Just last week we were proudly proclaiming that we didn’t pay much attention to corporate earnings reports because they don’t affect our main interest, the S&P500 mini-futures (ES).

Then we took a look at Alcoa (AA) the first of the large caps to report, and we were disturbed. Maybe even a little appalled. The earnings were not only lousy; some magic accounting was applied so they would look better than they are.

So we looked at a couple of others. And now we’re downright horrified.

Earnings are mother’s milk to companies; without them the enterprise fails to thrive. This quarter, earnings are expected to be bad; but they are not only worse than the headline numbers being reported, they have been massaged to the point that what you see is definitely not what you get. Traditional reported earnings-per-share are no longer a reliable guide to corporate performance… if they ever were.

Here’s a quick example. Johnson and Johnson (JNJ) reported earnings yesterday: Revenues were down about $1.3 billion from the same quarter a year ago, and about $300 million below the analysts’ consensus. Wow. Yet JNJ managed to report non-GAAP earnings per-share of $1.49, better than the consensus. Another beat! Yeaah!

How come? Ask the accountants.

Last year JNJ had an effective tax rate of about 30% for accounting purposes; this quarter it is using a tax rate of 18%, about 40% less. (JNJ doesn’t get to choose its own taxes, of course; this is just a computed figure used to estimate expenses).

So pre-tax revenue is way down, but JNJ’s estimate of its tax liabilities is also way down. Voila! EPS beat expectations. Let’s buy some stock.

And that’s just what JNJ is going to do. Shortly before the earnings were released yesterday JNJ announced it as buying $10 billion worth of its own stock. The effect will be to reduce the number of shares outstanding… and increase the earnings per share.

JNJ is not doing anything illegal. All of these gimmicks are within the bounds of “normal” accounting practices, and lots of large-cap companies use them. Coke and Intel did something similar earlier this year.

But you shouldn’t be making long-term investment decisions on the basis of these reported earnings, either for individual companies or for the large-cap index as a whole. At some point it will blow up. We just don’t know when.

Today

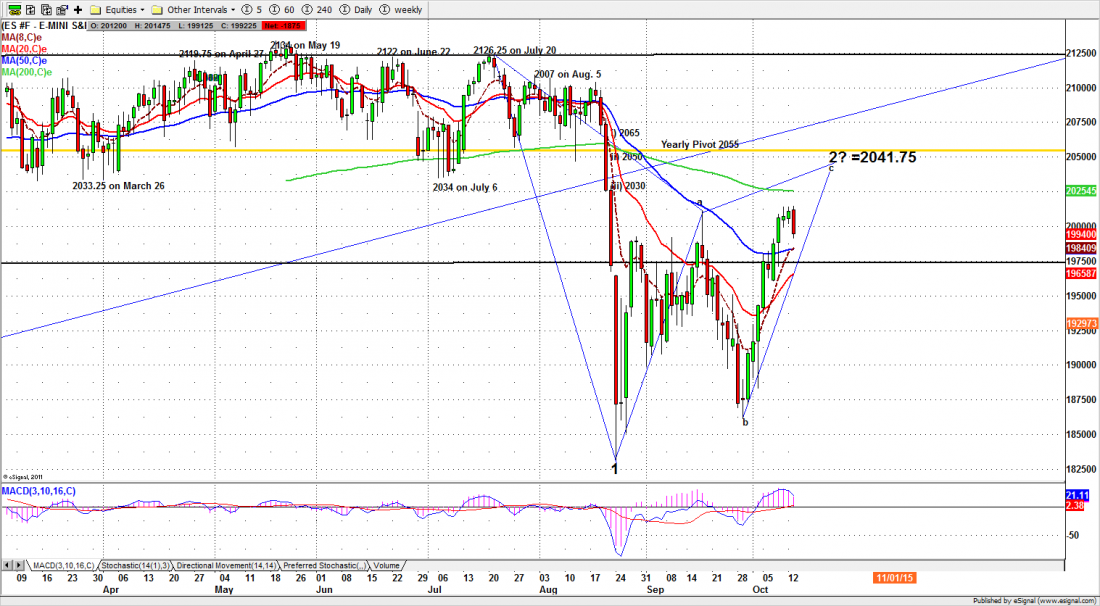

The S&P500 mini futures (ES) were down yesterday, as might be expected after nine days of advances, but they managed to reach the high around 2014-15 that has been the top area for the past three days. That could be a short-term top for this week, or perhaps longer.

The 50- and 10-day moving average lines are overlapping, which could act as today’s first major support line. A move below 1972 could trigger sell orders and push ES down toward 1965-62.50 area. A move below 1950 and a weekly close there would give final confirmation that the short-term top has been posted. Otherwise ES still has a chance to move back up again.

Short on bounces or buy on the dips is the strategy today.

The major support levels for Wednesday: 1928-29.50, 1900-03.75, 1880-75, 1850-45;

major resistance levels: 2016.50-14.50, 2025-32, 2050-46.50

For more detailed market analysis from Naturus.com, free of charge, follow this link

http://www.naturus.com/mailing-list-signup-page/