The gold market has been in a downward trend for the last six years. Over the course of the last five years, symmetry has developed during this market’s decline. The market has developed a pattern of spring rallies followed by summer doldrums and a fall rally prior to closing the year weakly. We’ve already discussed our ideas for topping copper and silver markets right here in these pages. While copper has agreed wholeheartedly with our analysis, silver is putting up a bit of a fight. We think this ties into gold’s rally, which may be the lynchpin to the entire move in the metal markets. Unfortunately for silver, we think gold is about finished here as well.

The gold market’s rally has been fueled by the Federal Reserve Board’s decision to leave interest rates unchanged. Gold bugs are suggesting that this will lead to worse inflation further down the road. It is important to remember that many of these same people would’ve questioned whether a ¼ point raise would’ve been sufficient to keep up with the rampant inflation they’re expecting. Either way, inflation plays have been a losing proposition since the post QE commodity bubble burst in 2011. Perhaps, early calendar year, “This is gonna be the year” buying is what’s buoyed this market’s spring strength only to be followed by loss selling as it turns out not to be the case. Either way, the market has risen in a timely matter and faces stiff resistance at these levels.

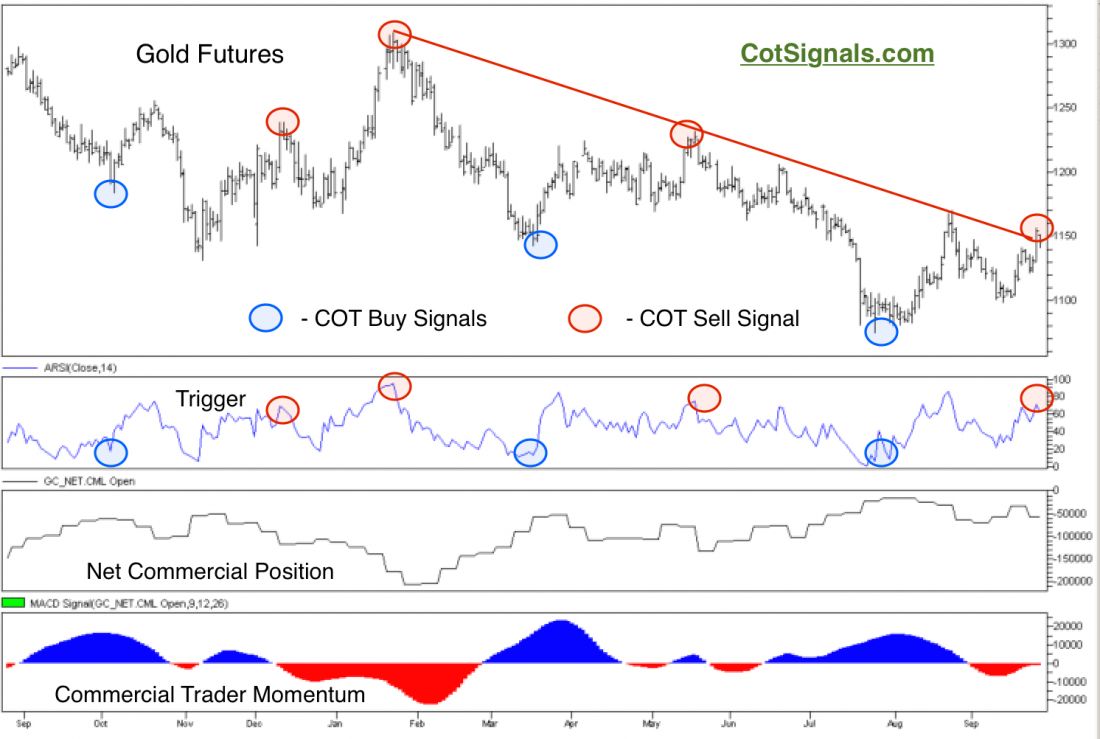

The December gold futures have risen to meet the downward sloping trend line established at the last major high in January. This now comes into play around $1,146, just a shade above Friday’s close of 1145.6. This trend line falls directly inline with major resistance at the $1,150 per ounce level. Note also that commercial trader momentum, in the bottom pane of the chart below, has shifted into negative territory on this rally. We believe that the combination of cyclicality, technical action and still unfounded announcements of inflation’s arrival places smart money on the sell side.

There are a couple of ways to enter the short side of this market given Friday’s general lack of action as evidenced by the inside bar. The most obvious entry technique is the inside bar breakout. Place an entry sell stop at Friday’s low of $1140.10. If the order is filled during Monday’s trading session, place a good till cancelled protective buy stop above Thursday’s high of $1,156.40, which is also the swing high for the current rally. Alternatively, COTSignals published an outright sell on Sunday night with a corresponding protective buy stop to be placed at $1,156.40. Finally, astute readers of technical chart intricacies might have noticed the Trigger indicator is ripe for a bearish divergence. This would require Monday or Tuesday’s high to surpass Thursday’s while registering a lower number on the Trigger. Regardless of the entry method chosen, our research suggests that there is more money to be made on the short side of this market, given the current situation, than there is on the long side.