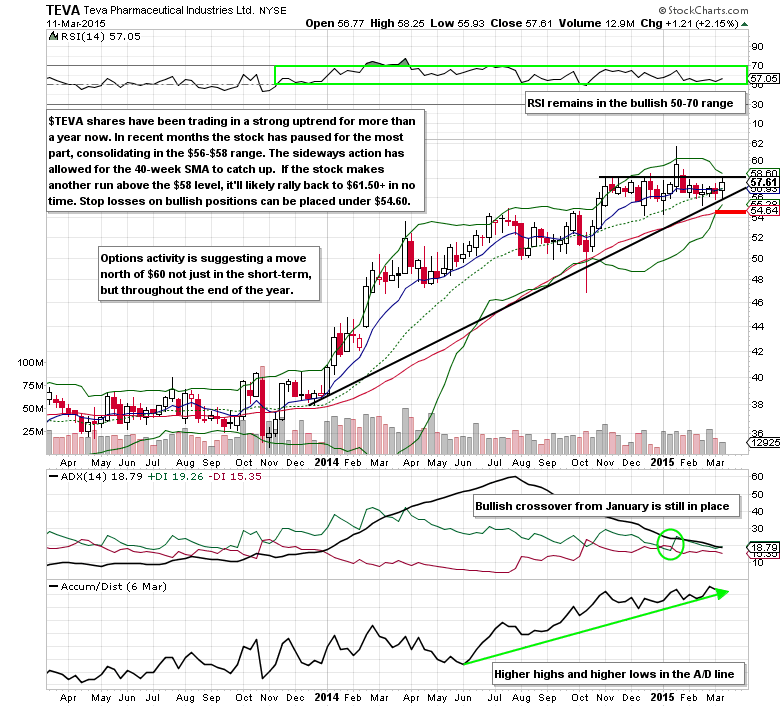

The Apr 17 $55/$60 bull risk reversal was put on 2,500 times for a $0.30 debit on March 11th (bought the $60 calls and sold the $55 puts). Not long after this trade, someone came in and bought another 1,500 Apr $60 calls for $1.07 each.

Call activity was 4 times the average daily volume on the day. These trades come after the March 5th rollout from 4,000 Mar 20 $52.50 calls ($4.05 credit) into 6,000 Jan 2016 $45/$60 bull risk reversals ($2.90 debit) and the 12,000+ June $57.50/$65 call spreads bought and 5,000+ June $50 puts sold throughout February.

September options have also seen bullish activity as well, but, to put it simply, large hedge funds and institutions see significant upside in the stock in the near term and longer term.

Teva Pharmaceutical Industries Options Trade Idea

- Buy the June $57.50/$65 bull call spread for a $2.40 debit or better

- (Buy the June $57.50 call and sell the $65 call, all in one trade)

- Stop loss- None

- 1st upside target- $4.80

- 2nd upside target- $7.20

Disclosure: I may buy call spreads in Teva sometime soon.

#####

To get Mitchell’s ORM Market Commentary featuring analysis on Interactive Brokers, Alaska Air Group, and more, please click here.