The Australian Dollar has declined by more than 18% against the U.S. Dollar over the last six months. These losses accelerated last September once the market fell through $.92 support area. The chart we’ve included focuses on a shorter timeframe as we attempt to determine the quality of April’s rally off the lows.

Commercial traders in the Australian Dollar are value players just like everyone else. The only difference is that they are hedging currency risk rather than the physical risk typically associated with commodities. That being said, currency risk is just as big of a risk to a multi-national corporation as bad weather can be to a local farmer. This brings the big boys to the currency markets where they employ the same type of value based models in the currency markets as they use in the physical markets. They buy more as the market becomes more undervalued and they sell more when they believe the market is becoming overvalued.

During the Australian Dollar’s six month decline, commercial traders made net purchases of nearly 160,000 contracts. The Australian Dollar is a $100,000 contract. That means commercial traders purchased more than $16,000,000,000 worth of currency below about $.90 to the U.S. Dollar. Now that we’ve gotten a bit of a rally, we’re seeing a mad dash for the exits.

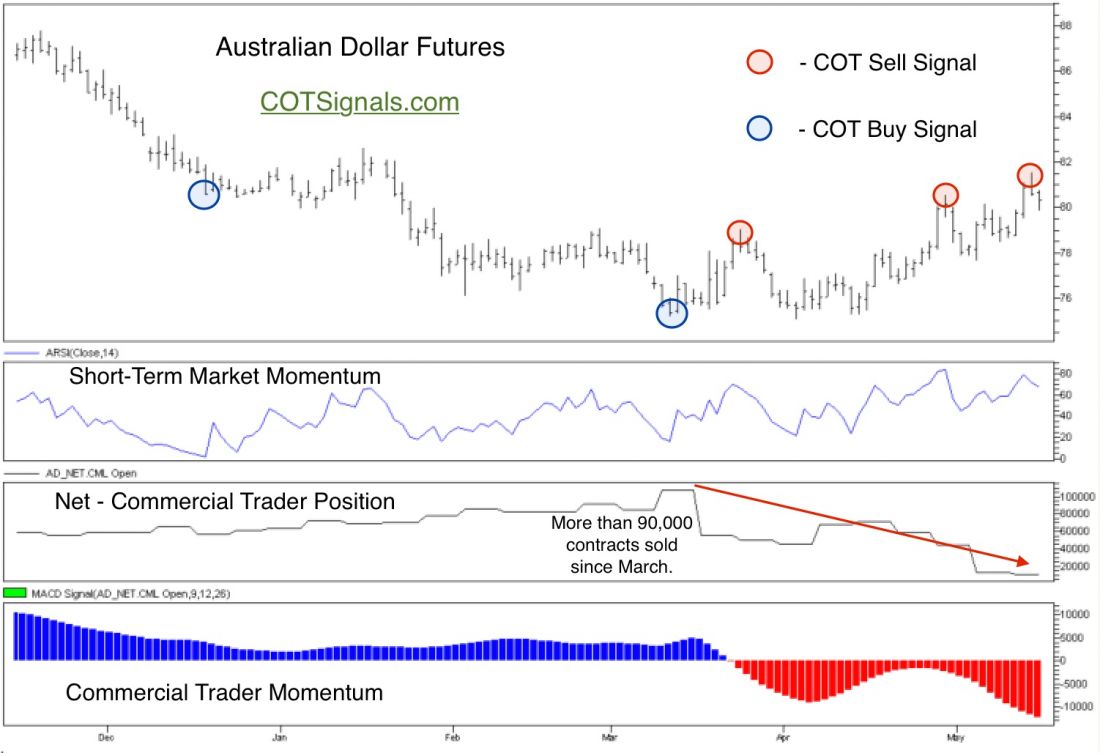

Looking at the included chart you see our standard four pane COT chart setup. Since the Australian Dollar bottomed near $.75 to the Dollar, commercial traders have become net sellers to the tune of more than 100,000 contracts. The selling has firmly plunged the commercial traders’ momentum into negative territory and has put us on the lookout for COT Sell Signals.

We use our short-term momentum indicator as a trigger. Friday’s action provided two tips. First, our setup generated an official COT Sell Signal in the Australian Dollar futures. Secondly, Friday’s turnaround created a bearish divergence between the market and our market momentum indicator. These factors have us selling short the Australian Dollar and placing a protective buy stop at the recent high of $.8151. We’ll know more about the profit side of things once the market tests $.78 to the Dollar.

###

To Leverage the Resources of the World’s Biggest Traders, Click Here

Related Reading: