Oil prices are on the way back up. The big question in the media these days is where is it going now? Like everyone else, I have my opinion (which I gladly shared on Fox Business this week, my fellow analyst aghast that I dare counter Goldmans forecast). However, opinions on where prices are going are more of a fun conversational topic for the media.

When it comes to making money, you’ll want to focus on where prices are likely not going. This is not an exciting media topic. But, as with anything in life, the story of how things really get done seldom is.

To do that, lets first look at the current fundamentals of oil.

Current Fundamentals favor Bulls

A big focus of many oil bulls has been the falling Rig Counts in the US. To be sure, US rig counts have fallen drastically. There are only 84 rigs now operating on North Dakota’s Bakken Shale vs. 209 in early 2012. Nationally, the count is down to 679 from 1,527 just last year. Yet crude production levels have not yet fallen significantly. We cannot then, directly attribute the rise in crude prices simply to falling rig counts.

Something else is going on.

But what?

What is Responsible for the Price Rally?

Certainly not Saudi Arabia which continues to pump out 10 million barrels per day. And not US drillers, which despite falling rig counts, continue to crank out 9.4 million barrels per day, just below the February high of 10 million barrels.

Could it be Macro factors? Yesterday, the EIA lowered its 2015 crude production growth estimate, while raising its forecast for U.S. oil demand. The report came after OPEC raised its 2015 forecast of global oil demand to 1.18M barrels per day. Is the global oil balance responsible for higher prices? While it certainly doesn’t hurt the bull cause, crude has been rallying for several months. And markets rarely respond immediately to such longer term predictions, making this an unlikely cause.

No, what is going on is something else.

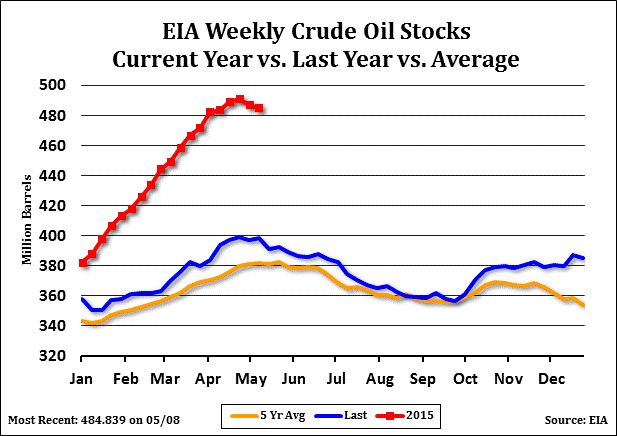

What is going on is Expectations. In particular, it is expectations for crude stockpiles to begin a decline. And this despite rising stocks, this expectation has been going on throughout for several months.

Last month saw all time highs in crude storage levels in the US. Yet, prices were nearly $20 per barrel higher than this winters lows. Why? Because this is the futures market. Futures look forward to the future. This is what novice oil traders never seem to understand. Prices are based on how traders expect the supply level to move in the future. And right now, traders are expecting the supply to fall. This anxiety brings buying into the market – with both traders and some end users trying to buy now before prices theoretically rise later – when supply is even lower.

The question is, why is the market pricing a decline in stockpiles?

The answer is two reasons, one economic, one cyclical.

Economic Incentive for Refineries

Last week, the weekly Energy Information Agency stocks report showed the first draw on crude oil inventories in several months after swelling to all time highs in April. This week saw the second consencutive draw on stocks. This weeks consensus was for a 400,000 barrel draw on stocks. Instead we saw a 2.2 million barrel draw. Last week, consensus was for a 1.5 million barrel build in stock levels. Instead, the EIA report showed a 3.9 million barrel draw on stocks.

———————————————————————————————–

What is going on is Expectations. In particular, it is expectations for crude stockpiles to begin a decline.

———————————————————————————————-

It appears that expectations are finally becoming reality.

This is NOT due to lower production but to Refineries RAMPING UP Production, thereby using up crude supplies at a faster rate.

Refinery profit margins are soaring – giving them incentive to ramp up production NOW to make more profits while it lasts. And ramp up they are. As of May 1, US refinery operating rates stood at 93%. This vs. 90.1% at the beginning of April and 87.8% at the beginning of March.

Refineries operating at higher capacity means producing more “end” products such as gasoline. This means using raw crude oil at a faster rate, thereby drawing down supply. (To read our forecast for this occurrence and it’s projected effect on Oil prices read “Oil Market Special – How Low is Too Low” from the blog, February 12.

But higher profit margins don’t tell the whole story. There is another reason refineries are using up crude at a faster clip.

Seasonal Demand

If you’ve read The Complete Guide to Option Selling 3rd Edition, (chapters 15 and 16 on seasonal tendencies) you know crude oil demand has a very cyclical nature to it. The summer “driving season” kicks in about June. Good weather brings vacationers and more overall traffic the roads, driving up demand for gasoline. Distributors prepare for this phenomenon in advance by building up gasoline stockpiles in the Spring. This increase in wholesale demand means refineries increase output during these time periods.

