Thursday

The Federal Reserve Open Market Committee has met 55 times since the last interest rate increase, nine years ago.

For at least half of those meetings, the Fed has hinted that interest rates will return to “normal” – that is, someplace north of zero – as soon as some set of benchmarks were met, perhaps at the current meeting!

And each time, like Lucy yanking away the football at the last moment, they didn’t do what they hinted they were going to do. They ducked out.

They did it again yesterday. This was the time, so many pundits proclaimed, when the Fed was going to start ending the various programs that have kept interest rates at zero or close to it since the Crash of 2008. The benchmarks, for employment especially, have been met, they said, and now the market should start to set interest rates organically, through a process of price discovery. If only.

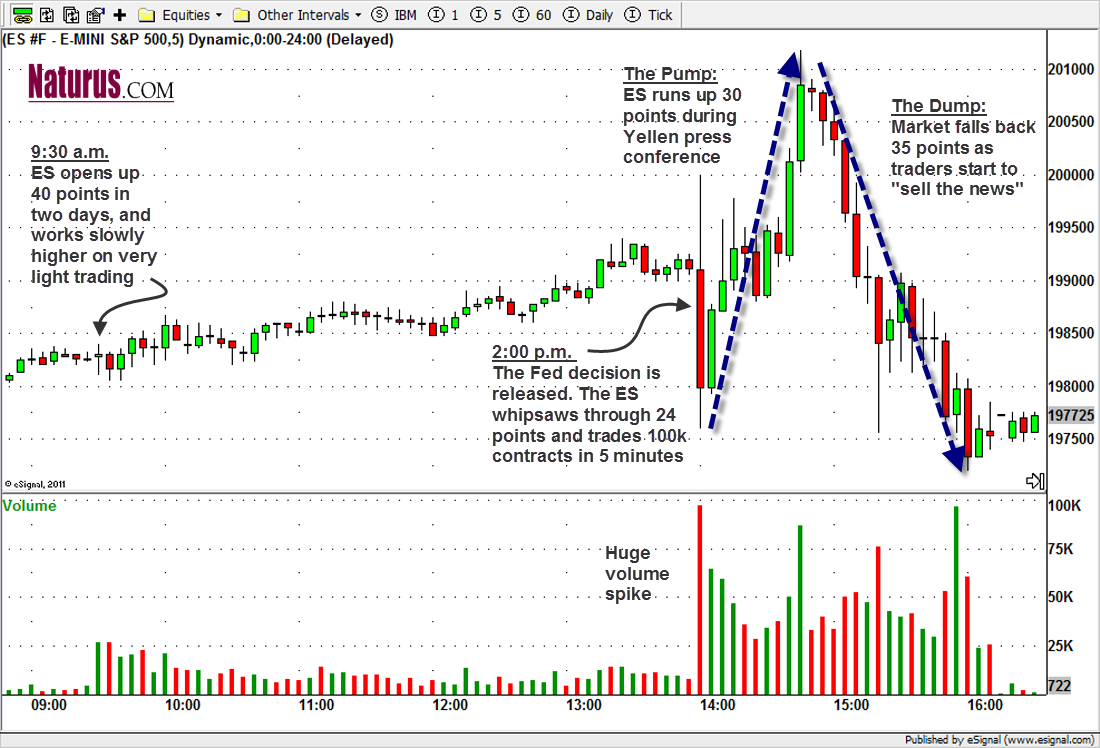

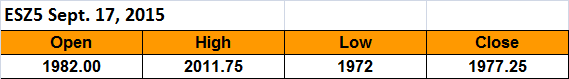

For the 55th time the Fed declined to change its zero interest rate policy – not zero for you; zero for the banks and their buddies. The stock market, as measured by the SP500 mini-futures, ESZ5, did what it always does.

It ran up 55 points from Monday to Wednesday, then slammed another 35 points up on extremely heavy volume during the Fed press conference. It moved past the August 28 high – the first relief rally after the latest Black Monday – and got almost to the 50-day moving average.

And then, after leaving the shorts for dead and option sellers sweating bullets, the players began to sell the news. By the end of the day the ES gave back all of the gain and ended 10 points in the red. A classic pump and dump.

So what happens next?

Today is the final quadruple witching expiration day, and options and futures either have expired or will expire at the open. The expiration of the options will remove some of the pressure to keep the futures contract at heavily-bought strike level and free the market up for further movement.

A lot depends on how the overnight trading goes. 2002-04 and 2012-15 are current resistance areas and 1965.50 and 1950-55 will be current support. 1983.75 is today’s key line. Above that line, ES could move up to test yesterday’s high; stay below it, and the ES could go lower toward 1965.50.

Major support levels for Friday: 1950-45, 1900-03.50, 1975-80, 1850-45;

major resistance levels: 1998.75-95.50, 2012.50-2013.50 2032-2035

For more detailed market analysis from Naturus.com, free of charge, follow this link

Chart: Classic Pump and Dump. S&P500 mini futures (ESZ5) intraday.

5-minute bars, Sept. 17, 2015