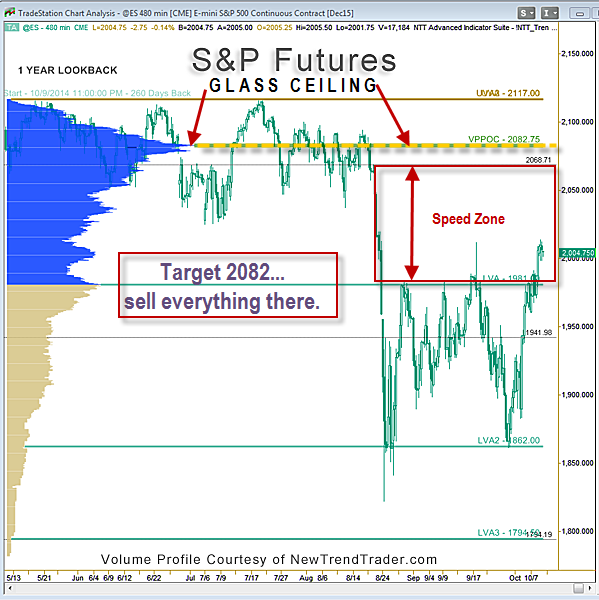

In my personal trading I much prefer bull phases. The pullbacks in an uptrend make more sense to me. Thus, I’m looking forward to a continuation of last week’s rally with a generous target of 2082 in the S&P futures.

Why 2082? This is the Volume Profile Point of Control for a look-back of one year. In other words, it’s a critical level that will be watched by ‘big money.’ I say that because it is a high volume node (HVN) of a very extreme sort. You can see the hyper-extended shelf-like projection on the accompanying chart.

What this ‘shelf’ means in simple terms is that the market will encounter a bulletproof glass ceiling at 2082. Everyone who bought in that area is already underwater and holding their collective breath until they can get out a breakeven.

Additionally, large funds which bought at much lower prices need high volume areas to transact business efficiently. Thus, there will be two very aggressive groups of sellers around 2082: mom/pop investors and outfits like Blackrock that need to take advantage of the volume to adjust asset allocation.

Since the NQ is above its long term VPPOC, conditions are bullish for the 4-letter set. Therefore, the NQ should provide fuel to propel the ES up to its VPPOC.

There’s no telling how long it will take for the market to turn there, but I expect it will be fairly obvious when it starts. It will feel like someone pulled the rug out. Since this is a year-long shelf, the ensuing correction could be measured in years, as well.

If you need help with trader discipline in this volatile market visit: http://www.daytradingpsychology.com/increasing-trader-discipline/