Thus the combination of high refinery profit margin and increased wholesale gasoline demand are driving up refinery operating rates. This is expected to begin to draw down crude stockpiles.

Crude Oil Storage levels typically begin to decline in May. 2015 sees May stockpiles at record highs.

The seasonal chart below indicates that in past years, expected seasonal demand followed by actual draws on crude stocks has tended to have a bullish impact on prices – often deep into summertime. While there is no guarantee prices will trade higher this year, we have every reason to believe crude stocks will begin a gradual decline this month.

While past performance is not indicative of future results, in past years, oil prices have tended to gain strength into US summer driving season.

Price Projection

We do not see crude oil at the beginning of a bull move but rather in the middle of one. As the public begins to see draws in crude stocks, it could create another leg higher into the summer months. The trend higher was started by traders fueled by expectations. It could be continued by the public as they watch those expectations come to pass.

Our price projection is to see crude prices at or above $70 by July.

Am I willing to bet money on that? No, I am not. But as an option seller, I don’t have to.

Conclusion and Strategy

With seasonal demand in full swing, refinery operating rates spiking and a strong seasonal tendency for firmer prices, it is our opinion that crude oil prices will strengthen into mid-summer.

However, rather than attempting to profit from a potential push higher in crude prices, would not a higher probability trade be to simply invest in the idea that crude prices will not fall substantially in the next 90 days ?

I won’t bet that prices are going to $70, even though I think they should. I will invest funds in the idea that prices aren’t going to fall. If you invest this way, even if you’re wrong on your price projection, you can still be right on the trade – you can still make money.

If that makes sense to you, you have just discovered the strategy of selling puts in bullish markets.

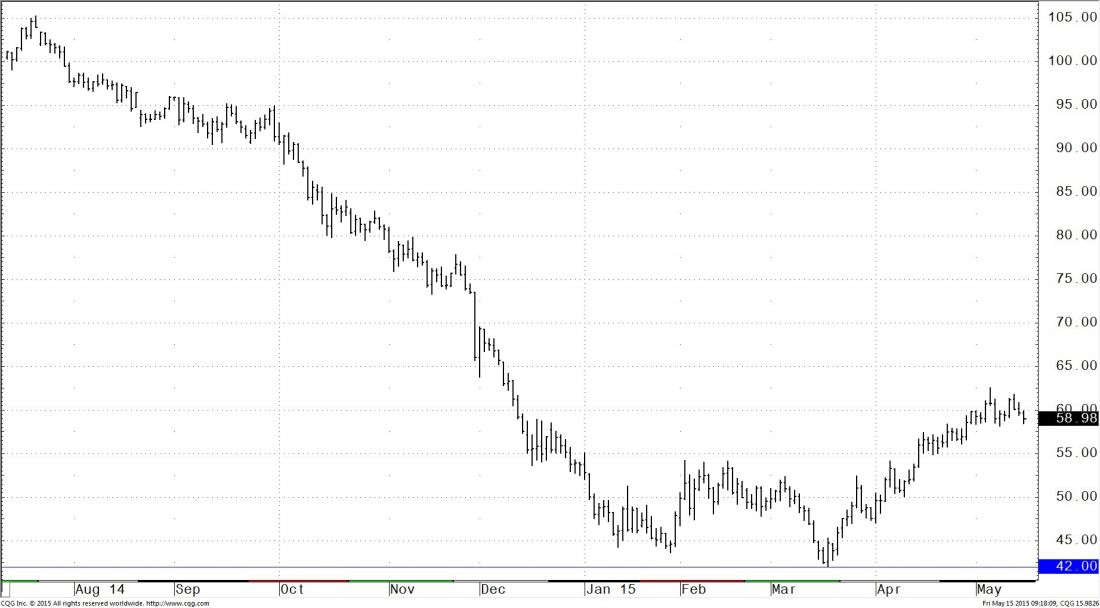

Crude Oil Chart

Crude Oil showing $42 Strike

If you are looking for a fast rate of time decay, we suggest selling the September 46 put option for a $500 to $600 premium. You’ll likely need a down day or two to get these premiums. Be patient. These options expire in August and could be nearly worthless by July on just a modest uptick in crude prices. As long as crude futures are anywhere above $46 per barrel at expiration, the options expire worthless.

More conservative traders can look to sell the November 42 puts for similar premium to stay further out of the money. This trade may be able to be converted to a strangle this summer as receding crude prices are possible this fall.

But that is a subject for another article.

Until then, take advantage of some of the put premiums in crude available now. And have a great month of Option Selling.

###

If you are a high net worth investor interested in selling options in crude oil and other commodities, you may qualify for a managed option selling portfolio with OptionSellers.com. To learn more, request your Free Investor Discovery Kit at www.OptionSellers.com/Discovery.

Related Reading:

Coffee: Broad View of Fundamentals Continues to Favor Options Sellers