Hi traders from all over the world! How are you doing? I hope you are ready for a most exceptional and exciting week ahead.

I want to give you a quick overview and glance at METALS this week to give you an idea of what I’m thinking.

I am bearish on Silver and Gold for the next few weeks actually. There has been some serious selling in both the SLV and GLD ETFs. The selling has been pretty fast and furious even though many envision a beautiful and bright future on metals.

I do agree that both Silver and Gold should be good longer term buys, to possibly protect again inflation, or the end of the world for my real ‘doomsday traders’. Bottom line, I personally don’t feel Gold or Silver are at good buying levels, at least not yet.

I like Gold much better at $970 an ounce, but even more so at $700 an ounce. Will it make it to those levels? Possibly. It won’t happen this week, that’s for sure. I love Silver at $10 an ounce and anything cheaper than that. This would likely be a longer-term buy and hold for me on metals. I do not think the returns will be very glamorous, but it would fit the ‘buy low, sell high’ profile very well.

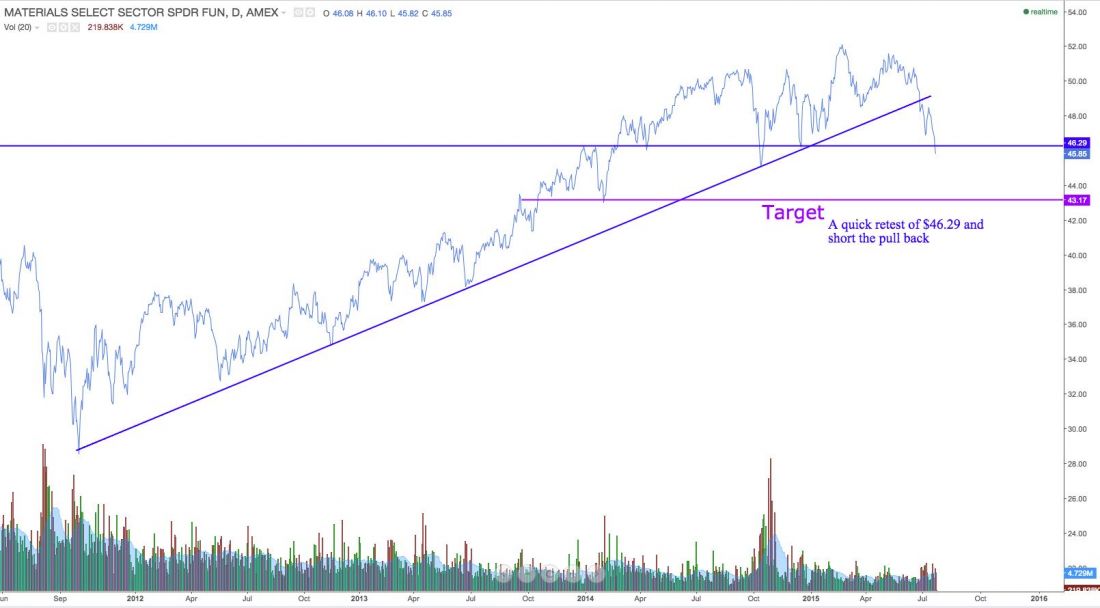

Therefore, to sum it up, one could trade GLD, SLV, or XLB. I am looking for bearish trades after some small pullbacks.

Here is my chart on XLB. I am specifically looking for a pullback to approximately $46.50, looking for some white candles and then a small gap and some bearish candles to confirm the roll over. This ETF is below the 10,20,50 EMAs on the daily and weekly charts and below the 100/200 SMAs on the daily along with the 100 SMA on the weekly.

Have fun, Traders! Remember, the best way to navigate any market is simply by creating and writing down your trading plan and following it. Consistency, discipline and risk mitigation is key. Have a great week, my friends!