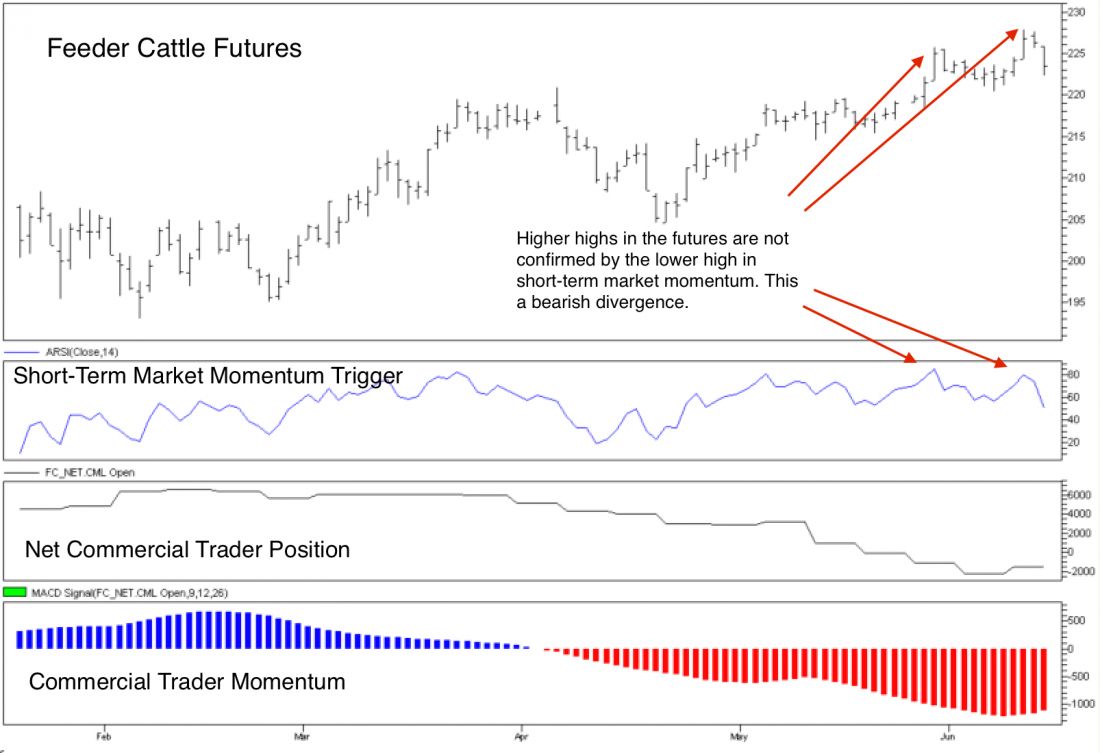

The cattle markets, both live and feeders, tend to peak through the hot months of summer as the animals’ deliverable weights decline. Typically, we see commercial traders lead the seasonal tendencies. This often leads to the chicken and the scenario in separating the force of the market’s dominant players from the typical seasonality. For today’s trade, we’ll look at the fundamental picture through the commercial traders’ actions and follow the market’s lead through the technical bearish divergence that developed Friday.

Commercial feeder cattle traders are rapidly abandoning the long the hedges laid in through January and February’s decline. Their net long position peaked in mid February. Since then, the commercial traders have been net sellers in 13 out of the last 16 weeks. Even without knowing the “why” of their selling, their actions clearly indicate their meager prospects for this market. We’ll side with them and look for selling opportunities like the one that developed on Friday.

Having established our bias to side with the commercial traders, we must now look for short selling opportunities. The August feeder cattle contract made a new high for this move last Wednesday. Thursday’s lack of volatility saw little direction on either side and left the day as an inside day. This means the high and low were less than and greater than Wednesday’s, respectively. Friday’s reversal action tripped our short-term market momentum indicator triggering the short sale. The important detail is that the indicators reading at Wednesday’s close was lower than the reading at the last high on May 28th. This is called, “bearish divergence.” Therefore, we’ll be selling August Feeder cattle and placing a protective buy stop at last Wednesday’s high of $227.80.