PTC Therapeutics, a $2 billion biotech company that has Ataluren (treatment for a nonsense mutation) as one of their lead product candidates, isn’t expected to post a profit for a couple years, but revenue growth is starting to come on strong. Last year, the company did $25M in sales and that is projected to more than quadruple to $110M in 2016 ($40M annually this year). However, PTC may not make it to profitability as a standalone company if you listened to Roche’s CFO on June 2nd. Alan Hippe noted that the Swiss pharmaceutical giant may look at acquiring an orphan drug developer (likes of a PTC Therapeutics or BioMarin Pharmaceutical). Regardless of whether they are an M&A target or not, the company has Phase 3 top-line data of Ataluren due out by the end of 2015.

PTC trades at a price to sales ratio of 81.25x and a price to book ratio of 6.99x. The average price target of the 11 Wall Street analyst firms that cover the stock is $91.56 (57%+ upside from current levels). Credit Suisse made them a top idea on May 5th, assuming an outperform rating and a $100 price target.

Unusual Options Activity

On June 3rd, 1,000 Dec $70 calls were purchased for $12.40-$12.70. This may not sound like a large trade, but it was nearly 2 times the average daily call volume and cost about $1.25M in time premium. Breakeven on this trade is between $82.40 and $82.70.

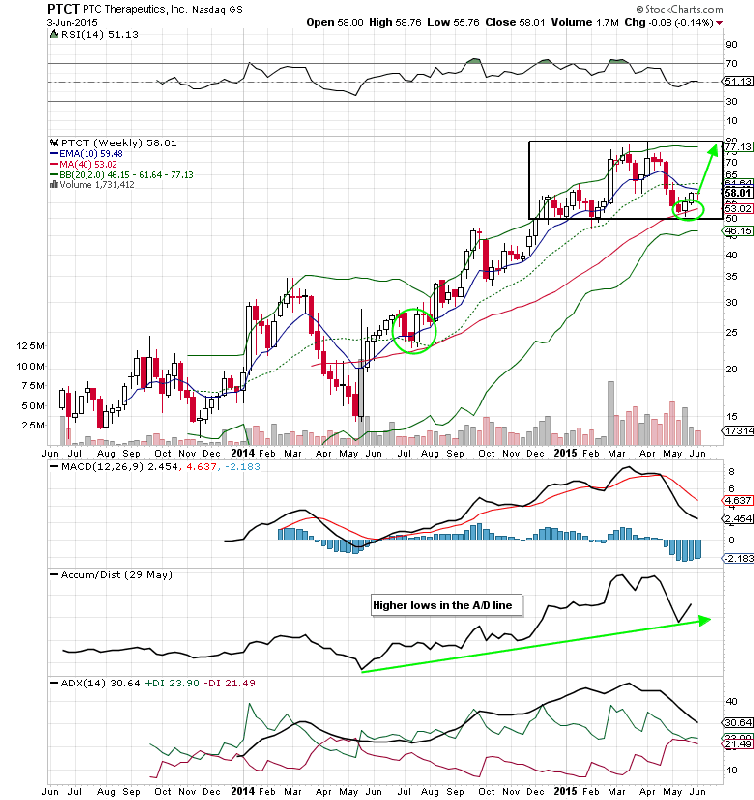

The two year weekly chart above (went public in June of 2013) shows that for the last six months, PTC has been trading in a wide range of $50 to $80. The stock tumbled early in the spring, but was able to attract buyers on the retest of the 40-week simple moving average (similar to a 200-day SMA) and just above the $50 support level.

Now is the time to consider taking a bullish options position given the accelerating revenue growth, takeover chatter, and the fact that shares are off $20 from the all-time highs. December options are currently pricing in a $33 move in either direction, which means PTC could be a $90-$100 stock or one that is more than cut in half by the end of the year (why you want to use options).

PTC Therapeutics Options Trade Idea

Buy the Dec $60/$90 bull call spread for a $9.25 debit or better

(Buy the Dec $60 call and sell the Dec $90 call, all in one trade)

Stop loss- None

1st upside target- $18.50

2nd upside target- $29.00